In the contemporary landscape of capital markets, understanding the intricacies of the U.S. fixed income market is crucial for both institutional and retail investors. The Securities Industry and Financial Markets Association (SIFMA) offers an invaluable resource through its comprehensive research and data analysis on this pivotal segment. This article delves into the trends and data highlighted by SIFMA, illustrating the role of U.S. fixed income markets in economic growth, as well as the dynamics of Treasuries, corporate bonds, and other significant instruments.

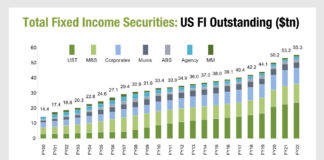

The U.S. fixed income market, encompassing government and corporate debt, mortgage-backed securities (MBS), municipal bonds, and asset-backed securities (ABS), is a cornerstone of global financial systems. SIFMA Research provides a detailed breakdown of this market, offering insights into issuance, trading, and outstanding securities. This data is crucial for understanding market liquidity, risk appetites, and the broader economic implications of fixed income market movements.

The Role of Treasuries in the Fixed Income Market

U.S. Treasuries, often seen as the safest investment, form the backbone of the fixed income market. They are instrumental in setting the benchmark interest rates that influence the pricing of other securities. In 2023, Treasuries accounted for a significant portion of the market's outstanding securities, reflecting their role as a favored asset for risk-averse investors and their utility in managing monetary policy. The Federal Reserve's interest rate decisions, which are closely linked to Treasury yields, have profound implications for the broader economy.

According to SIFMA's U.S. Fixed Income Securities Statistics, the issuance of Treasuries has been robust, driven by the need to finance government expenditures and manage economic stability. The data showcases monthly, quarterly, and annual trends, providing investors with a granular view of market dynamics.

Corporate Bonds: A Reflection of Economic Confidence

Corporate bonds, another significant component of the fixed income market, serve as a barometer for economic confidence and corporate health. These instruments offer higher yields compared to Treasuries, reflecting the increased risk associated with corporate debt. SIFMA's data indicates that corporate bond issuance has been buoyant, supported by low-interest rates and strong corporate balance sheets.

The performance of corporate bonds often correlates with economic cycles. During periods of economic expansion, corporations are more likely to issue debt to fund expansion and capital investments. Conversely, in times of economic uncertainty, corporate bonds may experience increased volatility and spreads as investors reassess risk.

Mortgage-Backed Securities and Their Economic Impact

Mortgage-backed securities (MBS), which are pools of mortgages packaged into investable instruments, play a vital role in providing liquidity to the housing market. SIFMA's research highlights the issuance and trading volumes of both agency and non-agency MBS, offering insights into the housing sector's health and the broader economic outlook.

The MBS market has experienced significant changes over the past decade, particularly following the 2008 financial crisis. Regulatory reforms and shifts in consumer behavior have reshaped the landscape, impacting issuance patterns and investor demand. The data provided by SIFMA helps investors navigate these complexities, offering a clearer picture of risk and return in the MBS sector.

Municipal Bonds: A Secure Investment with Tax Benefits

Municipal bonds, issued by state and local governments, offer investors tax-free income and are often considered a secure investment. SIFMA's data underscores the attractiveness of munis, particularly in high-tax states where their tax-exempt status enhances after-tax returns.

The municipal bond market is diverse, with thousands of issuers across the United States. SIFMA's detailed breakdown of issuance, trading, and outstanding securities in this sector provides investors with a comprehensive view of market opportunities and risks. The strength of municipal finances, underpinned by tax revenues and fiscal management, plays a crucial role in the creditworthiness of these bonds.

Asset-Backed Securities: Diversification and Risk Management

Asset-backed securities (ABS) represent another segment of the fixed income market, comprising instruments backed by assets such as auto loans, credit card receivables, and student loans. SIFMA's research tracks the issuance and performance of ABS, offering insights into consumer credit trends and economic conditions.

The ABS market provides diversification benefits and risk management opportunities for investors, as they are backed by a diverse array of underlying assets. SIFMA's data helps investors understand the nuances of this market, highlighting trends in consumer behavior and credit quality.

Conclusion: Navigating the Fixed Income Landscape

The U.S. fixed income market is a complex and multifaceted landscape, with each segment offering unique opportunities and challenges. SIFMA Research provides a vital resource for investors seeking to understand this market's dynamics, offering comprehensive data and analysis that informs investment strategies and economic forecasts.

As the global economic environment continues to evolve, staying informed about fixed income trends is essential for making informed investment decisions. The insights provided by SIFMA equip investors with the knowledge needed to navigate this critical market, enabling them to capitalize on opportunities and mitigate risks in an ever-changing financial landscape.