Navigating the U.S. Stock Market Correction: Key Indicators and Strategies

The U.S. stock market has entered a correction phase, with the S&P 500 closing in correction territory, having declined more than 10% from its recent highs. This move has generated a wave of concern among investors who are acutely aware of the volatility that currently pervades global markets. In this climate, identifying key indicators and employing robust strategies is essential for navigating the turbulent waters of a market correction.

Understanding Market Indicators

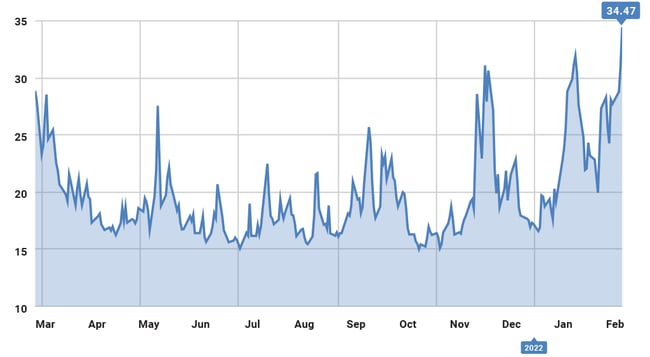

Among the most crucial indicators for investors to monitor during this period is the CBOE Volatility Index (VIX), widely known as the "fear gauge." The VIX measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices. A rising VIX often indicates increased fear in the market, which can signal further volatility ahead. Currently, the VIX has surged, reflecting heightened investor anxiety amidst geopolitical tensions and economic uncertainties.

Sector performance also offers insights into market trends. Notably, the technology and financial sectors have been under pressure. The financial sector, often seen as sensitive to interest rate fluctuations and economic cycles, is grappling with the implications of potential interest rate hikes by the Federal Reserve. Meanwhile, the technology sector, a previous darling of the stock market, is experiencing significant corrections, partly due to concerns over stretched valuations and global supply chain disruptions.

Geopolitical Tensions and Market Sentiment

Geopolitical tensions have further exacerbated market conditions, with recent threats of tariffs adding to the uncertainty. For instance, the Trump administration's threat to impose tariffs on wine and other products has weighed on market sentiment, leading to a sharp sell-off. Analysts at Yahoo Finance highlighted how these developments are prompting investors to reassess risk and reposition their portfolios in anticipation of potentially prolonged market instability.

Strategic Investment Approaches

In light of these challenges, strategic diversification and a focus on high-quality stocks are recommended. Diversification can help mitigate risk by spreading investments across various asset classes and sectors. Investors are advised to consider sectors that traditionally offer stability during downturns, such as utilities and consumer staples, which provide essential goods and services.

As noted by MarketWatch, another prudent strategy involves maintaining a long-term perspective. While short-term volatility may be unsettling, historical data shows that markets have always rebounded over the long term. This perspective encourages investors to ride out the storm rather than make hasty decisions driven by fear.

Additionally, value investing, which focuses on undervalued stocks with solid fundamentals, may present opportunities during a market correction. This approach involves rigorous analysis to identify stocks with strong potential for recovery, offering an attractive risk-reward balance for patient investors.

Conclusion

The current correction phase of the U.S. stock market underscores the importance of vigilance and strategic planning for investors. By monitoring key indicators such as the VIX and sector performance, staying informed about geopolitical developments, and employing diversified and value-focused investment strategies, investors can better navigate this period of heightened volatility. While the path forward may be fraught with challenges, a disciplined approach can help safeguard against the risks and potentially uncover opportunities for growth in the long run.