The petrochemical industry is currently experiencing significant challenges as global trade tensions and supply chain disruptions impact its operational landscape in 2025. The imposition of tariffs by the United States on key trading partners, including Canada, Mexico, and China, has led to increased costs for raw materials and transportation. This has resulted in profitability concerns across the sector, as reported by ICIS.

Tariff Impact and Geopolitical Tensions

In an already volatile market, the US tariffs—set at 25% on most imports from Canada and Mexico—have further complicated international trade dynamics. These measures, effective from March 4, 2025, have left industry participants grappling with the impacts on trade flows and cost structures. Despite exemptions for goods compliant with the USMCA free trade agreement until April 2, the full implementation of these tariffs remains uncertain. Analysts from ING anticipate a 2.5% growth in global trade for 2025, driven by increased intra-continental trade and strategic adaptations among companies.

The World Integrated Trade Solution (WITS) data highlights that the US accounts for 13.6% of global exports, emphasizing the country's pivotal role in international trade. However, the reliance on non-substitutable raw materials and intermediate products necessitates new alliances and potential trade deals to sustain the flow of goods.

Supply Chain Disruptions

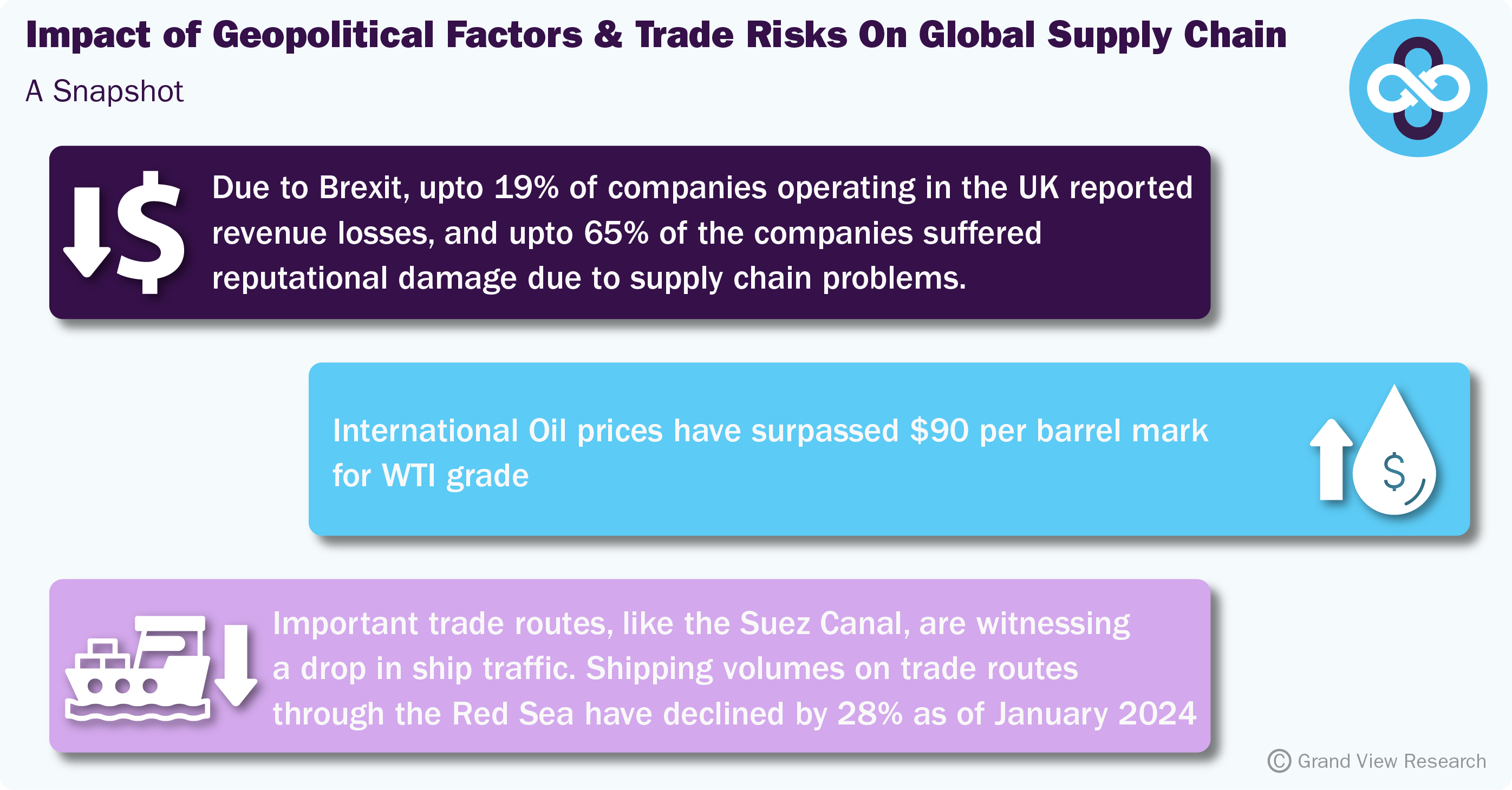

The petrochemical sector's supply chain has been further strained by logistical challenges, such as limited capacity for US-flagged chemical tankers and restricted passage through the Panama Canal due to drought conditions. These factors have compounded the difficulties faced by companies in maintaining efficient operations. The Panama Canal Authority (PCA) had to limit daily crossings, affecting trade routes crucial for the petrochemical industry.

Gabriel Mariscal, agency business manager at CB Fenton & Co, noted improvements in the Panama Canal's conditions, yet the shifting weather patterns remain a concern. The canal's customer ranking system, which prioritizes high-volume shippers, adds another layer of complexity to logistical planning.

Strategic Adaptations

To navigate these challenges, industry experts advocate for strategic adaptations. GreenChem Industries, a chemical distributor, suggests several measures: diversifying raw material sources from regions with favorable trade agreements, optimizing transportation routes, and seeking affordable chemical alternatives that maintain quality. Furthermore, reevaluating trade agreements to secure competitive pricing and exploring manufacturing opportunities within strategic markets could help mitigate tariff impacts.

The US Trade Representative (USTR) has proposed new port charges on Chinese-owned ships, which could further strain supply chains. These fees, potentially up to $1.5 million per US port call for vessels built in China, are part of a broader strategy to counteract practices deemed unreasonable by the US government. The proposal's implications for liquid chemical tankers, predominantly Chinese-built, are significant, affecting 25% of US liquid bulk exports and 21% of imports.

Market Outlook

The petrochemical industry must also contend with fluctuating crude oil prices, influenced by geopolitical tensions and shifting energy policies. The Energy Information Administration (EIA) provides insights into factors driving crude oil prices, which remain a critical input cost for petrochemical production.

Judah Levine, head of research at Freightos, highlighted a recent fall in container shipping rates from East Asia and China to the US, attributed to seasonal demand slumps and an end to frontloading ahead of tariffs. However, this trend offers limited relief amid broader supply chain challenges.

Conclusion

As the petrochemical industry grapples with these multifaceted challenges, companies are urged to adopt flexible strategies and explore new market opportunities. The combination of tariffs, supply chain disruptions, and geopolitical uncertainties necessitates a proactive approach to sustaining operations and profitability. Industry stakeholders must remain vigilant and adaptable to navigate the evolving global trade landscape effectively. For more detailed analysis and insights, readers can explore resources provided by ICIS and EIA.

As the industry continues to evolve, the need for comprehensive market analysis and strategic planning becomes increasingly crucial. The insights provided by these expert sources offer valuable guidance for navigating the complexities of the petrochemical market in 2025 and beyond.