The European Central Bank (ECB)'s recent monetary policy decisions have been pivotal in shaping the performance of European equities, offering investors new insights and strategies for capitalizing on market dynamics. Over the past several months, the ECB has undertaken a series of measures aimed at stimulating economic growth and bolstering financial markets across the continent. Measures such as interest rate cuts and liquidity injections have been particularly influential, creating a fertile environment for value-oriented stocks and smaller capitalization companies, both of which are typically more sensitive to economic shifts.

)

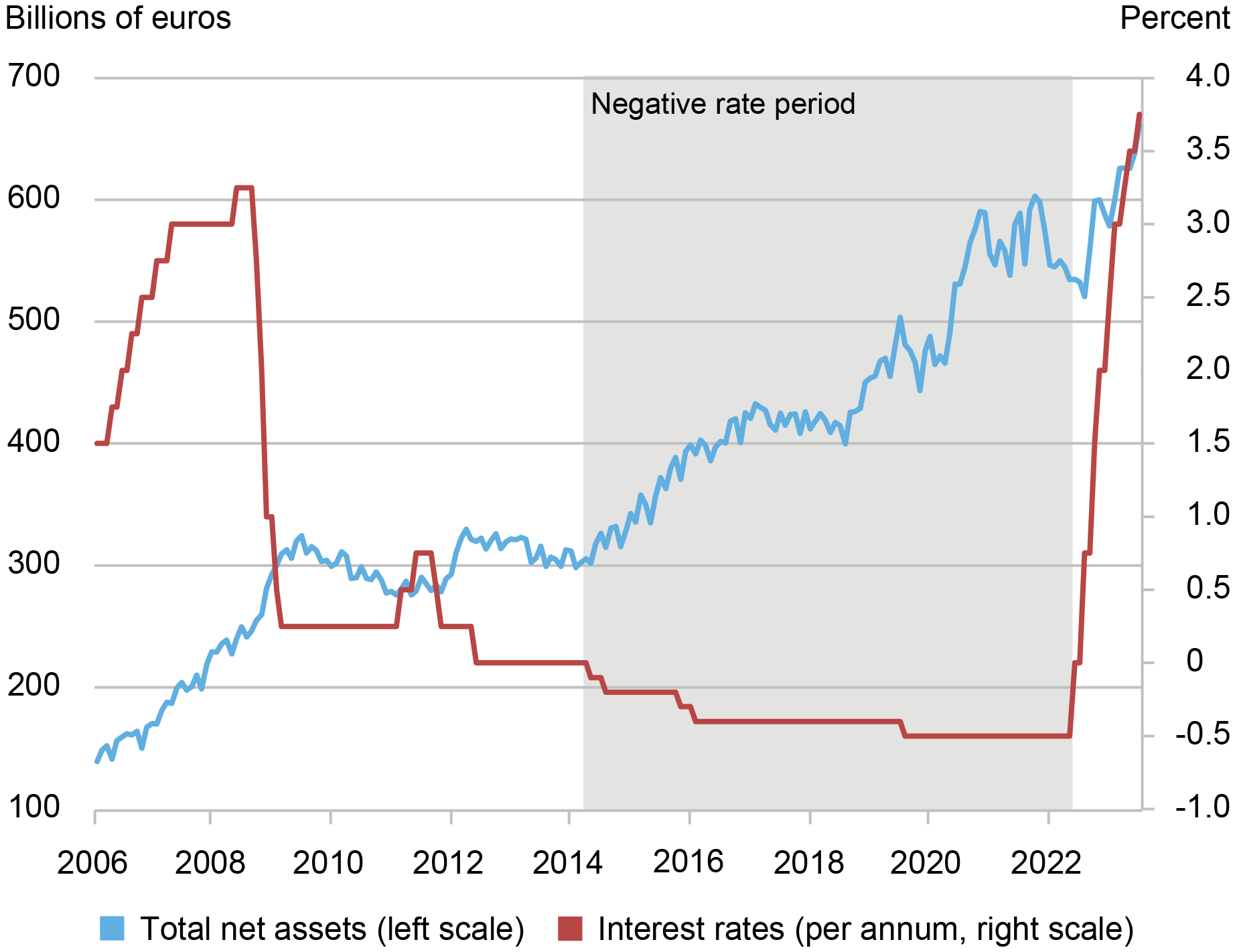

The ECB's recent actions have been largely driven by the need to navigate a complex global economic landscape, characterized by geopolitical tensions and fluctuating demand. By reducing interest rates to historically low levels, the ECB has effectively lowered borrowing costs, thereby encouraging business investments and consumer spending. This monetary easing has been a critical factor in the observed outperformance of European equities, especially as investors seek alternatives amidst global market uncertainties.

Analysts have noted that the ECB's policies provide a tailwind for mid-cap and value stocks, sectors which have experienced renewed investor interest. "Make European Equities Great Again," a phrase coined amidst the recent market reawakening, reflects the optimism surrounding these stocks. This resurgence is bolstered by a higher nominal growth environment, which tends to benefit value-oriented and smaller capitalization stocks.

The impact of the ECB's monetary policy extends beyond immediate market performance. By fostering a low-interest-rate environment, the ECB is indirectly supporting sectors like real estate and consumer goods, which flourish under such conditions. Furthermore, the policy shift has sparked a wave of mergers and acquisitions, particularly within mid-cap stocks, as companies capitalize on favorable financing conditions to expand and consolidate.

However, while the ECB's actions have catalyzed certain market segments, they also present challenges. The prolonged low-rate environment raises concerns about long-term financial stability and the potential for asset bubbles. Moreover, as European markets continue to navigate these changes, investors are compelled to remain vigilant, closely monitoring ECB policy developments and adjusting their portfolios accordingly.

Investment strategists emphasize the importance of adaptability in such a dynamic environment. "Investors should keep a close eye on the ECB's policy signals," advises Ingrid Wheelock, a market strategist at Invesco. "Understanding the broader economic context and how it translates to specific market movements is crucial for optimizing investment strategies."

As European markets confront ongoing global challenges, including trade tensions and inflationary pressures, the ECB's role in steering economic policy remains pivotal. The central bank's commitment to maintaining market stability and fostering growth underscores the strategic importance of its policy decisions for investors aiming to leverage European market opportunities.

In conclusion, the ECB's recent monetary policy measures are not only shaping the performance of European equities but also redefining investment strategies within the region. By offering a supportive environment for growth, these policies provide investors with both opportunities and challenges. As such, a strategic focus on ECB developments is essential for those looking to optimize their portfolios amidst Europe's evolving market landscape. Investors are thus advised to remain informed and agile, ready to adjust their strategies in response to the ECB's policy trajectory and its impact on market performance.