The Resilience of the Sustainable Bond Market: A 2025 Outlook

The sustainable bond market has demonstrated remarkable resilience, with annual issuance exceeding $1 trillion in 2024. This marks a significant milestone, reflecting a robust growth trajectory that experts anticipate will continue into 2025. This article explores the factors driving this trend and the implications for global investors.

Overview of Market Growth

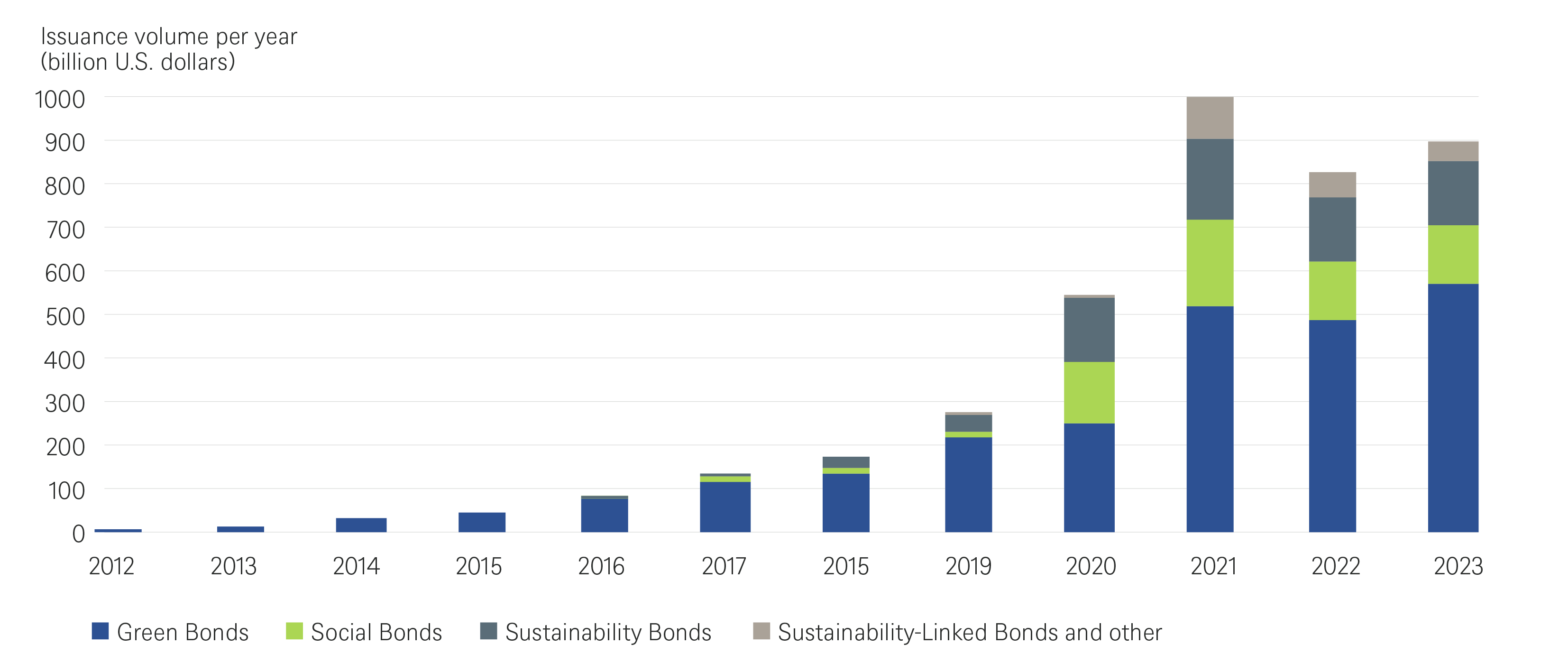

The sustainable bond market, encompassing green, social, and sustainability-linked bonds, has expanded rapidly over the past few years. According to a forecast by Environmental Finance, the market's growth is underpinned by increasing awareness and demand for investments that align with Environmental, Social, and Governance (ESG) criteria. In 2024, the market surpassed the $1 trillion mark in annual issuance, with projections suggesting continued expansion in 2025.

This growth aligns with broader trends in the financial markets, where ESG considerations are becoming a central focus for investors and regulatory bodies alike. As the world grapples with climate change and social inequality, sustainable bonds offer a viable solution for channeling capital towards projects that can make a tangible impact.

Key Drivers of Growth

Investor Demand: One of the primary drivers of growth in the sustainable bond market is the rising investor appetite for ESG-aligned products. A survey by the Global Sustainable Investment Alliance indicates that sustainable investment assets reached $35.3 trillion in 2024, a 15% increase from the previous year. This trend demonstrates a strong shift towards responsible investing, driven by both institutional and retail investors.

Regulatory Support: Governments and regulatory bodies around the world are increasingly supporting sustainable finance through favorable policies and incentives. The European Union's Sustainable Finance Disclosure Regulation (SFDR) and the European Green Deal are pivotal frameworks that have catalyzed growth in this sector. These policies aim to enhance transparency and encourage investments in sustainable projects, thereby boosting the appeal of sustainable bonds.

Corporate Participation: Corporations are increasingly issuing sustainable bonds to finance projects that align with their ESG goals. Data from BloombergNEF shows that corporate issuance of green bonds alone grew by 20% in 2024, highlighting a trend where companies are actively seeking to improve their sustainability credentials.

Implications for Investors

For investors, the sustainable bond market offers a compelling proposition. The potential for stable returns and diversification benefits make these instruments attractive, especially in a context of volatile equity markets. As noted by BlackRock, sustainable investments have historically shown resilience during market downturns, providing a buffer against economic shocks.

Moreover, the maturing of the sustainable bond market presents opportunities for yield enhancement. With the development of new products, such as sustainability-linked bonds, investors can access innovative instruments that offer performance-linked incentives aligned with ESG targets.

Expert Insights

Industry experts underscore the importance of incorporating sustainable bonds into investment portfolios. "The resilience of the sustainable bond market is a testament to the growing importance of ESG in investment decision-making," says Jane Ambachtsheer, Global Head of Sustainability at BNP Paribas Asset Management. "Investors are increasingly recognizing the financial and social returns that can be realized through these instruments."

Challenges and Opportunities

Despite its growth, the sustainable bond market faces challenges. Standardization of ESG metrics remains a critical issue, as investors require consistent and reliable data to assess the impact of their investments. Efforts by international organizations, such as the International Capital Market Association (ICMA), to establish guidelines and frameworks are crucial in addressing these challenges.

The market also presents opportunities for innovation. The integration of technology, such as blockchain, can enhance transparency and traceability in sustainable finance, thereby attracting a broader range of investors.

Conclusion

The sustainable bond market's resilience and growth potential make it an attractive option for global investors seeking to align their portfolios with ESG principles. As the market continues to evolve, it offers promising opportunities for both yield enhancement and risk mitigation. For investors looking to navigate the complexities of the modern financial landscape, sustainable bonds provide a pathway to achieving financial goals while contributing to a more sustainable future.

The robust performance of the sustainable bond market reflects a broader shift in the investment landscape, where ESG considerations are increasingly becoming mainstream. As we look towards 2025, the sustainable bond market is poised for further growth, driven by continued investor demand, regulatory support, and corporate participation.

For those interested in exploring this dynamic market, staying informed about developments in ESG standards and regulatory changes will be crucial. As the market matures, it is set to play a pivotal role in shaping the future of global finance.