Economic calendars are indispensable tools for forex traders, providing a detailed roadmap of scheduled economic events that can significantly sway currency valuations. These calendars, often available on platforms like Forex Factory, list key economic releases such as GDP figures, employment data, inflation reports, and central bank meetings. Understanding and leveraging these calendars can help traders anticipate market volatility, adjust their strategies accordingly, and ultimately make informed trading decisions.

The Role of Economic Calendars in Forex Trading

The forex market is highly sensitive to economic data releases and geopolitical events. An economic calendar provides a comprehensive schedule of these events, allowing traders to prepare for periods of expected volatility. For instance, a surprising change in a major economy's interest rate can cause dramatic shifts in currency values. Traders who are aware of the timing of these announcements can position themselves strategically, either by hedging their positions or capitalizing on predicted movements.

Economic calendars not only list the date and time of each event but also categorize them by expected impact. High-impact events, such as U.S. non-farm payroll reports or European Central Bank announcements, are marked to alert traders of potential significant market movements. As these events can influence liquidity and currency demand, staying informed is crucial for those looking to optimize their trading strategies.

Integrating Economic Calendars into Trading Strategies

To effectively use economic calendars, traders must integrate them into a broader trading strategy. This involves not only tracking upcoming events but also understanding the potential implications of these events on currency pairs. For instance, if a trader is focused on the USD/JPY pairing, attention must be given to U.S. Federal Reserve meetings or Japanese economic releases that could affect this currency cross.

Traders often combine economic calendar insights with technical analysis to refine their approaches. For example, if a key economic indicator is set to be released, traders might look for technical signals that could confirm or contradict their expectations. This dual approach—melding fundamental insights with technical trends—can lead to more robust trading decisions.

Best Practices for Using Economic Calendars

-

Prioritize High-Impact Events: Focus on events likely to cause significant volatility. Depending on your trading strategy, these might be opportunities for quick gains or signals to adopt a more cautious stance.

-

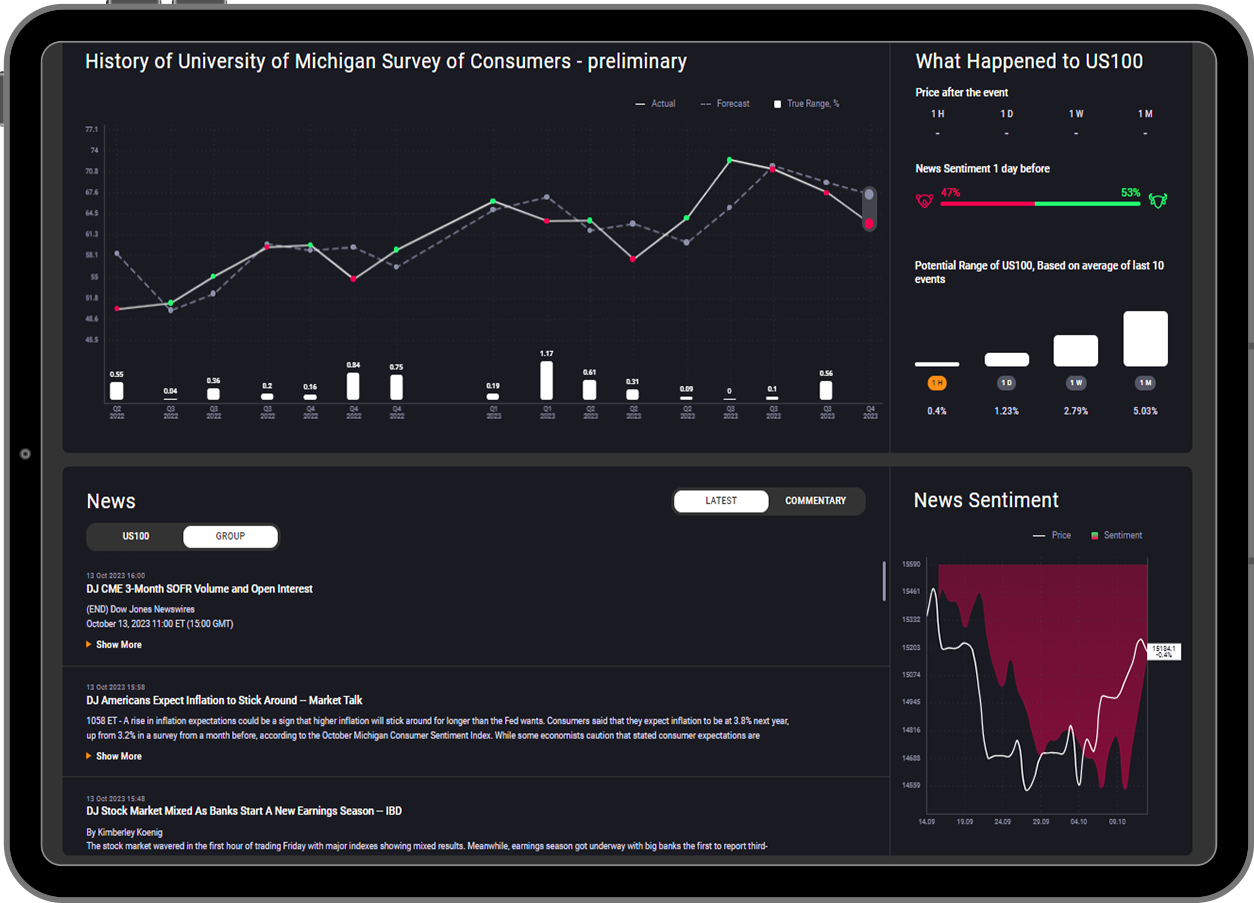

Evaluate Historical Data: Understanding past market reactions to similar events can provide insights into potential future movements. Historical data can reveal patterns, helping traders anticipate market reactions.

-

Stay Updated with Real-Time Changes: Use platforms that offer real-time updates. Economic conditions can change rapidly, and having the latest information is vital. ForexLive often provides timely insights that can complement calendar data.

-

Adapt Strategies Accordingly: Whether it's adjusting stop-loss orders or setting new entry points based on anticipated volatility, being flexible with your strategy is key.

-

Combine with Technical Analysis: Use economic calendar insights in conjunction with technical analysis to validate potential trade setups. Platforms like TradingView offer tools for this combined approach.

Expert Insights on Economic Calendars

A seasoned forex trader, Marco Santori, notes, "Economic calendars are more than just tools—they are the cornerstone of a strategic approach to forex trading." He highlights that understanding the ebb and flow of market expectations around economic events can provide an edge, especially in volatile markets.

Similarly, in a recent session covered on Action Forex, experts emphasized that while economic calendars provide a roadmap, the true value lies in interpreting the data within the broader economic context. This involves staying informed about not just the events themselves, but the underlying economic conditions they represent.

Conclusion: The Strategic Edge of Economic Calendars

In the dynamic forex market, where fortunes can change in a matter of minutes, having a strategic tool like an economic calendar is invaluable. By anticipating market-moving events and adapting strategies to align with economic data, traders can better navigate volatility and make informed decisions that enhance their trading outcomes.

For traders looking to refine their strategies, integrating an economic calendar is not just advisable; it's essential. As the marketplace becomes increasingly complex with global interdependencies, tools that provide clarity and foresight offer a competitive advantage, positioning traders to capitalize on the nuances of the forex market.