Bitcoin ETFs: A Game Changer for Cryptocurrency Trading Volumes

The advent of Bitcoin Exchange-Traded Funds (ETFs) in the US market marks a significant milestone in the evolution of cryptocurrency trading. With major financial institutions like Grayscale and BlackRock spearheading the movement, these ETFs have already made a profound impact on trading volumes and investor behavior, setting a new precedent for the integration of digital assets into traditional financial markets.

A Surge in Trading Volumes

The launch of Bitcoin ETFs has been met with substantial trading activity. According to Bloomberg Intelligence, Grayscale's Bitcoin ETF alone accounted for approximately half of the market's activity on its debut, with $1 billion in trades occurring within the first 90 minutes. BlackRock's iShares Bitcoin ETF also experienced similar enthusiasm, recording over $1 billion in trades by the end of its first trading day.

The total trading volume reached a staggering $4 billion on the first day, reflecting not only the inflow of new capital but also a rotational shift from existing products like Grayscale’s Bitcoin Trust. This trust, which charges a 1.5% fee, saw investors reallocating their holdings to the newly launched ETFs, which offer more competitive fee structures.

Investor Behavior and Market Dynamics

The introduction of Bitcoin ETFs is reshaping investor behavior and market dynamics. Todd Rosenbluth, head of research at VettaFi, suggests that the trading volumes observed in the ETFs reflect both new investments and strategic reallocations by current Bitcoin holders. This suggests that the ETFs are not just attracting new investors but are also absorbing interest from existing market participants seeking more efficient investment vehicles.

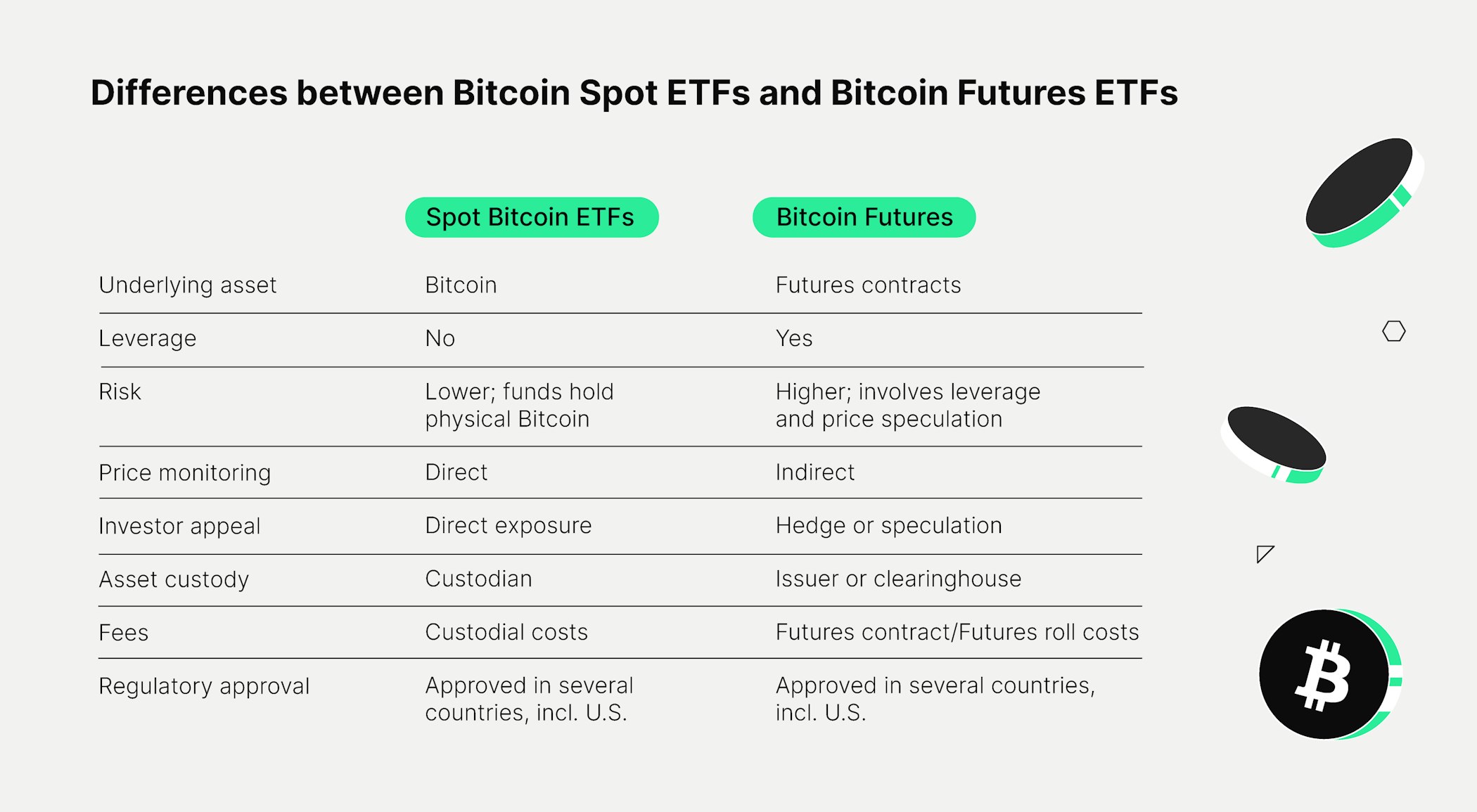

Moreover, the shift from futures-based ETFs to spot Bitcoin ETFs marks a critical change. The earlier futures-based ETFs, such as those launched by ProShares in 2021, garnered $1 billion in investor money within the first two days. However, the direct exposure provided by spot Bitcoin ETFs is anticipated to drive even greater interest and sustained growth.

Implications for the Cryptocurrency Market

The impact of Bitcoin ETFs extends beyond immediate trading volumes. Their introduction is likely to enhance liquidity and price discovery in the cryptocurrency market. By providing a regulated and accessible investment vehicle, ETFs could attract a broader range of institutional investors who were previously hesitant due to regulatory uncertainties and the complexities of direct cryptocurrency ownership.

Matthew Sigel, VanEck’s head of digital assets research, noted that the first day of ETF trading proceeded smoothly, with the Bitcoin blockchain showing no signs of congestion. This operational success sets a positive precedent for future ETF launches and may pave the way for other digital assets to follow suit.

The Future of Cryptocurrency Investments

Bitcoin ETFs are poised to influence future cryptocurrency investments significantly. As these products gain traction, they could lead to increased mainstream adoption of cryptocurrencies and further integration into the global financial system. The potential for other digital assets to be packaged into ETFs could open new avenues for diversification and risk management in investment portfolios.

Furthermore, the regulatory approval of these ETFs by the US Securities and Exchange Commission (SEC) signals a growing acceptance of cryptocurrencies within traditional financial frameworks. This could encourage other jurisdictions to follow suit, fostering a more unified and robust global market for digital assets.

Challenges and Considerations

Despite their promising outlook, Bitcoin ETFs face several challenges. Market participants must navigate the complexities of managing and securing digital assets, ensuring compliance with evolving regulatory standards, and addressing potential liquidity concerns in underlying markets.

Additionally, investors should remain vigilant of the inherent volatility in cryptocurrency markets. While ETFs offer a more regulated environment, the price fluctuations of digital assets like Bitcoin remain a critical risk factor. Investors are encouraged to conduct thorough due diligence and consider their risk tolerance before engaging with these financial products.

Conclusion

The launch of Bitcoin ETFs represents a transformative development in the cryptocurrency landscape, offering new opportunities and challenges for investors. By bridging the gap between traditional finance and digital assets, these ETFs are set to redefine market dynamics, drive trading volumes, and influence investment strategies. As the market continues to evolve, stakeholders must remain adaptable and informed to capitalize on this burgeoning financial frontier.

For more detailed insights into the debut of Bitcoin ETFs and their market implications, refer to Reuters and Financial Times.