Risk Management in the ETF Market: Navigating the Complex Landscape

The exchange-traded fund (ETF) market has witnessed remarkable growth over the past two decades, evolving into a cornerstone of modern investment strategies. As of 2025, the global ETF market has surpassed $10 trillion in assets under management, showcasing its pivotal role in the financial markets. This growth, however, brings an increased focus on risk management, a critical component in ensuring the stability and sustainability of these investment vehicles.

Understanding ETF Risks

ETFs offer investors diversified exposure to various asset classes, including equities, fixed income, and commodities, through a single investment vehicle. Despite their advantages, ETFs are not without risks. These include market risk, liquidity risk, tracking error, and operational risk. Market risk pertains to the volatility and potential loss associated with the underlying securities of an ETF. Liquidity risk involves the potential difficulty in buying or selling ETF shares without significantly impacting the market price.

Tracking error, on the other hand, refers to the discrepancy between the performance of the ETF and its benchmark index. This can arise from various factors such as management fees, rebalancing costs, and dividend withholding taxes. Operational risks encompass issues related to trading, settlement, and other administrative processes.

Regulatory Frameworks and Their Role

Regulatory bodies play a crucial role in mitigating these risks by establishing guidelines and frameworks that govern the operation of ETFs. The U.S. Securities and Exchange Commission (SEC) has implemented rules to enhance transparency and protect investors. These include the requirement for daily portfolio disclosure and adherence to certain liquidity risk management programs. The SEC also mandates that ETFs comply with the Investment Company Act of 1940, ensuring a level of oversight similar to mutual funds.

In Europe, the Undertakings for Collective Investment in Transferable Securities (UCITS) directive provides a regulatory framework for ETFs, emphasizing investor protection and risk management. UCITS-compliant ETFs are subject to strict rules on diversification, transparency, and leverage, making them a popular choice among risk-averse investors.

Derivative Strategies in Risk Management

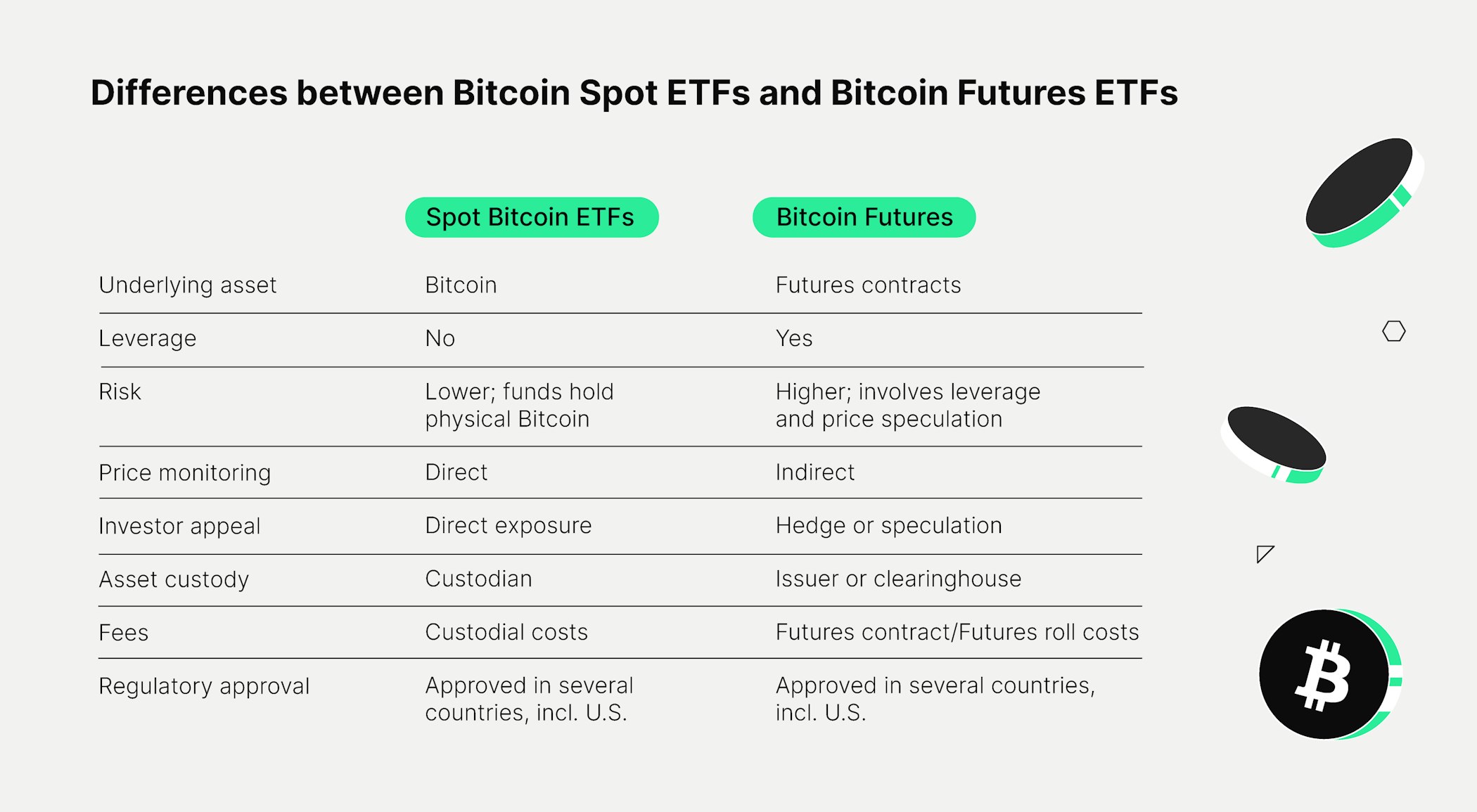

To effectively manage risk, ETF managers often employ derivative strategies. Derivatives, such as options and futures, allow managers to hedge against adverse market movements. For instance, an ETF tracking the S&P 500 may use futures contracts to offset potential losses during a market downturn. These strategies can enhance an ETF’s ability to track its benchmark closely while mitigating volatility.

According to a report by Risk.net, the use of derivatives in ETFs has grown significantly, driven by the need for precise risk management tools. "Derivatives provide ETF managers with the flexibility to manage risks dynamically, ensuring that the fund remains aligned with its investment objectives," says John Smith, a senior analyst at a leading financial institution.

The Role of Technology in Risk Management

Technological advancements have also played a crucial role in enhancing risk management within the ETF market. Advanced algorithms and artificial intelligence (AI) are increasingly used to monitor market conditions in real-time, enabling fund managers to respond swiftly to changing dynamics. These technologies facilitate better decision-making by providing insights into market trends, liquidity conditions, and potential risks.

The integration of blockchain technology is another promising development. Blockchain can enhance transparency and reduce operational risks by providing a secure and immutable record of transactions. This technology is particularly beneficial in ensuring the integrity and accuracy of data, which is vital for risk management processes.

Expert Insights and Industry Perspectives

The importance of robust risk management practices in the ETF market cannot be overstated. Experts emphasize the need for continuous innovation and adaptation to address emerging risks. "As the ETF market continues to evolve, risk management strategies must also adapt to new challenges," notes Sarah Johnson, Chief Risk Officer at a prominent asset management firm. "This includes staying ahead of regulatory changes, technological advancements, and market developments."

Industry leaders are also advocating for greater collaboration between regulators, fund managers, and technology providers to enhance risk management frameworks. "A proactive approach involving all stakeholders is essential to develop effective risk management solutions that safeguard investor interests," says David Lee, CEO of a major ETF provider.

Conclusion

Risk management remains a cornerstone of the ETF market, essential for maintaining investor confidence and ensuring the market’s long-term viability. As ETFs continue to grow in popularity and complexity, the development and implementation of sophisticated risk management strategies will be crucial. Leveraging regulatory frameworks, derivative strategies, and technological advancements will enable the ETF market to navigate the challenges of a dynamic financial landscape effectively.

Investors and fund managers alike must remain vigilant, continuously assessing and adapting their risk management practices to align with the evolving market environment. By doing so, they can harness the full potential of ETFs while mitigating the inherent risks associated with these versatile investment vehicles.