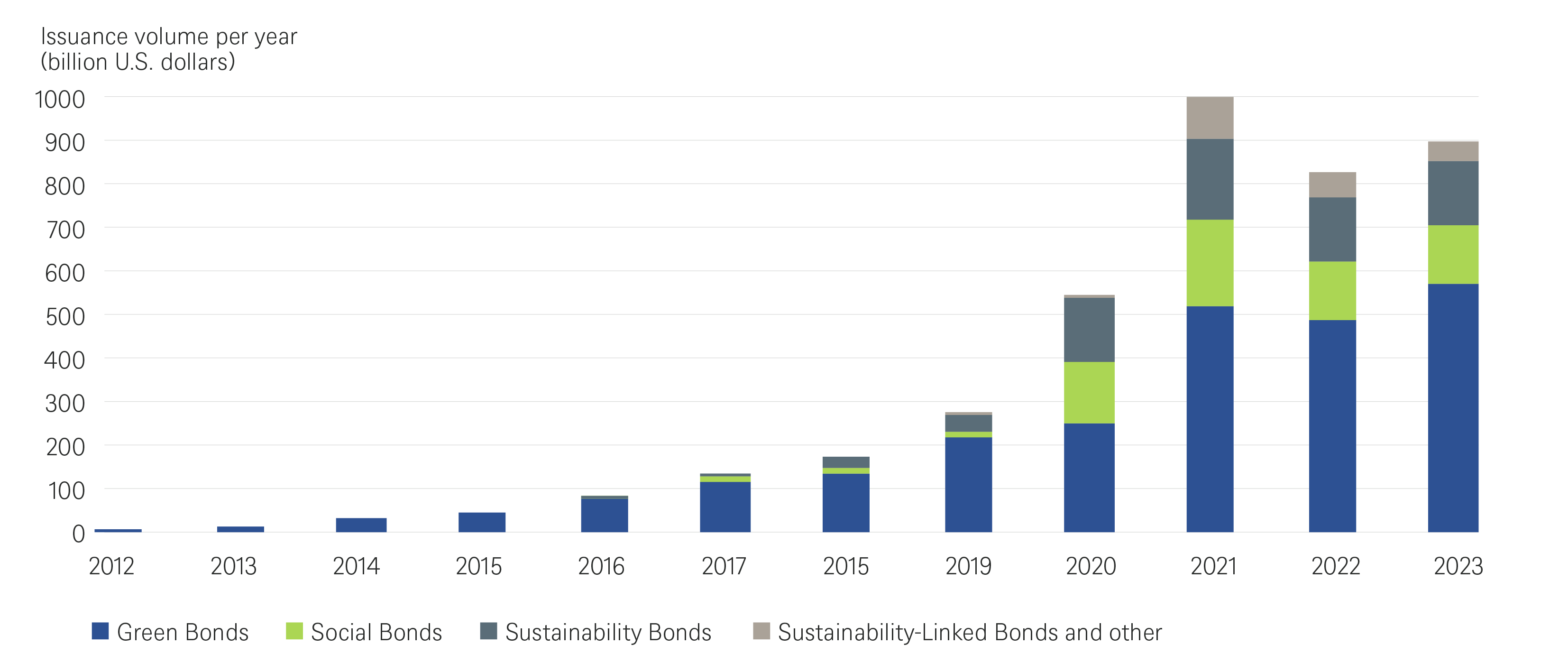

The sustainable bond market has reached a historic milestone, surpassing $1 trillion in annual issuance for the first time in 2024, signaling robust growth and resilience in the face of global economic challenges. This achievement underscores the increasing appetite among investors for financial instruments that align with environmental, social, and governance (ESG) criteria. As the market continues to evolve, its trajectory offers valuable insights into the future of sustainable finance.

Market Dynamics and Growth Drivers

The growth of the sustainable bond market can be attributed to several key factors. According to a report by Environmental Finance, the surge in issuance reflects heightened investor awareness of climate risks and an increasing commitment to sustainable development goals (SDGs). This trend is further bolstered by supportive regulatory frameworks across various jurisdictions, which have incentivized both issuers and investors to engage with sustainable finance.

"The market's resilience is a testament to the growing recognition of the importance of sustainable investment," says Michael Grubb, a leading analyst in sustainable finance. "Investors are increasingly demanding transparency and accountability in how their funds are used, and sustainable bonds provide a structured way to achieve this."

Regulatory Influence and Investor Demand

Regulatory frameworks have played a pivotal role in shaping the sustainable bond market. In the European Union, the introduction of the EU Green Bond Standard has set a benchmark for issuers, ensuring that proceeds are allocated to projects that make a significant contribution to the EU's climate and environmental objectives. Similarly, the United States has seen a rise in municipal green bonds, supported by state-level incentives and tax breaks.

Investor demand for ESG-compliant investments is also driving market growth. Institutional investors, including pension funds and insurance companies, are increasingly integrating ESG considerations into their investment strategies. This shift is driven by both ethical considerations and the recognition that sustainable investments can offer competitive returns over the long term.

According to data from Reuters, companies that issue green bonds are better positioned to tackle emissions, aligning financial incentives with environmental outcomes. This alignment is crucial for attracting capital from investors committed to combating climate change.

Challenges and Opportunities

Despite its impressive growth, the sustainable bond market faces several challenges. One of the primary concerns is the lack of standardization in ESG reporting, which can lead to "greenwashing"—where issuers overstate their environmental credentials. To address this, industry stakeholders are calling for more rigorous standards and verification processes to ensure the credibility of sustainable bonds.

Moreover, the market must navigate the complexities of geopolitical tensions and economic uncertainties. The ongoing volatility in global bond yields, as highlighted by MarketWatch, could impact the attractiveness of sustainable bonds as an investment option.

Nonetheless, the opportunities for growth remain substantial. The transition to a low-carbon economy necessitates significant investment in infrastructure, renewable energy, and energy efficiency projects—areas where sustainable bonds can play a crucial role. Additionally, the rise of social bonds, which fund projects with positive social outcomes, represents a burgeoning segment within the sustainable bond market.

The Road Ahead

As the sustainable bond market continues to mature, it is expected to attract increasing amounts of capital from both institutional and retail investors. The integration of technology, such as blockchain, in the issuance and tracking of sustainable bonds could enhance transparency and efficiency, further boosting investor confidence.

"Technology will be a game-changer in the sustainable finance landscape," notes Sarah Novak, a fintech specialist. "Blockchain can provide immutable records of how funds are used, offering unparalleled transparency and accountability."

In conclusion, the surpassing of the $1 trillion milestone in sustainable bond issuance marks a significant achievement in the journey towards a more sustainable financial system. With continued investor interest, supportive regulatory environments, and technological advancements, the market is poised for further growth. As stakeholders navigate the challenges and seize the opportunities, sustainable bonds will remain a vital tool in the global effort to achieve sustainable development goals.