Bitcoin's wealth distribution remains a topic of significant concern within the cryptocurrency market, with the concentration of holdings raising questions about market stability and equity. Recent reports, such as The Wall Street Journal, highlight that a small percentage of holders control a disproportionate share of Bitcoin's total supply. This concentration is not merely a statistical anomaly but a structural feature of the cryptocurrency landscape, with profound implications for market behavior and investor dynamics.

Understanding Bitcoin's Wealth Concentration

Bitcoin, often touted as a decentralized financial system, ironically suffers from a significant concentration of wealth. According to the Wall Street Journal, approximately 1% of Bitcoin holders control over 90% of the cryptocurrency's total supply. This stark inequality mirrors the wealth distribution patterns seen in traditional financial systems, challenging the narrative of Bitcoin as a democratizing financial tool.

The concentration of Bitcoin in the hands of a few "whales"—large holders capable of making significant market moves—presents risks akin to those in traditional finance, where large institutional players can influence markets through substantial trades. This concentration could lead to price manipulation, increased volatility, and potential market destabilization, particularly if these major holders decide to liquidate their positions.

Implications for Market Stability

The concentration of Bitcoin holdings has direct implications for market stability. In traditional financial markets, the presence of large shareholders often results in increased market volatility. This is because a single entity's decision to buy or sell can dramatically influence asset prices. In the context of Bitcoin, where market sentiment can already be highly volatile, the actions of a small number of holders could lead to rapid and unpredictable price swings.

Moreover, the potential for price manipulation is a real concern. If these large holders—whether individuals or institutional investors—coordinate their actions, they could artificially inflate or deflate prices, impacting smaller investors who may not have the resources to weather such volatility. This scenario undermines the principles of fair market practices and poses a challenge to regulatory bodies aiming to ensure market integrity.

Equity and Accessibility Concerns

Beyond market stability, the concentration of wealth in Bitcoin raises questions about equity and accessibility. The ideal of cryptocurrencies as tools for financial inclusion is undercut by the reality that access to significant wealth in Bitcoin is limited to those who entered the market early or possess the means to make substantial investments.

This concentration also affects the perception of Bitcoin and other cryptocurrencies among potential new investors. According to a Pew Research Center survey, a significant portion of Americans remain skeptical about the safety and reliability of cryptocurrencies. Such skepticism is likely exacerbated by the knowledge that market dynamics are largely driven by a wealthy minority, potentially discouraging broader participation.

Potential Solutions and Future Outlook

Addressing the concentration of Bitcoin wealth is a complex challenge with no straightforward solution. However, several strategies could mitigate its impact on market stability and equity.

Regulatory Interventions

Regulatory bodies could play a role in addressing wealth concentration by imposing transparency requirements for large Bitcoin transactions and holdings. Such measures could deter market manipulation by increasing the visibility of trades that could significantly impact prices. Additionally, regulations could promote fairer market conditions, encouraging broader participation by reducing the risks associated with extreme volatility.

Decentralized Finance (DeFi) Innovations

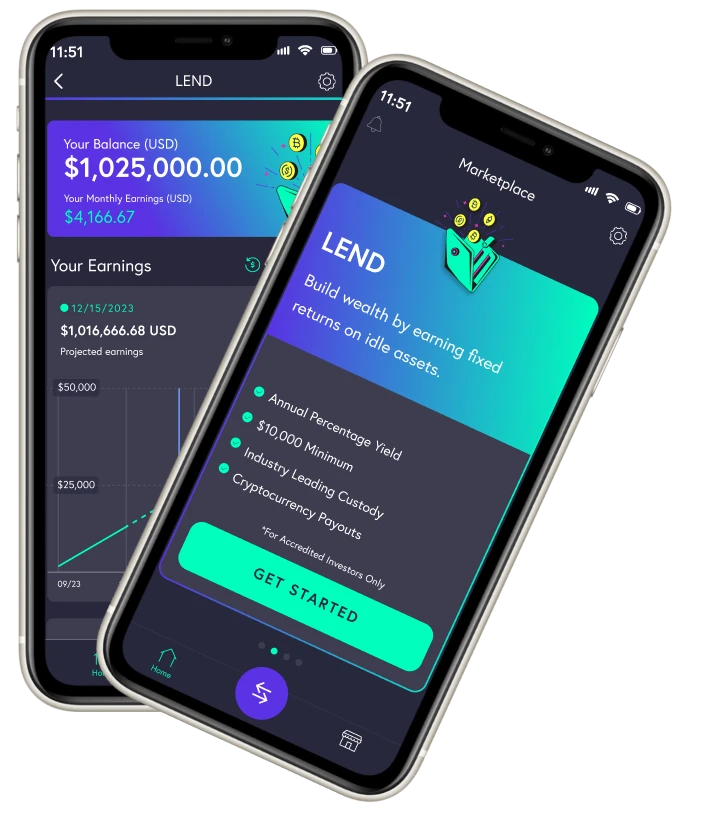

The rise of decentralized finance (DeFi) offers alternative models that could redistribute wealth more equitably. By enabling peer-to-peer lending, borrowing, and trading without intermediaries, DeFi platforms could democratize access to financial services traditionally dominated by large entities. While DeFi is still in its nascent stages, its potential to influence wealth distribution within the cryptocurrency ecosystem should not be overlooked.

Community-Driven Initiatives

Community-driven initiatives, such as token distribution models that prioritize broader ownership, could also help address the concentration issue. For instance, projects that distribute tokens or coins through airdrops or community rewards could foster a more diverse holder base. However, these initiatives require careful design to avoid unintended consequences, such as diluting value or creating new forms of inequality.

Conclusion

The concentration of Bitcoin wealth poses significant challenges to market stability and equity. While Bitcoin and other cryptocurrencies have the potential to revolutionize the financial landscape by providing greater accessibility, the current distribution of wealth within these systems reflects traditional patterns of inequality. Addressing this concentration will require a multifaceted approach, including regulatory oversight, technological innovation, and community engagement, to ensure that the benefits of cryptocurrency can be realized by a broader population.

As Bitcoin continues to evolve, the dynamics of wealth concentration will remain a critical issue for investors, regulators, and the broader financial community. Balancing the ideals of decentralization and democratization with practical steps to mitigate concentration risks will be essential for the long-term viability and credibility of the cryptocurrency market.