In recent years, the cryptocurrency market has been marked by significant volatility, a characteristic that both intrigues and challenges investors. Bitcoin (BTC), the flagship cryptocurrency, has experienced a notable 7% rise recently, highlighting the rapid price swings that can occur within the digital currency landscape. This volatility presents both opportunities and risks, prompting investors to explore strategies that can help them navigate these turbulent waters effectively.

Understanding Cryptocurrency Volatility

Cryptocurrency markets are inherently volatile, driven by factors such as regulatory developments, technological advancements, and macroeconomic trends. For instance, the recent 7% increase in Bitcoin's price can be attributed to a combination of renewed investor interest and broader market dynamics. According to CoinDesk, Bitcoin's market cap has reached significant highs, reflecting its increasing adoption and the speculative activities surrounding it.

Volatility, however, is not exclusive to Bitcoin. Other cryptocurrencies, including Ethereum (ETH) and USD Coin (USDC), have also exhibited significant price fluctuations, influenced by different market forces. As such, understanding the underlying reasons for these movements is crucial for investors looking to capitalize on potential gains while managing risks.

Strategies for Navigating Volatility

-

Diversification and Asset Allocation

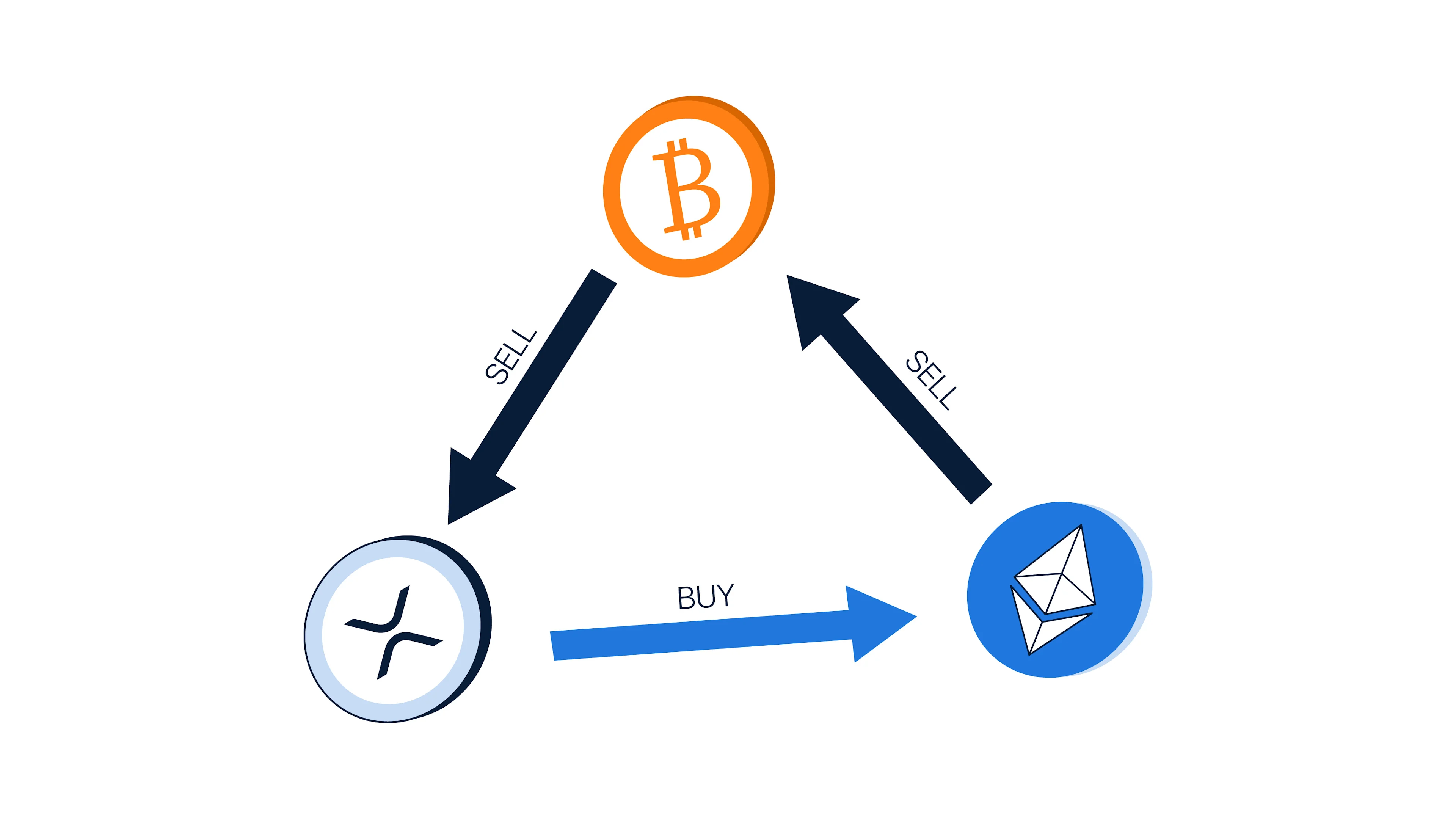

Diversification remains a cornerstone strategy for mitigating risk in any investment portfolio. By spreading investments across various cryptocurrencies and other asset classes, investors can reduce their exposure to the volatility of any single asset. This approach can be complemented by strategic asset allocation, which involves adjusting the proportion of assets in a portfolio based on market conditions and investment goals.

-

Utilizing USD-Anchored Tokens

For investors seeking stability amid the volatility, USD-anchored tokens such as Tether (USDT) present a viable option. These tokens are pegged to the US dollar, offering a stable value that can shield investors from the dramatic price swings of other cryptocurrencies. Additionally, staking USDT can generate annualized returns ranging from 8% to 12%, providing a "low-risk arbitrage" opportunity for investors looking to earn passive income without being subjected to significant price fluctuations.

-

Leveraging Regulated Trading Platforms

The importance of using regulated trading platforms cannot be overstated. These platforms provide a secure environment for trading, ensuring that investor funds are protected against fraud and other risks. For instance, Nebraska's recent legislative efforts to regulate cryptocurrency kiosks and ensure transparency underscore the significance of choosing platforms that adhere to regulatory standards (Nebraska Law).

-

Adopting Long-Term Investment Perspectives

While short-term trading can yield quick profits, it also exposes investors to heightened risk. Conversely, a long-term investment strategy allows investors to weather short-term volatility and benefit from the overall growth of the cryptocurrency market. Historical data suggests that Bitcoin's four-year halving cycle creates a natural value anchor, contributing to its long-term appreciation. This approach aligns with the strategies employed by institutional investors who successfully navigate market cycles through sustained investments.

-

Incorporating Advanced Analytical Tools

Advanced analytical tools, such as wavelet quantile correlation methodologies, offer insights into the relationships between cryptocurrencies and other financial assets. These tools help investors understand how different factors influence cryptocurrency prices, enabling them to make informed decisions. For example, a study in the West African Monetary Zone revealed how cryptocurrencies can serve as hedge agents against sovereign bond yields, providing diversification benefits in volatile markets.

The Role of Gold as a Hedge

In addition to traditional diversification strategies, gold has emerged as a reliable hedge against cryptocurrency volatility. According to a recent study, gold exhibits a positive correlation with the Cryptocurrency Policy Uncertainty Index (CPUI), offering stronger hedging potential over medium- to long-term horizons. This relationship underscores the utility of incorporating gold into a diversified investment portfolio, particularly during periods of heightened market uncertainty.

Conclusion

As the cryptocurrency market continues to evolve, investors must remain vigilant and adaptable. By employing a combination of diversification, strategic asset allocation, and the use of regulated platforms, investors can effectively navigate the volatility that characterizes this dynamic space. Additionally, leveraging advanced analytical tools and considering alternative hedging options like gold can further enhance an investor's ability to mitigate risks and capitalize on market opportunities.

Ultimately, the key to successful cryptocurrency investing lies in maintaining a well-informed, strategic approach that balances risk and reward, enabling investors to thrive in an ever-changing financial landscape.