Private-asset exchange-traded funds (ETFs) are swiftly emerging as a novel conduit for retail investors eager to tap into the lucrative private equity space. These products, such as the PEO AlphaQuest Thematic PE ETF (LQPE) and Man Buyout Beta Index ETF (BUYO), are designed to replicate the performance of private equity investments while maintaining the liquidity and accessibility that traditional ETFs offer. However, the journey to effectively emulate private equity through ETFs is fraught with challenges, primarily due to regulatory constraints and the inherent nature of private market investments.

The Allure of Private-Asset ETFs

Private-asset ETFs represent a burgeoning segment of the ETF market, driven by investors’ growing appetite for diversification and higher returns. They offer indirect exposure to private equity by holding publicly traded stocks related to the private-markets landscape. This structure allows retail investors, who might otherwise find it difficult to access private equity directly, to partake in the potential upside of private markets. The appeal is further amplified by the promise of muted volatility, a characteristic that stands in stark contrast to the often tumultuous public markets.

Despite these advantages, the actual replication of private equity performance remains a formidable challenge. Traditional private equity investments are characterized by their illiquid nature, long investment horizons, and complex valuation processes. In contrast, ETFs are required to maintain a high level of liquidity, and regulations impose strict limits on the percentage of illiquid assets they can hold—capping it at 15% of the fund's holdings.

Regulatory Challenges and Innovative Responses

The regulatory landscape presents a significant hurdle for the full realization of private-asset ETFs. In the United States, the Securities and Exchange Commission (SEC) mandates that open-ended funds can only have a limited portion of their assets in illiquid securities. This restriction poses a fundamental challenge to ETFs attempting to replicate the inherently illiquid and longer-term nature of private equity investments.

However, industry giants like Apollo Global Management and State Street Global Advisors are pioneering innovative approaches to navigate these regulatory constraints. They are currently exploring novel trading strategies for their credit funds, aiming to create ETFs that can more closely mirror the private equity experience while adhering to regulatory limits. These efforts are under regulatory review, and their outcome could significantly shape the future of private-asset ETFs.

Diverse Strategies Within Private-Asset ETFs

Private-asset ETFs employ a variety of strategies to approximate the private equity experience. Some, like LQPE and BUYO, offer synthetic exposure based on indices or theoretical investment strategies akin to those of buyout firms. Others, such as the WHITEWOLF Publicly Listed Private Equity ETF (LBO), hold publicly traded stocks of companies engaged in the private-markets sector, such as KKR & Co. This approach provides indirect exposure while maintaining liquidity.

A standout in the category is the ERShares Private-Public Crossover ETF (XOVR), which has attracted significant inflows by investing in private companies like Elon Musk’s SpaceX. Despite the challenges of investing in non-publicly traded companies, XOVR’s strategy of blending public equity with private company exposure has resonated with investors, evidenced by inflows of $130 million year-to-date.

Market Reception and Investor Sentiment

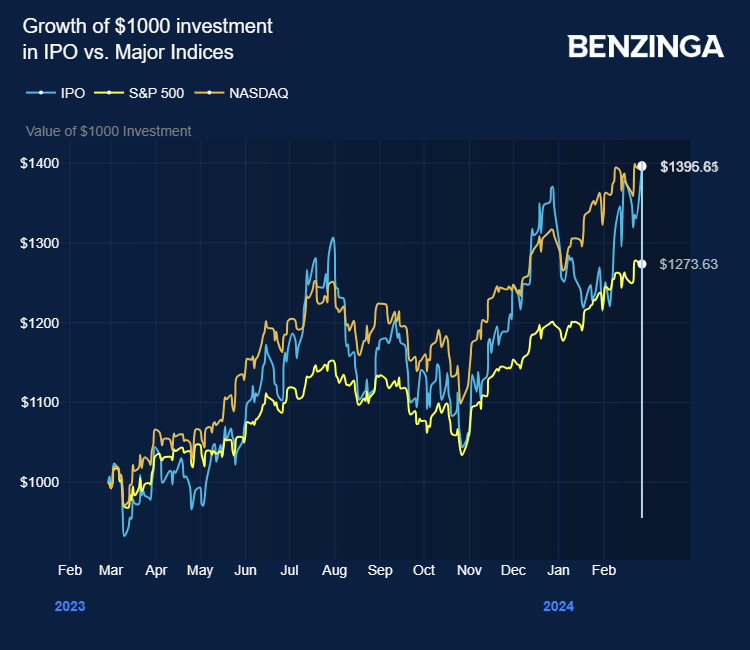

The market reception to private-asset ETFs has been mixed. While products like BUYO, LQPE, and PEVC have seen modest asset accumulation, with combined assets totaling just $28 million, the underlying demand for private equity-like exposure remains strong. The performance of these funds has been varied, with BUYO lagging behind broader indices like the S&P 500 and Russell 2000, whereas PEVC has shown resilience, outperforming the S&P 500 since its launch.

This tepid demand underscores the complexities involved in replicating private equity performance in a liquid ETF format. As highlighted by Bloomberg Intelligence’s Athanasios Psarofagis, while private-asset ETFs offer an accessible entry point, they often fall short of delivering the nuanced returns associated with direct private equity investments. The analogy he draws—comparing expectations for an A5 wagyu filet to receiving ground-up hooves—aptly captures the disparity between investor expectations and actual outcomes.

The Road Ahead for Private-Asset ETFs

The evolution of private-asset ETFs is emblematic of the broader trend towards democratizing access to alternative investments. As the market matures, these products are likely to evolve, driven by investor demand and regulatory developments. The ability of ETF issuers to innovate within the regulatory framework will be crucial in determining the success and growth of private-asset ETFs.

For investors, private-asset ETFs represent a compelling proposition, offering a chance to diversify portfolios with private-market exposure without the traditional barriers to entry. However, as with any investment, due diligence is paramount. Investors must carefully assess the strategies, performance, and risks associated with these ETFs to ensure alignment with their financial goals and risk tolerance.

In conclusion, while private-asset ETFs present exciting opportunities, they also come with significant challenges. The ongoing efforts by industry leaders to refine and innovate these products will be pivotal in shaping their future role in investment portfolios. As the landscape continues to evolve, investors and market participants alike will be watching closely to see how these innovative investment vehicles navigate the intersection of private markets and public accessibility.