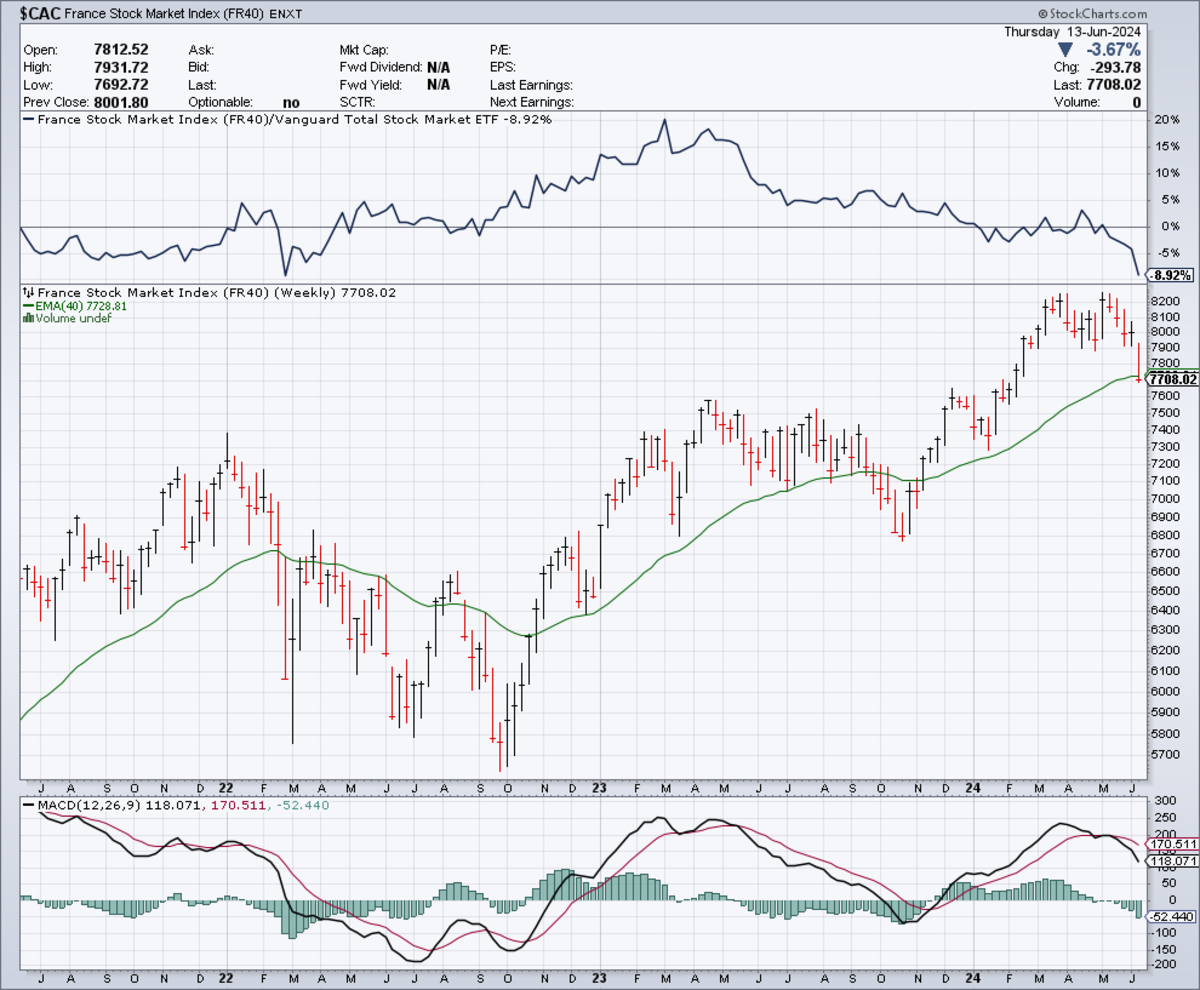

In the early months of 2025, the French stock market has been making waves with remarkable performance, as evidenced by the FR40 index, which has surged an impressive 10.03%, equating to a 740-point increase. This growth is reflective of a renewed investor confidence and a resilient economic climate in France, marking a significant recovery trajectory post-pandemic.

The surge in the FR40 index can be attributed to several key factors, including robust economic recovery, favorable government policies, and a resurgence in key sectors that have traditionally driven the French economy. In this analysis, we delve into the pivotal sectors fueling this growth and explore the potential risks that could influence future performance.

Economic Recovery and Government Policy

The French economy, like many others globally, was significantly impacted by the COVID-19 pandemic. However, the concerted efforts by the French government to stimulate economic activity through substantial fiscal and monetary measures have borne fruit. These measures include targeted fiscal stimulus packages, tax incentives for businesses, and an accommodative monetary policy stance by the European Central Bank (ECB).

France's GDP growth has accelerated, with projections indicating a steady upward trajectory throughout 2025. This macroeconomic stability has contributed to a positive market sentiment, reflected in the strong performance of the FR40 index. Moreover, the government's focus on sustainability and digital transformation has positioned France as a forward-looking economy, attracting investments in technology and green energy sectors.

Sectoral Performance: Key Drivers

Several sectors have been instrumental in propelling the FR40 index upward. Notably, the technology and renewable energy sectors have emerged as significant contributors to this growth.

Technology Sector

The technology sector in France has seen a resurgence, driven by the acceleration of digital transformation initiatives. Companies within this sector have benefited from increased demand for digital solutions, as businesses across various industries expedite their digitalization efforts. This trend is evident in the strong performance of tech giants listed on the FR40, which are capitalizing on France's burgeoning digital economy.

Renewable Energy

The commitment to environmental sustainability has placed renewable energy at the forefront of France's economic agenda. Investments in this sector have surged, supported by government incentives and a global shift towards sustainable energy sources. The performance of companies involved in solar, wind, and other renewable energy projects has been robust, contributing significantly to the FR40's growth.

Financial Services

The financial services sector has also played a pivotal role, buoyed by a recovery in consumer and corporate lending activities. French banks have demonstrated resilience, with improved balance sheets and an uptick in lending, reflecting a broader economic recovery. The sector's stability has been further enhanced by regulatory reforms aimed at strengthening financial institutions.

Risks and Challenges

While the FR40 index's performance is promising, several risks could potentially impact its trajectory. Key among these are geopolitical tensions, inflationary pressures, and potential policy shifts.

Geopolitical Tensions

Geopolitical tensions, particularly those involving France's key trade partners, pose a risk to market stability. Any escalation in global trade disputes or regional conflicts could result in market volatility, affecting investor confidence and potentially stalling economic growth.

Inflationary Pressures

Inflationary pressures remain a concern, with rising energy prices and supply chain disruptions contributing to upward price pressures. The French government and the ECB's response to these inflationary trends will be crucial in maintaining economic stability and investor confidence.

Policy Shifts

Potential shifts in government policy, particularly those related to taxation and regulatory frameworks, could impact market dynamics. Investors will be closely monitoring any policy changes that could affect corporate profitability and investment incentives.

Conclusion

The impressive performance of the FR40 index in early 2025 underscores the resilience and dynamism of the French economy. The index's growth is underpinned by strong sectoral performances, particularly in technology, renewable energy, and financial services. However, investors should remain cognizant of the potential risks that could impact future performance, including geopolitical tensions, inflationary pressures, and policy shifts.

As France continues to navigate its post-pandemic recovery, the outlook for the FR40 index remains cautiously optimistic. The country's strategic focus on sustainability and innovation will likely continue to attract investments, positioning the French stock market as a key player in the global economic landscape.

In summary, while the FR40's ascent is commendable, prudent investment strategies should be employed to navigate potential market volatilities. Investors should remain vigilant, leveraging market data and expert insights to make informed decisions in this evolving economic landscape.