Vanguard, a prominent player in the investment management sphere, has released its fixed income market outlook for 2024, providing a comprehensive analysis of anticipated economic conditions and investment strategies. The Vanguard Fixed Income Group foresees a pivotal shift in the market landscape, emphasizing the importance of quality assets amid a projected economic downturn.

In the face of economic uncertainty and the potential for recession in 2024, Vanguard's strategic pivot towards high-quality fixed income assets underscores a considered approach to market volatility. The firm's outlook suggests that investors prioritize stability, with a focus on U.S. Treasuries and high-grade corporate bonds. These instruments are perceived as safe havens offering reliability amidst broader economic turbulence.

Interest Rate Projections and Economic Growth

Vanguard's analysis anticipates a nuanced trajectory for interest rates, taking into account current monetary policy and economic indicators. Despite the Federal Reserve's efforts to manage inflation through interest rate adjustments, Vanguard suggests that rates might remain elevated longer than previously expected. This conservative stance reflects the broader market sentiment that rates will stabilize at higher levels compared to the pre-pandemic era.

The expectation of a recession in 2024 further complicates the interest rate landscape. While a cooling economy often leads to rate cuts, Vanguard’s perspective is that any such adjustments will be cautious, aligning with the Fed's careful balancing act to manage inflation without stifling economic growth. The broader implications of these anticipated rate dynamics are significant, influencing both fixed income yields and investor strategies across various asset classes.

Quality Over Yield

In response to the evolving economic backdrop, Vanguard's focus remains firmly on quality. The allure of high-quality bonds, particularly U.S. Treasuries, lies in their historical role as reliable sources of income during periods of economic instability. Vanguard also highlights the potential of high-quality corporate bonds, which, despite the increased risk relative to government securities, offer attractive yields and a measure of security for risk-averse investors.

This strategic emphasis on quality reflects a broader industry trend towards risk mitigation. As investors navigate potential volatility, the appeal of stable, income-generating assets becomes increasingly pronounced. Vanguard’s strategy aligns with this sentiment, advocating for a measured approach that prioritizes capital preservation.

Monitoring Commercial Real Estate

Vanguard's outlook also extends to the commercial real estate sector, an area of heightened interest given current economic conditions. The group remains vigilant about the potential impact of high interest rates on real estate valuations and demand, particularly in office spaces affected by post-pandemic shifts in work habits. However, Vanguard remains optimistic that any downturn in this sector will be contained, owing to strong fundamentals and adaptive market strategies.

This cautious optimism is indicative of Vanguard's broader approach to market analysis, blending a recognition of risk with an acknowledgment of underlying strengths in the economy. The firm’s perspective on commercial real estate highlights a nuanced understanding of sector-specific dynamics, reinforcing the importance of a diversified investment approach.

Implications for Investors

For investors, Vanguard's fixed income outlook presents both opportunities and challenges. The emphasis on quality assets suggests a reevaluation of portfolios, with a shift towards instruments that offer greater security and stability. In this context, U.S. Treasuries and high-quality corporate bonds emerge as key components of a resilient investment strategy.

Furthermore, Vanguard’s analysis provides actionable insights into navigating the complexities of the current market environment. By prioritizing quality and maintaining a vigilant stance on economic indicators, investors can better position themselves to weather potential downturns. This approach underscores the necessity of informed decision-making, supported by comprehensive market analysis and a clear understanding of individual risk tolerances.

Conclusion

Vanguard's fixed income market outlook for 2024 paints a picture of cautious optimism, grounded in a strategic focus on quality assets and a measured response to economic volatility. As investors grapple with the potential for recession and continued interest rate fluctuations, Vanguard’s insights offer a roadmap for navigating these challenges. Emphasizing stability and resilience, Vanguard's strategy is designed to safeguard investor interests in an uncertain economic landscape.

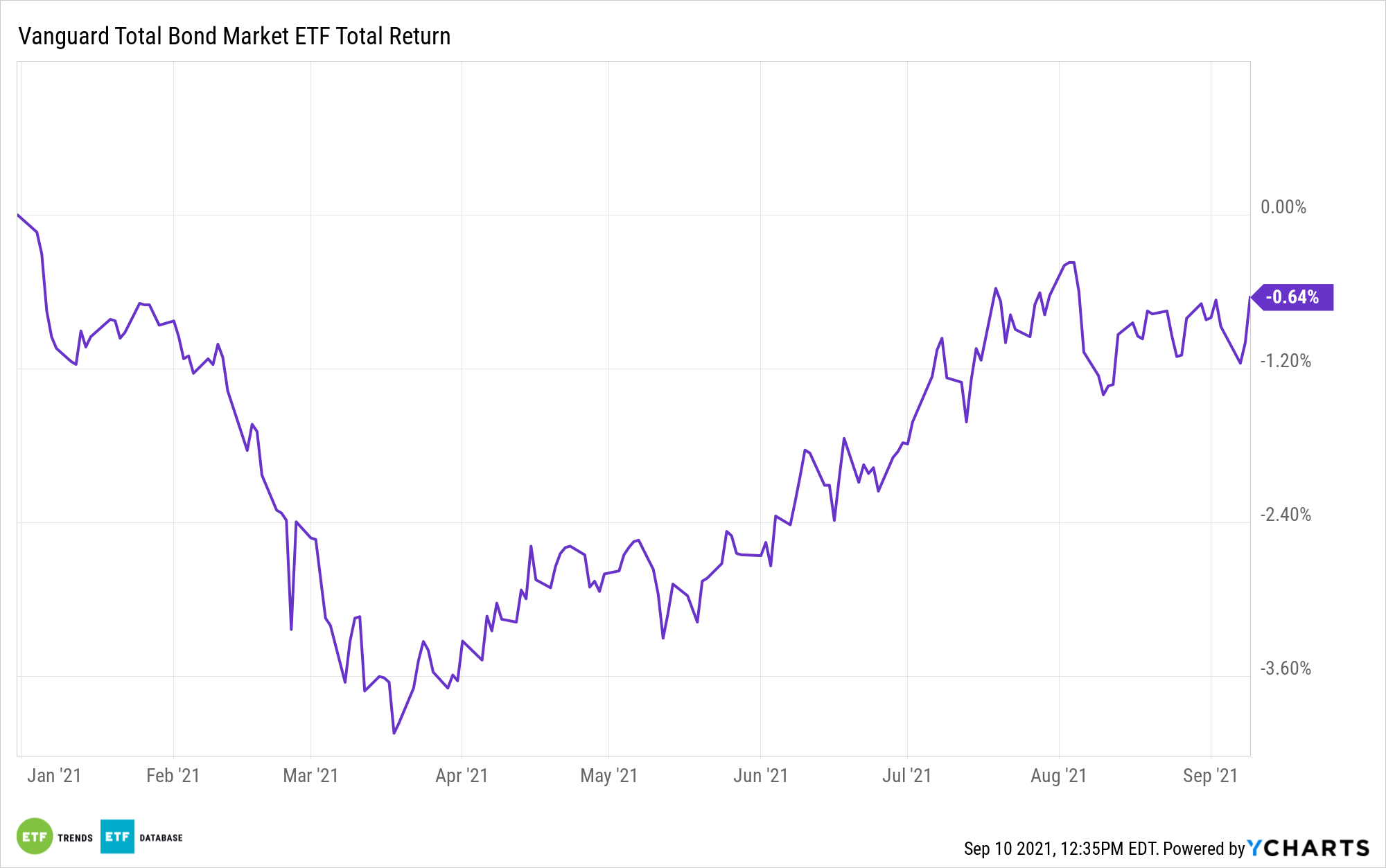

This image illustrates Vanguard's strategic focus on duration management within fixed income portfolios, a key component of their approach to navigating interest rate changes. As investors consider their options, this visual representation underscores the importance of balancing risk and return in the pursuit of long-term financial goals.