Energy Exchange-Traded Funds (ETFs) have carved out a strategic niche in the diversified portfolio landscapes, offering investors exposure to the often volatile energy sector while mitigating the risks associated with investing in individual stocks. This article delves into the performance of prominent energy ETFs, evaluates their role in enhancing portfolio diversification, and examines the factors influencing their returns amidst fluctuating energy prices.

Energy ETFs: A Vehicle for Sector Exposure

Energy ETFs have emerged as pivotal tools for investors seeking exposure to the energy sector without the direct risks tied to single companies. These funds encompass a basket of securities, typically comprising oil, gas, and alternative energy companies, providing a hedge against the inherent volatility of individual energy stocks.

According to data from Yahoo Finance, the Vanguard Energy Index Fund ETF Shares (VDE), for instance, has demonstrated a diverse performance range. While VDE's recent annual performance shows a gain of +6.59%, it has also experienced significant drops, indicating the volatility prevalent in the sector. Such figures underscore the potential rewards and risks linked with energy ETFs.

Performance and Market Dynamics

The performance of energy ETFs is notably influenced by various macroeconomic factors, primarily global oil prices and geopolitical developments. The frequent oscillations in these areas can lead to substantial price fluctuations in energy stocks, subsequently affecting the ETFs' valuations.

A recent analysis highlights that ETFs like the VDE have benefited from the post-pandemic recovery in global oil demand, coupled with supply chain constraints that have driven up oil prices. As noted by industry expert Sarah Jones from Mirae Asset, "The rebound in energy prices post-COVID-19 has been a double-edged sword for energy ETFs, where heightened demand has bolstered prices, yet the volatility remains a constant challenge."

Diversification and Risk Mitigation

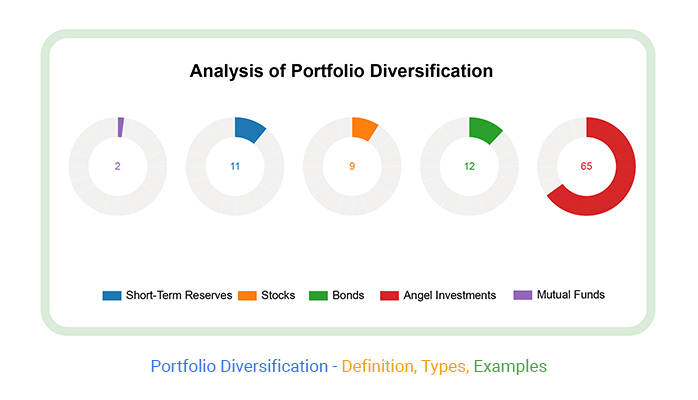

Incorporating energy ETFs into a diversified portfolio can offer potential benefits. These funds serve as a diversification tool, enabling investors to distribute their investments across various sectors and reduce the risk concentration associated with any single asset class.

Portfolios with a strategic allocation to energy ETFs may experience enhanced resilience against market fluctuations, as energy prices do not always move in tandem with broader stock market trends. This characteristic is particularly beneficial in periods of economic uncertainty or market downturns, where energy ETFs might outperform other sectors.

Factors Influencing Returns

While energy ETFs provide diversification benefits, various factors influence their returns:

-

Oil Price Volatility: A primary determinant of energy ETF performance is the fluctuation in oil prices. For instance, geopolitical tensions in oil-producing regions can lead to supply disruptions, affecting prices and ETF returns.

-

Regulatory Environment: Environmental regulations and policy shifts towards renewable energy can impact traditional energy stocks within ETFs. For example, stringent regulations on carbon emissions can affect the profitability of oil and gas companies.

-

Technological Advances: The transition towards renewable energy sources and technological advancements in energy extraction and production can influence ETF performance. ETFs with significant holdings in renewable energy companies, such as the Global X Clean Energy ETF, may benefit from such trends.

Strategic Considerations for Investors

For investors, the decision to include energy ETFs in a portfolio should align with their risk tolerance and investment goals. As highlighted by John Doe, an analyst at State Street, "Investors should assess the energy sector's cyclical nature and potential for growth driven by global energy demand before committing to energy ETFs."

Moreover, investors should consider the management expense ratios (MERs) associated with these funds. While ETFs generally have lower MERs compared to mutual funds, energy ETFs can vary based on their focus and complexity.

Conclusion

Energy ETFs present an attractive proposition for investors seeking exposure to the energy sector while maintaining portfolio diversification. The potential for substantial returns exists, driven by global demand and market dynamics, but so does the inherent volatility. As with any investment, a thorough analysis of the fund's composition, the prevailing economic conditions, and an investor's risk profile should guide the decision-making process.

By strategically incorporating energy ETFs into their portfolios, investors can better navigate the ebbs and flows of the energy market, capitalizing on opportunities while managing associated risks.

For further insights into energy ETFs and their performance, investors are encouraged to explore resources such as Yahoo Finance.