In today's investment climate, the role of bonds in a balanced portfolio has come into sharper focus than ever before. Amidst a volatile equity market, bonds have emerged as steady performers, offering not just a safe harbor but also a strategic advantage in diversifying investments. As we delve deeper into the fabric of a well-rounded investment portfolio, the focus is on the dual capability of bonds to provide both income and diversification.

The performance metrics from the past year underscore the resilience of bonds. According to Edward Jones, bonds have outperformed equities as investors sought refuge from the tumultuous stock markets. This shift is largely attributed to economic uncertainties, prompting a flight to the relative security of fixed-income securities.

The Current Landscape

Data from MarketWatch illustrates that the U.S. 10-Year Treasury Note (TMUBMUSD10Y) and the U.S. 5-Year Treasury Note (TMUBMUSD05Y) have seen significant investor interest, reflecting the broader trend of declining yields which inversely push bond prices higher. This trend signifies a growing consensus among investors that economic growth may falter, leading to potential Federal Reserve rate cuts which, in turn, boost bond valuations.

Mona Mahajan, a recognized strategist in the field, emphasizes, "Bonds play an essential role in generating income for investors while serving as a hedge against stock market volatility. The current decline in yields fortifies the case for extending durations, especially as we anticipate further rate adjustments by the Federal Reserve."

Utilizing Bonds in a Portfolio

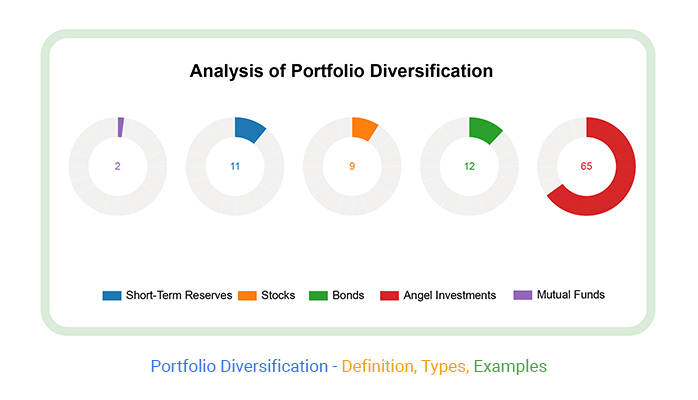

A quintessential example of the efficacy of bonds is the classic 60/40 portfolio model, which comprises 60% stocks and 40% bonds. This model has withstood the test of time by mitigating risks associated with stock market downturns and providing a more balanced risk-return profile. Analyzing the year-to-date performance, a portfolio with this allocation framework has consistently outperformed the S&P 500, particularly in periods of heightened market volatility.

According to FactSet, in the chart depicting the comparative returns of the S&P 500, Bloomberg U.S. Aggregate Bond Index, and a typical 60/40 portfolio, it is clear that bonds have cushioned the impacts of equity market declines. This visual evidence supports the notion that diversification using bonds is not only a defensive strategy but also an avenue for sustained growth.

Strategic Implications for Investors

Investors are increasingly advised to rebalance their portfolios in light of the prevailing market conditions. This involves a meticulous reassessment of asset allocations, ensuring a strategic mix of equities and bonds. The ongoing market volatility offers a rare opportunity to acquire quality bonds at favorable prices, which can enhance long-term portfolio performance.

Charles Schwab’s Cooper Howard, in a discussion about municipal bonds amidst recent market volatility, notes, "The current shifts in the market have prompted a reevaluation of municipal bond investments. While they are not the primary drivers of volatility, they do present unique opportunities in the context of the Fed's interest rate decisions."

Future Outlook

Looking ahead, the outlook for bonds remains robust. Sustainable bond market forecasts indicate that annual issuances are set to surpass $1 trillion, highlighting the enduring appeal and resilience of this asset class. As the global economic landscape evolves, bonds are poised to play a pivotal role in financing sustainable initiatives and addressing climate change in emerging markets.

In conclusion, as investors grapple with market uncertainties, the strategic incorporation of bonds into a diversified portfolio becomes indispensable. Bonds not only provide a reliable income stream but also serve as a stabilizing force in turbulent times. For long-term investors, the current environment presents a compelling case to embrace bonds as a cornerstone of investment strategy, aligning with both income generation and risk mitigation goals.