The Role of the US Dollar as the World's Reserve Currency

In the intricate tapestry of global finance, the US dollar stands as a cornerstone, serving as the world's primary reserve currency. Dominating international trade and finance, the dollar's position is unrivaled despite the formidable economic presence of the European Union. This article explores the significance of the US dollar in global trade and finance, emphasizing the reasons countries maintain dollar reserves and the impact of this on global financial stability.

The US Dollar: A Pillar of Global Finance

The Council on Foreign Relations describes a reserve currency as a foreign currency held by central banks and treasuries as part of their formal foreign exchange reserves. The US dollar's dominance in this role is attributed to several factors, including its widespread acceptance in international transactions, the stability of the US economy, and the depth of its financial markets.

Why Countries Hold Dollar Reserves

Countries maintain reserves of the US dollar for a multitude of reasons, primarily to mitigate economic shocks, facilitate imports, and ensure the ability to pay foreign debts. In times of financial distress, having a robust reserve of a stable currency like the US dollar can help countries stabilize their economies. Moreover, many nations cannot borrow or conduct trade in their own currencies, making it necessary to hold dollar reserves to ensure a steady supply of imports and to assure creditors of their debt repayment capabilities.

The Dominance of the US Dollar

The persistence of the US dollar's dominance, despite the European Union's economic size and robust financial markets, highlights its entrenched role in global finance. The dollar's widespread use is not just a relic of historical precedence but is reinforced by current economic practices. The depth and liquidity of US financial markets, the rule of law, and the transparency of US institutions further bolster confidence in the dollar, making it a preferred reserve currency.

The Impact on Global Trade and Stability

The US dollar's role as a reserve currency significantly influences global trade and economic stability. Its dominance facilitates smoother international transactions, reducing the need for currency conversion and the associated risks. This dominance also means that any fluctuations in the US economy or monetary policy can have ripple effects worldwide, impacting everything from commodity prices to emerging market economies.

Economic Stability and Volatility

Holding dollar reserves provides countries with a buffer against economic volatility. During periods of global financial instability, the dollar often appreciates as investors seek safety, thus increasing the value of reserves held in dollars. This can provide a cushion for countries facing economic challenges, allowing them to stabilize their currencies and economies.

However, this dependence on the US dollar also means that countries are susceptible to US monetary policy decisions, which may not always align with their economic conditions. For instance, a hike in US interest rates can lead to capital outflows from emerging markets, causing currency depreciation and economic instability in those regions.

Challenges and the Future of the US Dollar

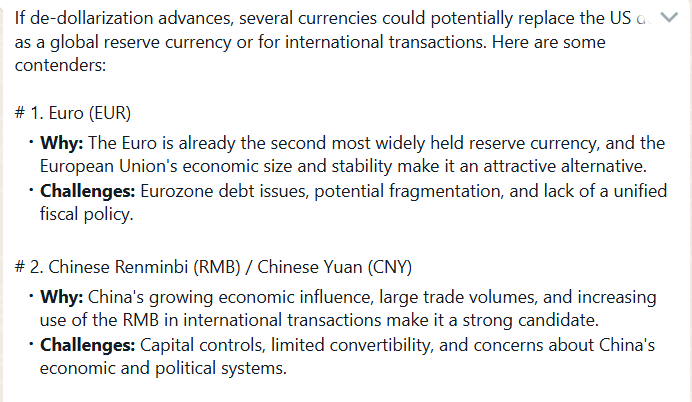

Despite its current dominance, the US dollar faces potential challenges. The rise of digital currencies and increasing geopolitical tensions pose questions about the future of the dollar as the world's primary reserve currency. The European Union and China, with their significant economic clout, continue to push for greater international acceptance of the euro and renminbi, respectively.

Digital Currencies: A New Contender?

The emergence of digital currencies, including central bank digital currencies (CBDCs), introduces a new dynamic into the global financial system. While they are still in their infancy, CBDCs could potentially alter the landscape of reserve currencies by offering a more efficient, transparent, and secure means of conducting international transactions. However, the transition from traditional reserve currencies to digital alternatives would require significant shifts in global financial infrastructure and regulatory frameworks.

Geopolitical Considerations

Geopolitical factors also play a crucial role in the future of the US dollar. Sanctions and trade policies can influence countries' decisions to hold or reduce their dollar reserves. Additionally, the strategic interests of countries like China, which seeks to internationalize the renminbi, could lead to shifts in the global reserve currency landscape.

Conclusion

The US dollar's position as the world's reserve currency remains secure for now, underpinned by the stability and strength of the US economy and financial markets. However, the evolving global economic environment, characterized by digital innovation and geopolitical shifts, presents both challenges and opportunities for the future of the dollar. As countries navigate these changes, the dynamics of global trade and finance will continue to evolve, with the US dollar playing a pivotal role in shaping the economic landscape.

In conclusion, while the US dollar continues to be a dominant force in global finance, ongoing developments in technology and international relations require constant vigilance and adaptation. The future may see a more diversified reserve currency system, but for now, the dollar remains the linchpin of global financial stability.