In the face of the recent cryptocurrency market correction, investors are increasingly turning to tokenized U.S. Treasuries as a reliable safe haven. This trend has been marked by a significant increase in the market capitalization of tokenized treasuries, which has reached an unprecedented $4.2 billion, according to CoinDesk. This shift is reminiscent of traditional investors flocking to U.S. Treasuries during periods of economic uncertainty, underscoring the allure of these digital assets as a "flight to quality."

Brian Choe, head of research at rwa.xyz, highlighted that the growth of tokenized treasuries is outpacing that of stablecoins. "This trend reflects a flight to quality, similar to how traditional investors move from equities to U.S. Treasuries during economic uncertainty," Choe explained to CoinDesk. The appeal lies in the combination of stability and yield that tokenized treasuries offer, allowing investors to benefit from the robustness of U.S. government-backed securities while leveraging the innovation of blockchain technology.

Tokenized treasuries represent a pioneering integration of traditional financial instruments with modern blockchain capabilities. By tokenizing U.S. Treasuries, issuers convert these government securities into digital tokens on a blockchain, making them accessible to a wider range of investors and providing enhanced liquidity. This process allows investors to hold and trade fractions of these securities, which can be particularly attractive in volatile markets.

The recent surge in the market cap of tokenized treasuries can be attributed to several factors. Firstly, the broader cryptocurrency market correction has prompted investors to reassess their risk exposure. As cryptocurrencies experienced significant volatility, the stability of U.S. Treasuries became increasingly attractive. Secondly, the yield-bearing nature of tokenized treasuries offers a compelling alternative to stablecoins, which typically lack yield generation capabilities.

The integration of these traditional assets into the crypto ecosystem reflects a broader trend of merging conventional finance with blockchain technology. This convergence not only enhances the accessibility of government-backed securities but also contributes to the diversification of investment portfolios in the digital asset space. As the demand for these secure, yield-bearing products grows, the tokenized treasuries market is poised for further expansion.

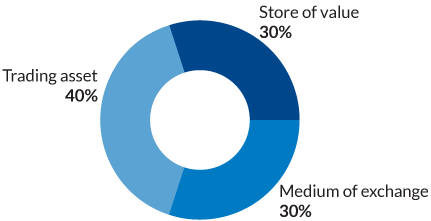

The shift toward tokenized treasuries also highlights a critical aspect of modern financial markets: the importance of adaptability and the ability to leverage new technologies amidst changing economic landscapes. For investors, the appeal of tokenized treasuries lies in their dual role as both a stable store of value and a source of income. This is particularly valuable in times of market stress, where traditional safety nets like U.S. Treasuries are augmented by the technological advantages of blockchain.

Additionally, the growth of tokenized treasuries underscores a significant trend in investor behavior—seeking stable, transparent, and regulated alternatives in times of uncertainty. This preference is likely to drive further innovation in the financial sector, as more traditional assets are expected to be tokenized, expanding the horizons of blockchain technology and its applications.

As the market for tokenized treasuries continues to grow, it raises important questions about the future of financial markets. Will more traditional financial instruments be digitized and integrated into blockchain platforms? How will regulatory frameworks adapt to accommodate the burgeoning market for tokenized assets? These questions highlight the evolving landscape of finance and the potential for blockchain to redefine how traditional assets are traded and held.

In conclusion, the rise of tokenized treasuries amidst the crypto market downturn signals a notable shift in investor sentiment toward safer, yield-generating assets. This trend not only reflects a "flight to quality" but also exemplifies the growing intersection of traditional finance and blockchain technology. As the financial industry continues to innovate, tokenized treasuries represent a promising development in the quest for stability and diversification in an increasingly digital world.