Coffee Market Analysis: Current Values and Future Projections

In recent years, the coffee market has captivated the attention of investors and analysts alike, with fluctuating prices and shifting supply dynamics providing a fertile ground for analysis. This article delves into the current state of the coffee market, examining current values, historical data, and future projections. Additionally, it provides insights for investors seeking to navigate this dynamic sector.

Market Overview

The coffee market is driven by a multitude of factors, including climatic conditions in major coffee-producing regions, global demand patterns, and macroeconomic indicators. According to Trading Economics, coffee prices have experienced notable volatility, influenced by both supply disruptions and changing consumer preferences. This volatility presents both challenges and opportunities for investors.

Current Values

As of March 2025, coffee prices reflect a complex interplay of supply and demand forces. Recent data indicates a modest rise in coffee prices, attributed to unfavorable weather conditions in key growing regions such as Brazil and Vietnam. These regions have faced droughts and irregular rainfall patterns, impacting crop yields and leading to supply constraints. Consequently, the market has witnessed fluctuations, with prices responding to these short-term supply shocks.

Historical Data

Analyzing historical data can provide valuable insights into the coffee market's trajectory. Over the past decade, coffee prices have been marked by periods of significant volatility. Historically, prices have been sensitive to climatic events and geopolitical tensions in coffee-producing countries. Past data from Trading Economics highlights periods of price spikes coinciding with adverse weather conditions and political instability, underscoring the importance of these factors in shaping market dynamics.

Future Projections

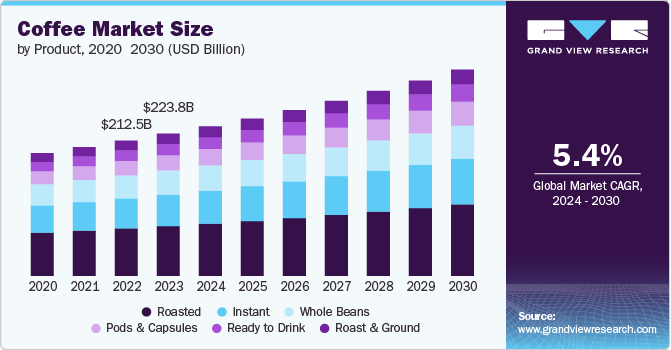

Looking ahead, analysts forecast a potential increase in coffee prices, driven by anticipated supply constraints and rising global demand. The International Coffee Organization (ICO) projects that coffee consumption will continue to grow, particularly in emerging markets where coffee culture is gaining traction. This surge in demand, coupled with potential supply challenges, is expected to exert upward pressure on prices.

Investment Insights

For investors, the coffee market presents both risks and opportunities. The key to successful investment lies in understanding the underlying market forces and adopting a diversified strategy. Investors should consider the impact of global economic conditions on coffee prices, as well as the potential for currency fluctuations to affect investment returns.

Given the market's inherent volatility, diversification remains a prudent strategy. Investors may explore a mix of direct investments in coffee futures, as well as indirect exposure through agricultural ETFs and companies involved in coffee processing and distribution.

Furthermore, sustainable investing trends are worth noting. With growing consumer awareness of ethical sourcing, companies that prioritize sustainability in their supply chains may offer attractive long-term investment prospects.

Conclusion

In conclusion, the coffee market is a dynamic sector with a complex set of influencing factors. By understanding current values, historical trends, and future projections, investors can position themselves to capitalize on opportunities while effectively managing risks. As the market continues to evolve, staying informed and adapting investment strategies accordingly will be crucial for those seeking to navigate the intricacies of the coffee market.

For continuous updates and detailed market data, investors are encouraged to access platforms such as Trading Economics and other reliable financial data sources. By leveraging these resources, investors can remain informed and agile in the face of market changes, optimizing their decision-making in the coffee market landscape.