Sustainable investing has emerged as a powerful trend in the investment landscape, driven by growing awareness of environmental, social, and governance (ESG) issues. Exchange-traded funds (ETFs) have become pivotal players in this movement, offering investors a versatile and accessible means to align their portfolios with sustainability goals. As investors' priorities shift towards responsible investing, ETFs are poised to play an increasingly significant role in shaping the future of sustainable finance.

The Rise of ESG-focused ETFs

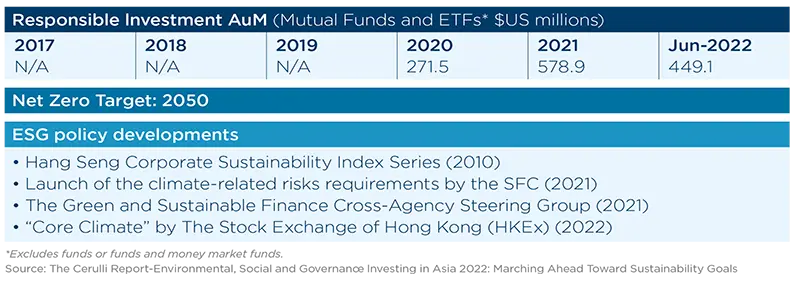

The Federated Hermes highlights the growing emphasis on responsible investing, underscoring the importance of integrating ESG criteria into investment strategies. With investors increasingly seeking to address climate change, social inequities, and corporate governance concerns, ESG-focused ETFs have gained substantial traction. These funds provide a streamlined vehicle for investors to align their financial goals with their ethical values, without sacrificing potential returns.

Bloomberg's market analysis further supports this trend, noting a surge in demand for sustainable ETFs. This shift reflects a broader realignment of investor priorities, as more individuals and institutions recognize the long-term benefits of investing in companies that adhere to sustainable practices. The proliferation of ESG ETFs is also indicative of a maturing market, where transparency in ESG metrics and performance is becoming a standard expectation.

Advantages of ESG ETFs

ESG ETFs offer several advantages that make them an attractive option for investors seeking sustainability. Firstly, they provide diversification across various sectors and regions, mitigating risk while capitalizing on diverse opportunities. This diversification is crucial in a rapidly changing global environment where sustainability issues can impact different industries in unique ways.

Moreover, ETFs are inherently more liquid than traditional mutual funds, allowing investors to enter and exit positions with ease. This liquidity is particularly beneficial in the context of ESG investing, where market developments can quickly influence the perceived value of sustainable assets. The ability to swiftly adjust one's portfolio to reflect new information or shifts in ESG ratings is a significant advantage for active investors.

The Performance Debate

While the ethical appeal of ESG investing is clear, questions about performance persist. Some investors are concerned that prioritizing ESG factors might lead to suboptimal financial outcomes. However, emerging data suggests otherwise. According to a recent study by Morningstar, sustainable funds, including ETFs, have matched or outperformed their traditional counterparts over a five-year period.

This performance is attributed to several factors. Companies that prioritize ESG criteria often exhibit strong governance practices, efficient resource use, and robust risk management, all of which contribute to long-term value creation. Additionally, as societal pressures mount, companies that fail to adapt may face regulatory penalties, reputational damage, and financial setbacks—risks that ESG-conscious companies are better positioned to navigate.

The Role of Regulation

Regulation plays a pivotal role in shaping the future of sustainable investing. Governments and regulatory bodies worldwide are increasingly implementing policies that mandate ESG disclosures and promote sustainable financial practices. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires asset managers to provide detailed information on the ESG characteristics of their products.

These regulatory frameworks not only enhance transparency but also drive the standardization of ESG metrics. As a result, investors can make more informed decisions based on consistent and comparable data. This regulatory momentum is expected to continue, further bolstering the growth of ESG ETFs and reinforcing their role in sustainable investing.

Challenges and Considerations

Despite their promise, ESG ETFs face several challenges. One of the primary concerns is the lack of uniformity in ESG ratings and criteria. Different rating agencies may use varying methodologies, leading to discrepancies that can confuse investors. This inconsistency underscores the need for industry-wide standards and greater transparency in ESG reporting.

Additionally, the risk of "greenwashing" remains prevalent. Companies may exaggerate their ESG credentials to attract investment without implementing genuine sustainable practices. Investors must exercise due diligence, scrutinizing both the ETF's underlying holdings and the criteria used to evaluate them.

The Path Forward

As sustainable investing continues to gain momentum, ETFs will undoubtedly play an integral role in shaping its trajectory. For investors, ESG ETFs represent a viable pathway to integrate ethical considerations into their portfolios while potentially reaping competitive financial returns. However, to fully harness the potential of these instruments, investors must remain vigilant, critically assessing the ESG credentials of the funds they choose.

The financial industry, too, must rise to the challenge, ensuring that ESG ETFs are grounded in robust, transparent, and standardized frameworks. Only then can sustainable investing achieve its full potential, driving positive change across markets and societies.

In conclusion, the future of sustainable investing is inextricably linked to the evolution of ETFs. As market dynamics shift and regulatory landscapes evolve, ETFs will continue to provide investors with the tools needed to navigate the complexities of ESG investing. By prioritizing sustainability, investors can contribute to a more equitable, sustainable world while pursuing their financial objectives.