Vanguard, one of the leading figures in the financial investment industry, continues to provide invaluable insights into the ever-evolving landscape of Exchange-Traded Funds (ETFs). As we look into the future of ETF trends, Vanguard's expert analysis sheds light on potential market movements and strategic investment opportunities that investors should not overlook.

Vanguard's Market Insights: A Look into Future ETF Trends

The ETF market has become an essential component of modern investment strategies, providing flexibility, diversification, and cost-effectiveness. As the global financial dynamics shift, Vanguard’s insights become crucial for investors aiming to anticipate and capitalize on these changes. In this analysis, we delve into the future outlook of ETFs, guided by Vanguard's market expertise.

Key Insights

Vanguard’s market analysis offers a comprehensive overview of the potential directions in which ETF markets could head, emphasizing the importance of staying informed and agile in the face of shifting economic landscapes. Here are some of the critical insights outlined by Vanguard:

-

Market Dynamics and Investor Behavior: The ETF landscape is influenced by various factors, including macroeconomic trends, investor sentiment, and regulatory changes. Vanguard highlights the importance of understanding these dynamics to navigate the market effectively. With the rise of thematic and sector-specific ETFs, investors are increasingly seeking targeted exposure to specific industries and trends.

-

Technological Advancements: The integration of technology in financial markets is reshaping how ETFs are structured and traded. Vanguard points out the growing role of artificial intelligence and machine learning in enhancing investment strategies and optimizing portfolio management. These technological advancements allow for more precise tracking and analysis of market movements.

-

Sustainable Investing: Environmental, Social, and Governance (ESG) criteria are becoming a focal point in investment decisions. Vanguard notes the rising popularity of ESG-focused ETFs as investors seek to align their portfolios with sustainable and socially responsible practices. This trend is expected to continue, driven by increasing awareness and regulatory support.

Future Outlook

The future of ETFs is marked by several emerging trends that present both opportunities and challenges for investors. According to Vanguard, these trends are pivotal in shaping the ETF landscape in the coming years:

-

Global Diversification: As global markets become more interconnected, the demand for geographically diversified ETFs is expected to rise. Investors are looking to capture growth opportunities in emerging markets while mitigating risks associated with domestic economic fluctuations. Vanguard underscores the importance of global diversification in achieving long-term investment goals.

-

Thematic Investing: Thematic ETFs, which focus on specific themes such as technology, healthcare, or clean energy, are gaining traction among investors. Vanguard's analysis indicates that this trend will continue as investors seek to capitalize on transformative trends and innovations. Thematic ETFs offer a way to gain exposure to high-growth sectors while diversifying risk across a particular theme.

-

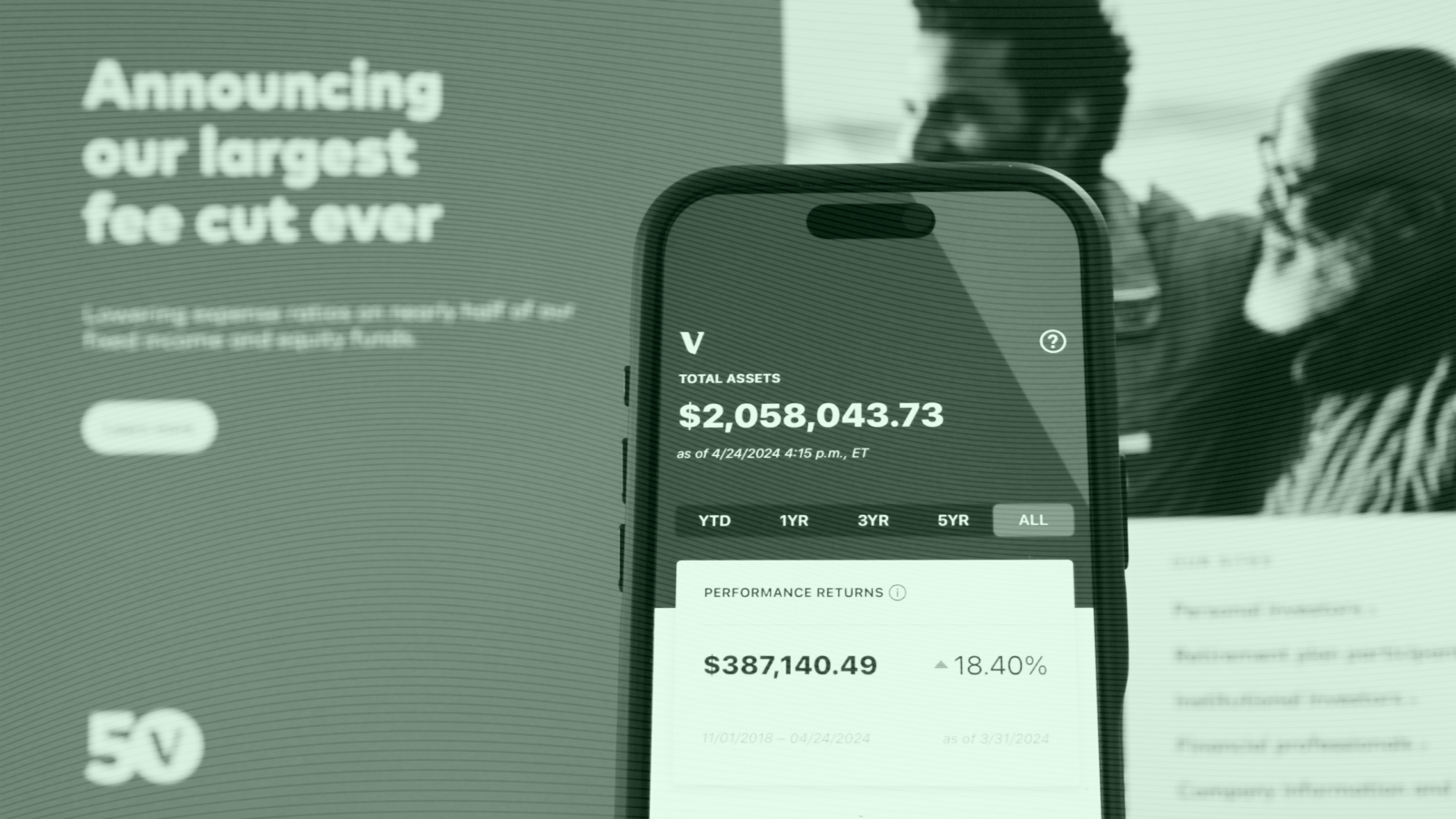

Cost Efficiency and Accessibility: ETFs are celebrated for their cost-effectiveness, and Vanguard predicts that fee compression will remain a significant theme. As competition intensifies, investors can expect more affordable options, making ETFs accessible to a broader audience. Vanguard remains committed to providing low-cost investment solutions, maintaining its position as a leader in the industry.

-

Regulatory Developments: Changes in regulatory frameworks can significantly impact the ETF market. Vanguard advises investors to stay informed about regulatory changes that could affect ETF structures, trading, and tax implications. Understanding these changes is crucial for making informed investment decisions and adapting strategies accordingly.

Investment Opportunities

For investors looking to harness the potential of emerging ETF trends, Vanguard's insights provide a roadmap to identifying and seizing investment opportunities. Here are some actionable strategies:

-

Monitor Sector Rotation: As economic conditions evolve, certain sectors may outperform others. Vanguard emphasizes the importance of monitoring sector rotation and adjusting portfolios accordingly. Sector-specific ETFs can offer targeted exposure to high-performing industries, enhancing overall portfolio performance.

-

Embrace Innovation: Investors should consider allocating a portion of their portfolios to innovative and disruptive technologies. ETFs focusing on areas such as artificial intelligence, biotechnology, and renewable energy provide opportunities to participate in the growth of these transformative sectors.

-

Focus on Quality and Stability: While pursuing growth, maintaining a balance of quality and stability is crucial. Vanguard advises incorporating ETFs that focus on companies with strong fundamentals, sustainable business models, and robust financial health. This approach helps mitigate risks and achieve steady, long-term returns.

-

Stay Informed and Agile: The ETF market is dynamic, and staying informed about market trends, economic indicators, and geopolitical developments is essential. Vanguard encourages investors to remain agile, ready to adjust their strategies in response to changing market conditions.

Conclusion

Vanguard’s market insights are invaluable for investors seeking to navigate the complexities of the ETF landscape. By understanding the key trends and potential opportunities, investors can position themselves to capitalize on the evolving market dynamics. As we look to the future, Vanguard’s expertise offers a guiding light, helping investors anticipate and adapt to the changes ahead.

For more in-depth analysis and updates on ETF trends, consider exploring Vanguard's insights, where timely analysis and expert commentary are regularly provided to keep investors informed and empowered.