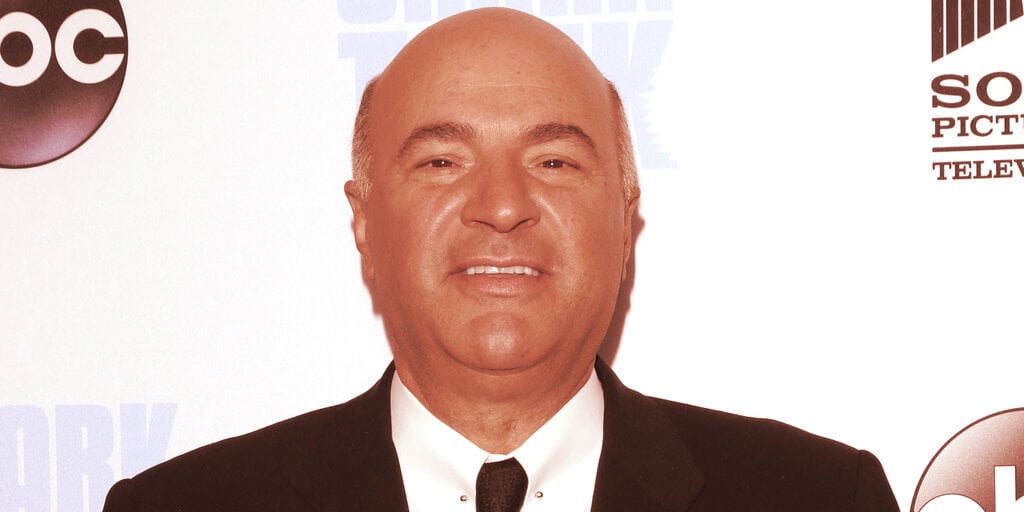

In a recent discussion on 'My View with Lara Trump,' Kevin O'Leary presented a bold vision for the future of cryptocurrency in the United States. The prominent investor and chairman of O'Leary Ventures, often recognized from his role on ABC's "Shark Tank," argued that cryptocurrency is poised to become the 12th sector of the U.S. economy. His predictions have sparked significant interest, particularly as the digital currency market continues to mature and increasingly integrates with traditional financial systems.

The Emergence of Cryptocurrency as a Sector

O'Leary's vision for cryptocurrency involves more than just its recognition as a standalone sector; he anticipates a seamless integration into the broader financial ecosystem. He stated, "They're going to provide regulations to allow this to become integrated with the financial institutions of America. It's going to become a payment system, an investment vehicle. It's going to become part of all the sectors of our economy." This integration, he argues, would not only legitimize digital currencies but also position them as essential components of economic activity.

Currently, the U.S. economy is delineated into 11 major sectors, including technology, healthcare, and financial services. The inclusion of cryptocurrency as a 12th sector would mark a significant shift in economic structure, one that reflects the growing importance of digital assets in global markets. This prediction comes at a time when digital currencies are gaining traction as stores of value and mediums of exchange, driven by advancements in technology and increasing institutional interest.

Regulatory Frameworks: Key to Integration

For cryptocurrency to achieve the status of a recognized economic sector, a robust regulatory framework will be crucial. O'Leary's insights highlight the necessity of regulatory clarity to facilitate integration. As cryptocurrencies gain popularity, regulatory bodies like the Securities and Exchange Commission (SEC) are working to develop guidelines that ensure market stability while encouraging innovation.

The current state of U.S. cryptocurrency regulation is complex, with various agencies taking divergent approaches to oversight. The Internal Revenue Service (IRS) treats cryptocurrencies as property for tax purposes, while the Commodity Futures Trading Commission (CFTC) classifies them as commodities. O'Leary's vision underscores the need for a unified regulatory approach that recognizes the unique attributes of digital currencies.

Challenges and Opportunities

Integrating cryptocurrency into the traditional economic framework presents both challenges and opportunities. Among the challenges are concerns about security, volatility, and the environmental impact of crypto mining. However, the opportunities are substantial. Cryptocurrencies offer potential for innovation in payment systems, increased financial inclusion, and new investment vehicles.

A notable opportunity lies in the potential for cryptocurrencies to provide efficient and low-cost payment solutions. Digital currencies can reduce transaction fees and processing times, making them attractive for both businesses and consumers. Moreover, as blockchain technology continues to evolve, it offers enhanced security features that can prevent fraud and increase transparency in financial transactions.

Economic Implications

If cryptocurrency were to become a recognized sector of the U.S. economy, the implications could be far-reaching. Such a development could attract significant investment into the sector, fostering economic growth and job creation. As O'Leary noted, "It's going to become part of all the sectors of our economy," suggesting that the influence of digital currencies could permeate various industries, from retail to real estate.

Moreover, the integration of cryptocurrencies could enhance the United States' position as a leader in financial innovation. By embracing digital assets, the U.S. could set global standards for cryptocurrency adoption and regulation, encouraging other nations to follow suit.

Looking Forward

Kevin O'Leary's prediction of cryptocurrency becoming the 12th sector of the U.S. economy reflects broader trends in the financial landscape. As digital currencies gain traction, their potential to reshape economic structures becomes increasingly apparent. The key to realizing this potential will be the development of regulatory frameworks that balance innovation with security and stability.

In conclusion, while challenges remain, the vision of cryptocurrency as an integral part of the U.S. economy is a compelling one. As regulatory clarity improves and technological advancements continue, the path toward O'Leary's prediction may become clearer. Investors and policymakers alike will be watching closely as this dynamic sector evolves, potentially redefining the future of finance.