Understanding the Current Trends in U.S. Treasury and Municipal Markets

The U.S. Treasury and municipal markets have recently drawn considerable attention due to fluctuations in yield ratios and evolving market characteristics. These changes present a significant challenge for investors who rely on fixed income securities as part of their investment strategies. Understanding these trends is crucial for making informed investment decisions, particularly in an economic environment marked by uncertainty and volatility.

The Dynamics of Yield Ratios

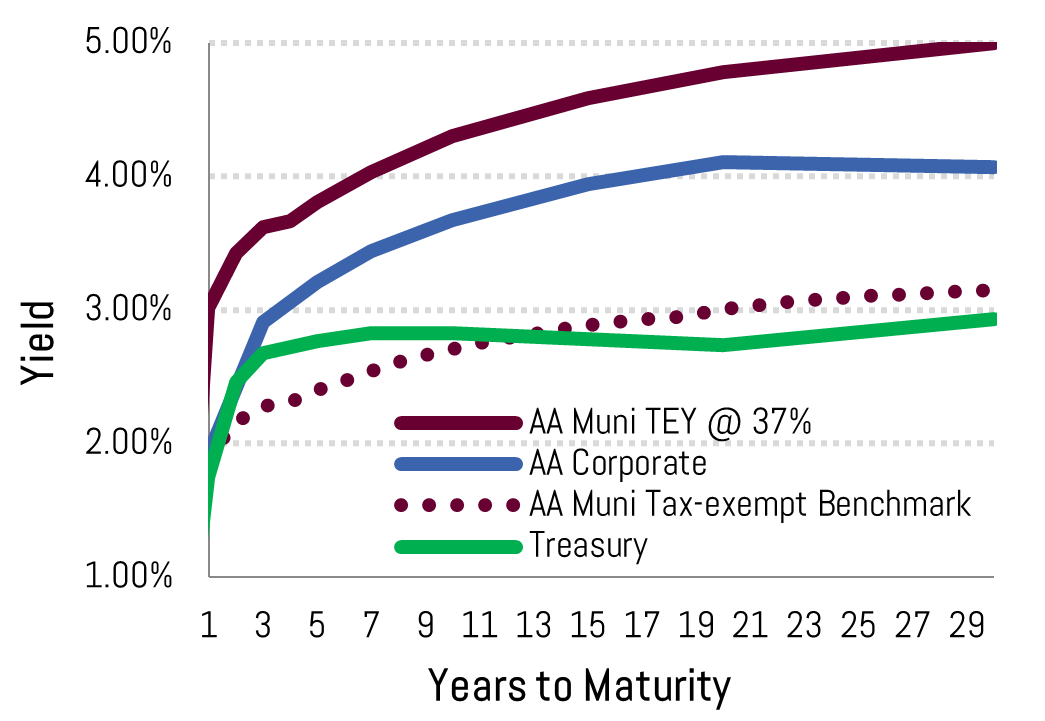

Yield ratios are an essential metric in evaluating the relative value of municipal bonds compared to U.S. Treasury securities. As highlighted by Nuveen's recent commentary, yield ratios and market characteristics are subject to market risk, a critical factor for investors to consider. The yield ratio is calculated by dividing the yield of a municipal bond by the yield of a comparable U.S. Treasury bond. A higher yield ratio often indicates that municipal bonds offer more attractive returns relative to their risk than Treasury securities.

In recent months, yield ratios have fluctuated due to changes in interest rates and investor perceptions of risk. These fluctuations are influenced by several factors, including monetary policy decisions by the Federal Reserve and economic indicators such as inflation and employment rates. As interest rates rise, the yield on Treasury securities typically increases, which can widen the yield ratio if municipal bonds do not experience a commensurate increase.

Market Characteristics and Investment Decisions

Market characteristics, such as liquidity, credit quality, and duration, also play a crucial role in shaping the landscape of the U.S. Treasury and municipal markets. Investors must navigate these characteristics to align their portfolios with their risk tolerance and investment objectives.

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. The U.S. Treasury market is known for its high liquidity, making it an attractive option for investors seeking to enter or exit positions quickly. In contrast, the municipal market may experience lower liquidity, particularly for bonds issued by smaller municipalities or those with lower credit ratings. This difference in liquidity can affect yield ratios, as investors may demand higher yields to compensate for the increased difficulty in trading municipal bonds.

Credit Quality

Credit quality is a measure of an issuer's ability to meet its financial obligations. U.S. Treasuries are considered one of the safest investments, backed by the full faith and credit of the U.S. government. Municipal bonds, however, vary widely in credit quality, with some posing a higher default risk. As noted in Vanguard's perspectives, credit quality can significantly impact yield ratios, as investors require higher yields for bonds with greater perceived risk.

Duration

Duration measures a bond's sensitivity to interest rate changes. Longer-duration bonds are more sensitive to interest rate fluctuations, which can influence both Treasury and municipal markets. In a rising interest rate environment, long-duration bonds may experience greater price volatility, affecting their yield ratios. Investors must consider duration when evaluating fixed income securities, balancing the potential for higher yields with the risk of price fluctuations.

The Impact of Interest Rates and Inflation

Interest rates and inflation are pivotal in shaping the fixed income landscape. The Federal Reserve's monetary policy decisions, particularly regarding interest rate adjustments, can have a profound impact on yield ratios and market characteristics. As interest rates rise, the yields on new Treasury securities typically increase, which can widen yield ratios if municipal bond yields do not increase at the same rate.

Inflation also plays a critical role, as it erodes the purchasing power of fixed income returns. Investors may demand higher yields to compensate for inflationary pressures, particularly in the municipal market, where issuers may face budget constraints that affect their ability to service debt. The interplay between interest rates and inflation is a key consideration for investors, as highlighted in Vanguard's analysis.

Strategic Considerations for Investors

Given the current trends in the U.S. Treasury and municipal markets, investors must adopt a strategic approach to navigate the evolving landscape. Here are some considerations to guide investment decisions:

-

Diversification: Diversifying across different fixed income securities can help mitigate risk. By holding a mix of Treasuries and municipal bonds, investors can balance the safety of U.S. government-backed securities with the potentially higher yields of municipal bonds.

-

Focus on Credit Quality: Prioritizing high-credit-quality municipal bonds can reduce default risk while still offering attractive yields. Investors should conduct thorough credit analysis to assess the financial health of issuers.

-

Monitor Interest Rate Trends: Staying informed about the Federal Reserve's policy decisions and economic indicators can provide valuable insights into future interest rate movements. Active monitoring allows investors to adjust their portfolios in response to changing market conditions.

-

Evaluate Duration: Consider the duration of fixed income investments in relation to interest rate expectations. Shorter-duration bonds may be less sensitive to interest rate increases, while longer-duration bonds may offer higher yields but greater volatility.

-

Assess Inflation Impact: Evaluate the potential impact of inflation on fixed income returns and consider inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), to safeguard against rising prices.

Conclusion

The U.S. Treasury and municipal markets are at a crossroads, with dynamic yield ratios and market characteristics requiring careful consideration by investors. By understanding the factors influencing these markets, including interest rates, inflation, and credit quality, investors can make informed decisions to optimize their fixed income portfolios. As the economic landscape continues to evolve, staying vigilant and adaptable will be key to navigating the challenges and opportunities in the fixed income market.