Emerging Trends in Defense and Aerospace Investments

The global defense and aerospace sectors are experiencing a renaissance in investment, fueled by escalating geopolitical tensions and rapid technological advancements. This resurgence is primarily led by the United States, where the Department of Defense (DoD) is revitalizing its commitment to the defense industrial base. The integration of cutting-edge technologies, particularly artificial intelligence (AI), is a pivotal component of these enhanced defense strategies, promising significant implications for investors and the broader economy.

Strengthening the Defense Industrial Base

In recent years, U.S. defense spending as a share of GDP has reached historically low levels, raising concerns about the country's ability to maintain deterrence amidst growing global threats. However, a paradigm shift is underway. The DoD is significantly increasing its investment in the defense industrial base, a sector historically noted for fostering innovation. This includes past contributions to transformative technologies like personal computing and air travel.

According to E*TRADE, the U.S. led global private investment in AI in 2023, with $67 billion allocated—8.7 times that of China, its nearest competitor. This substantial investment underscores the U.S. government's strategy to leverage AI and emerging technologies to maintain a strategic edge and bolster national security.

The Pentagon's initiatives, such as the Defense Innovation Unit and the Office of Strategic Capital, are instrumental in channeling venture capital into defense tech startups. These efforts aim to integrate AI into defense mechanisms, potentially reshaping the landscape of military capabilities and operational efficiency.

Economic Impact and Investment Opportunities

The ripple effects of increased defense spending are anticipated to extend beyond the immediate sector, potentially enhancing private sector productivity and stimulating investment across diverse industries. As outlined in BlackRock's insights, defense research and development (R&D) not only fosters innovation but also drives economic growth by increasing productivity and economic output.

Investors are advised to consider opportunities among large defense contractors and companies within the "family tree" of ancillary sectors, including aerospace, cybersecurity, and AI-related technologies. These sectors are likely to benefit from sustained defense investments and the modernization of military infrastructure.

Geopolitical Catalysts

Geopolitical tensions are a significant driver of the renewed focus on defense and aerospace investments. The current global landscape, characterized by increasing conflict potential, underscores the necessity for robust defense mechanisms. This geopolitical backdrop is likely to sustain and possibly accelerate the current investment trend in defense technologies and capabilities.

The U.S.'s strategic focus on incorporating AI into defense is not an isolated endeavor. Globally, countries are recognizing the need to modernize their military capabilities to counter potential threats. This global movement towards modernization is expected to bolster defense investments further, offering promising prospects for investors eyeing international defense markets.

Technological Integration and Innovation

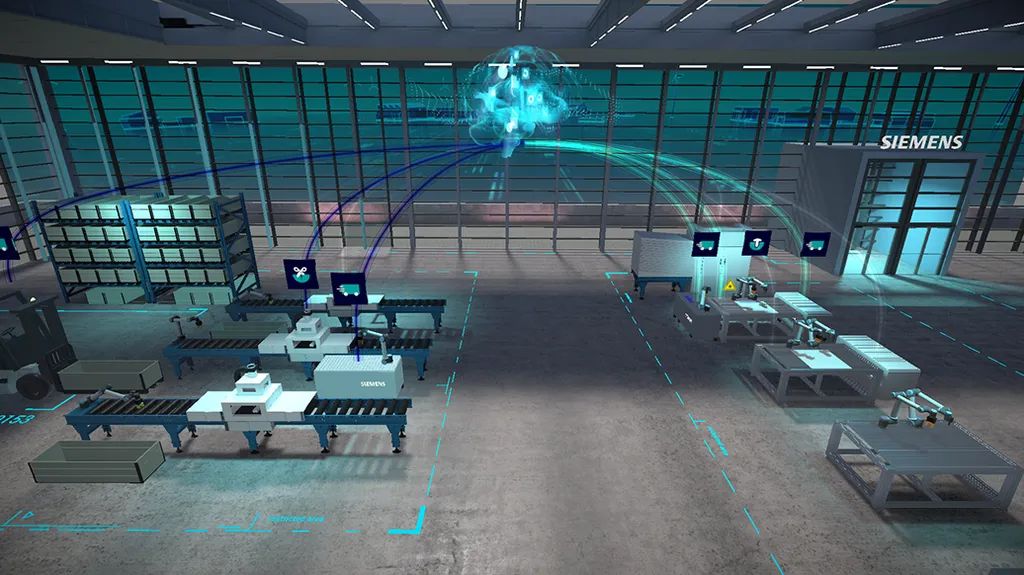

The integration of AI and other advanced technologies into defense strategies is reshaping the defense sector's future. For instance, AI's application in autonomous systems, cybersecurity, and data analytics is enhancing operational capabilities and decision-making processes. This technological integration is not only pivotal for maintaining a competitive edge but also for ensuring the safety and efficacy of defense operations.

The Defense Innovation Unit's active role in fostering partnerships with tech startups highlights the importance of collaboration between the defense sector and private tech companies. Such partnerships are crucial for developing and deploying innovative solutions that address modern defense challenges.

Challenges and Considerations

Despite the optimistic outlook, several challenges could affect the trajectory of defense and aerospace investments. Federal budget constraints and supply chain complexities are potential hurdles that need careful navigation. The sector's reliance on global supply chains makes it vulnerable to disruptions, which could impact production and deployment timelines.

Moreover, the potential for increased federal deficits as a result of heightened defense spending necessitates strategic planning to ensure fiscal sustainability. Balancing the need for modernization with budgetary constraints will be a critical challenge for policymakers.

Conclusion

As geopolitical tensions rise and technological advancements continue to transform the defense landscape, the defense and aerospace sectors present compelling investment opportunities. The U.S.'s leadership in integrating AI into defense strategies is a key factor driving this trend, promising substantial economic and strategic benefits.

Investors should remain vigilant, focusing on sectors that stand to gain from increased defense spending and technological integration. While challenges remain, the potential for significant economic impact and innovation makes the defense and aerospace sectors an attractive area for investment in the coming years.

For more detailed insights on market trends and investment opportunities, visit BlackRock's insights and E*TRADE's perspectives.