In the modern financial landscape, the cryptocurrency market has often been likened to historical speculative bubbles, such as the Tulip Mania of the 1630s and the dot-com bubble of the late 1990s. These historical events are characterized by rapid price surges followed by dramatic downturns, fueled by speculative trading and perceived scarcity. As digital assets continue to gain traction, concerns about their potential to mirror these infamous bubbles have intensified, prompting a deeper examination of the underlying risks and challenges facing the cryptocurrency market today.

Understanding Speculative Bubbles in History

The Tulip Mania, which occurred in the Netherlands during the 1630s, is one of the earliest documented speculative bubbles. At the height of this mania, tulip bulbs were valued higher than some of the most luxurious items of the time, such as homes and art. This frenzy was primarily driven by speculative trading, where the perceived scarcity of tulips led to highly inflated prices. However, this was unsustainable, and the market eventually collapsed, leaving many investors financially ruined.

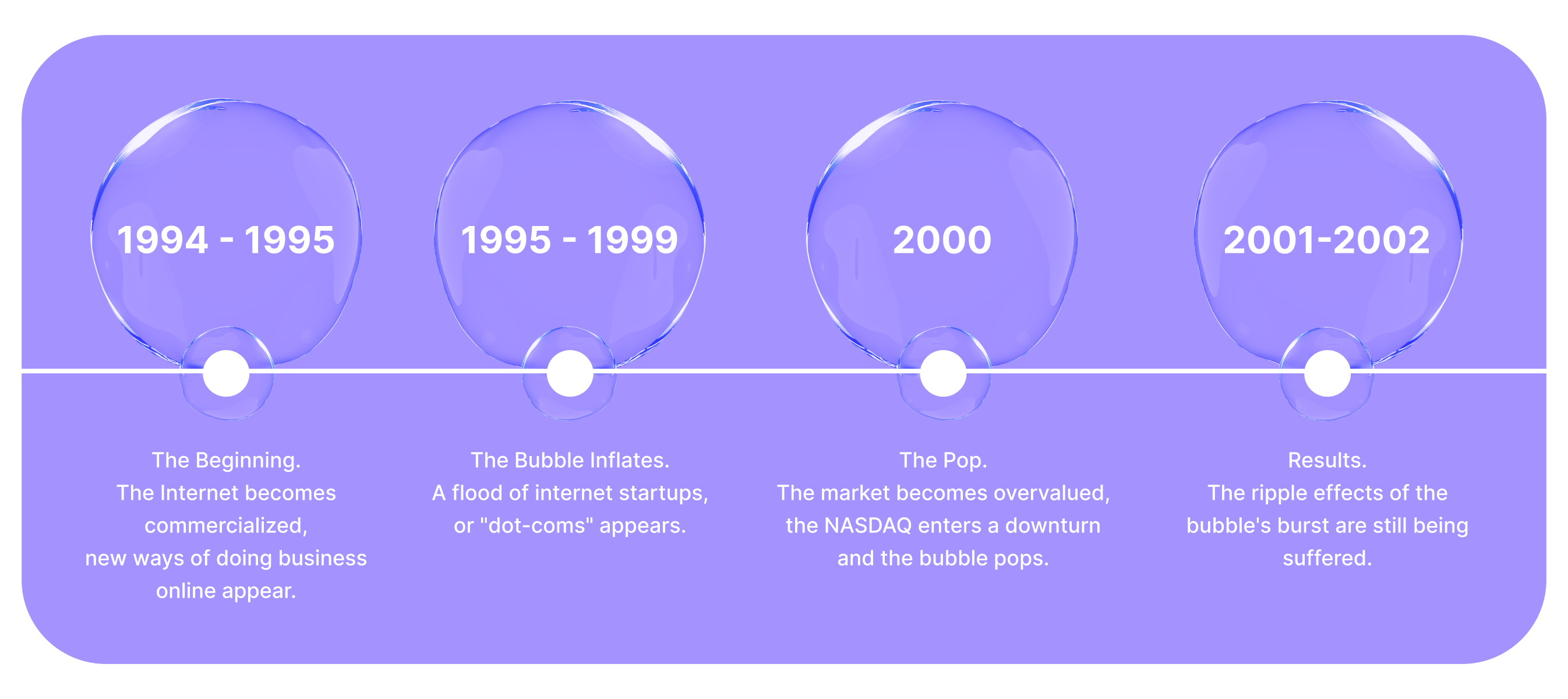

Similarly, the dot-com bubble of the late 1990s saw massive investments in internet-based companies with limited revenue and often unproven business models. The promise of technological innovation and the internet's potential drove stock prices to unrealistic heights. When reality set in, and companies failed to deliver on their promises, the market crashed, resulting in significant losses for investors.

Cryptocurrency Markets: A New Era of Speculation?

Cryptocurrencies, with their digital and decentralized nature, present a unique set of challenges and opportunities. Unlike traditional assets, cryptocurrencies are not backed by physical commodities or government guarantees. Instead, they derive their value from market demand, algorithmic scarcity, and the belief in future utility.

The rise of Bitcoin and other cryptocurrencies can be attributed to their promise of a decentralized financial system, their potential as a hedge against inflation, and their appeal to tech-savvy investors. However, the volatility of these digital assets has raised concerns about whether they might be a modern-day speculative bubble.

Jack Kadish, an industry analyst, notes, "Cryptocurrencies are akin to Monopoly money, where the perceived value is driven by scarcity and speculation rather than inherent worth." This perspective highlights the parallels between cryptocurrencies and historical bubbles, where market dynamics rather than intrinsic value dictated asset prices.

The Risks and Challenges Ahead

One of the primary risks associated with cryptocurrencies is their extreme volatility. Price swings of 20% or more in a single day are not uncommon, which can lead to significant financial losses for investors who are not prepared for such fluctuations.

Moreover, the decentralized and pseudonymous nature of cryptocurrencies presents security challenges. The recent case of North Korean hackers stealing $1.5 billion from a major exchange highlights the vulnerabilities within the crypto ecosystem. The potential for fraud, theft, and regulatory crackdowns remains a persistent threat.

Regulatory uncertainty is another critical challenge. Governments worldwide are grappling with how to regulate cryptocurrencies effectively. While some, like Thailand, have approved the trading of stablecoins such as USDT and USDC (source), others are implementing stricter controls to prevent money laundering and protect investors.

Potential for a Bubble Burst

The cryptocurrency market's dependence on speculative trading and lack of intrinsic value draws parallels to past bubbles, leading some experts to warn of a potential market collapse. As market sentiment shifts, either due to regulatory changes, technological failures, or economic downturns, the bubble could burst, resulting in another wave of financial losses reminiscent of the dot-com crash or the Tulip Mania.

Yet, there is a counterargument that cryptocurrencies, particularly blockchain technology, offer genuine innovation and utility. Proponents argue that digital currencies could revolutionize payment systems, provide greater financial inclusion, and offer new investment opportunities. This duality of perspectives underscores the complexity of the cryptocurrency landscape.

Conclusion

As the cryptocurrency market continues to evolve, it remains crucial for investors to understand the inherent risks and challenges. While the allure of substantial returns is tempting, the parallels to historical speculative bubbles serve as a cautionary tale. Investors must remain vigilant, informed, and prepared for volatility, ensuring that they do not fall victim to the pitfalls that characterized past financial manias. As Jack Kadish aptly remarked, "When the cryptocurrency bubble does eventually burst, one might not even be able to 'Pass Go - collect $200.'"

The future of cryptocurrencies holds both promise and peril. Whether it becomes a historic bubble or a transformative financial innovation will depend on market dynamics, regulatory developments, and technological advancements in the coming years.