The stock market is currently navigating a period of heightened volatility, marking its most tumultuous stretch of 2025. This instability has been attributed to a confluence of factors, including geopolitical tensions, economic uncertainties, and fluctuating interest rates. As investors grapple with these challenges, many are re-evaluating their strategies to better manage risk and identify opportunities amid the unpredictability.

Understanding the Volatility

The year 2025 began with a series of market fluctuations that have left investors wary. According to Trading Economics, Italy's main stock market index, IT40, has seen a notable increase of 14.36% since the start of the year. However, this is not indicative of a broader market trend as the global markets remain under pressure. In the U.S., the Nasdaq experienced its largest single-day drop since the COVID crash, plummeting 727 points as reported by Reddit.

Treasury Secretary Scott Bessent, attempting to assuage fears, remarked in a NBC News interview, “I’m not worried about the markets. Over the long term, we’ve seen markets bounce back from corrections.” His statement highlights a common sentiment among financial leaders that maintaining a long-term perspective is crucial during periods of market upheaval.

Strategic Adjustments for Investors

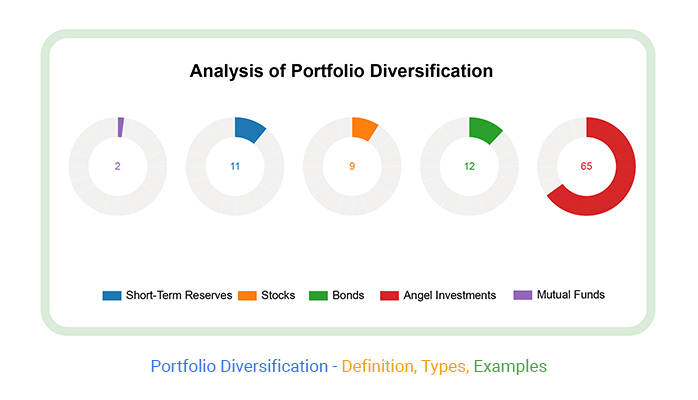

With the market's volatility showing no sign of abating, investors are advised to adopt strategies that offer protection against further downturns. One effective approach is diversification. By spreading investments across various asset classes, industries, and geographical regions, investors can mitigate risks. Diversification acts as a buffer, reducing the impact of any single downturn.

In addition to diversification, focusing on sectors with strong growth potential, such as technology and renewable energy, can present lucrative opportunities. These sectors have consistently shown resilience even in adverse market conditions. As reported by CNBC, technology companies like Nvidia continue to drive innovation, capturing investor interest despite broader market hesitations.

Monitoring Economic Indicators

Staying informed about economic indicators is another critical strategy for navigating market volatility. Key indicators such as inflation rates, employment data, and central bank policies provide insights into future market movements. The Federal Reserve's decisions on interest rates, for instance, play a pivotal role in shaping market dynamics. According to Yahoo Finance, investors are keenly awaiting updates from the Federal Reserve, hoping for clues on potential interest rate cuts that could stabilize markets.

Avoiding Panic-Driven Decisions

In volatile times, maintaining composure is vital. Panic-driven decisions often lead to regrettable financial outcomes. Experts recommend adopting a disciplined investment approach, aligning with long-term financial goals rather than short-term market fluctuations. As noted in a New York Times article, some investors are prematurely shifting strategies in response to political events, risking long-term portfolio health for short-lived market reactions.

Conclusion

The stock market's current volatility presents both challenges and opportunities for investors. By employing strategies such as diversification, focusing on growth sectors, monitoring economic indicators, and maintaining a long-term perspective, investors can navigate these turbulent times with greater confidence. As the market adjusts to ongoing economic and geopolitical developments, astute investors who remain informed and strategic are likely to emerge with strengthened portfolios.

Investors are encouraged to revisit their financial plans, consult with financial advisors, and stay informed through credible sources to ensure their strategies are aligned with the evolving market landscape. Keeping a steady hand and a watchful eye will be essential as 2025 unfolds.