Artificial Intelligence Tokens: The Future of Digital Assets

The world of digital assets is rapidly evolving, bringing new opportunities and challenges for investors. Among these developments, artificial intelligence (AI) tokens have emerged as a potentially transformative force within the cryptocurrency market. AI tokens such as Render (RENDER), NEAR Protocol (NEAR), Internet Computer (ICP), Filecoin (FIL), and the Artificial Superintelligence Alliance token (FET) are gaining traction, offering unique applications in the blockchain and AI ecosystems.

Understanding AI Tokens

AI tokens distinguish themselves by their focus on leveraging artificial intelligence in blockchain applications. For instance, Render (RENDER) is utilized for decentralized graphics rendering, offering a scalable solution for graphic-intensive projects. NEAR Protocol (NEAR) is designed to create a highly scalable blockchain platform, addressing some of the key limitations of existing blockchain technologies. Internet Computer (ICP) serves as the native token for the Internet Computer Protocol, which aims to extend the public internet to support a new breed of software applications. Filecoin (FIL) operates as a utility token for the Filecoin network, facilitating decentralized storage solutions. Lastly, the Artificial Superintelligence Alliance token (FET), the result of a merger between Fetch.ai, SingularityNET, and Ocean Protocol, supports a decentralized machine learning network.

Limited Correlation with Traditional Assets

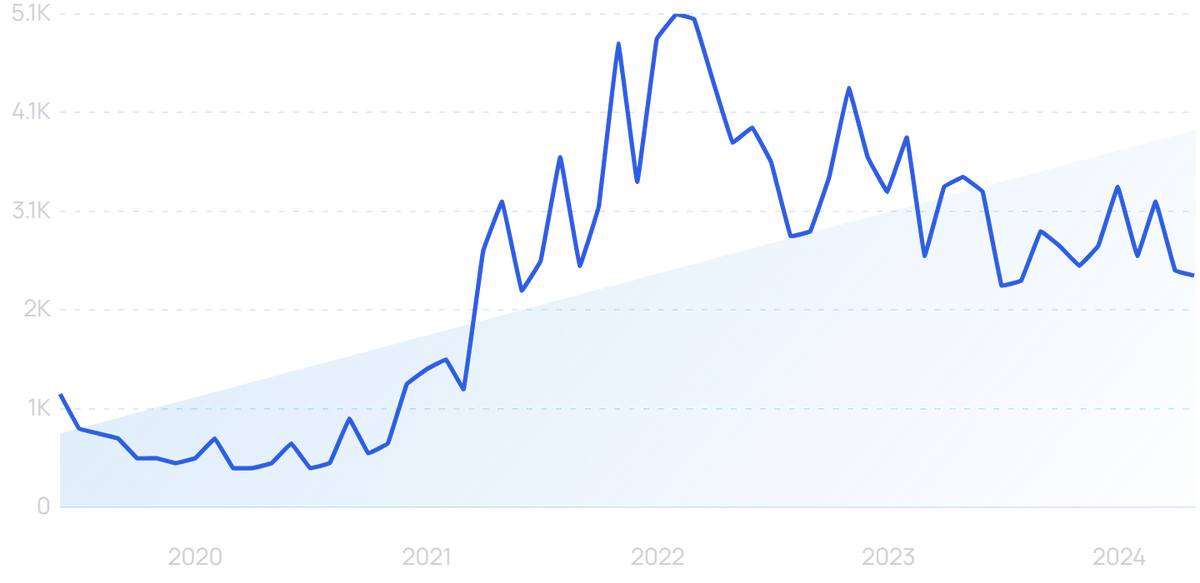

One of the most intriguing aspects of AI tokens is their limited correlation with traditional asset classes. According to a study published on arXiv, AI tokens exhibit weak or insignificant correlations with other asset classes, setting them apart from AI ETFs and green assets, which exhibit moderate correlations with each other. This unique characteristic could make AI tokens an attractive option for diversification in investment portfolios, especially during periods of market volatility.

Spillover Dynamics and Investment Implications

Despite their limited correlation with traditional assets, AI tokens are not immune to market dynamics. The study highlights that AI tokens and the S&P Green Bond (SPGB) maintain relatively low levels of overall spillover dynamics, with negative spillovers dominating most of the observation period. However, during periods of heightened market volatility, AI tokens tend to act as recipients of market shocks, with net spillover inflows becoming more pronounced.

For investors, this means that while AI tokens can provide diversification benefits, they should also be aware of the potential for spillover risks. The research suggests that investors should complement AI ETFs and clean energy assets with strong hedging assets to mitigate these risks. Moreover, given the dynamic nature of spillover roles, investors should closely monitor their exposure to AI-related cryptocurrencies and adjust their allocations accordingly.

Regulatory Considerations

The rise of AI tokens also poses regulatory challenges. The study advocates for regulators to monitor the volatility and systemic impact of AI ETFs and clean energy assets due to their risk-spreading nature. Implementing safeguards to prevent excessive market fluctuations is essential. Additionally, policymakers should support financial instruments that facilitate the integration of AI tokens into broader portfolios, preventing them from becoming hidden sources of risk.

The Future of AI Tokens

As the cryptocurrency market continues to evolve, AI tokens are poised to play an increasingly significant role. Their ability to leverage AI technology for innovative blockchain applications, combined with their unique market dynamics, positions them as a promising area for investment and development.

The continued collaboration between AI and blockchain technology could unlock new possibilities, from decentralized finance (DeFi) applications to enhanced data privacy and security solutions. As these technologies mature, the potential for AI tokens to disrupt traditional financial systems and create new markets will likely grow.

Conclusion

AI tokens represent a new frontier in the world of digital assets, offering investors and innovators an exciting opportunity to explore the intersection of artificial intelligence and blockchain technology. While they present unique challenges, such as spillover risks and regulatory considerations, their limited correlation with traditional assets and potential for innovation make them a compelling addition to the cryptocurrency landscape. As the market continues to develop, those who navigate these complexities with foresight and strategic planning stand to benefit from the transformative potential of AI tokens.

For further reading on the dynamic spillovers and investment strategies involving AI tokens, visit the comprehensive study on arXiv.

This article provides a comprehensive overview of the emerging role of AI tokens in the digital asset landscape. Investors, regulators, and technology enthusiasts must keep a keen eye on these developments as they continue to unfold, shaping the future of financial markets and technological innovation.