The U.S. Treasury yields, particularly the 10-year yield (US10Y), are pivotal in shaping global financial markets, serving as a benchmark for interest rates worldwide. Recently, fluctuations in these yields have exerted a significant impact on emerging markets, affecting everything from bond prices to currency valuations in these regions. As of March 2025, yields have been exhibiting a downtrend, a movement that requires careful analysis by investors in emerging markets.

The Current State of U.S. Treasury Yields

According to MarketWatch, the U.S. 10-year Treasury yield has been trading within a "Channel Down" pattern since its October 2023 high. This technical analysis term describes a downward-sloping channel that often indicates bearish market sentiment. Recent trading sessions have shown the yield in a downtrend, a technical "Bearish Leg," reflecting declining investor confidence or anticipation of lower future interest rates.

These movements are significant because they serve as a barometer for U.S. economic conditions. Typically, falling yields suggest expectations of slower economic growth or increased demand for safe-haven assets, such as U.S. Treasuries, amidst global uncertainty.

Implications for Emerging Market Bonds

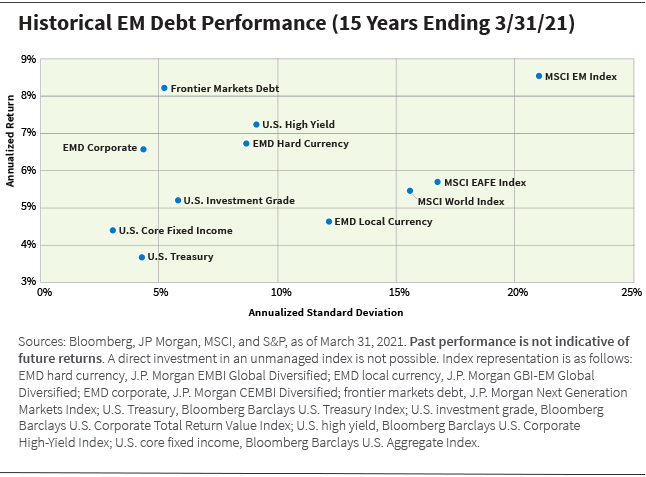

Emerging markets are particularly sensitive to changes in U.S. Treasury yields due to their reliance on U.S. dollar-denominated debt. When U.S. yields fall, the relative attractiveness of higher-yielding emerging market bonds increases, as pointed out by Kathy Jones, Chief Fixed Income Strategist at Schwab. She notes that "lower U.S. yields can lead to capital inflows into emerging markets as investors seek higher returns."

This dynamic can cause a strengthening of emerging market currencies against the U.S. dollar, which in turn reduces the cost of servicing dollar-denominated debt for these countries. However, if yields were to rise sharply, the converse would occur, potentially leading to capital outflows and currency depreciation, thereby increasing the debt burden.

Currency Valuations and Economic Stability

The fluctuations in U.S. Treasury yields also directly impact currency valuations within emerging markets. A decline in yields often results in a weakening of the U.S. dollar, which can bolster emerging market currencies. For instance, as noted on Trading Economics, emerging markets might experience a temporary boost in their currencies' valuation against the dollar when U.S. yields decline.

However, this can be a double-edged sword. While a stronger currency can reduce import costs and inflation, it can also make exports more expensive, potentially harming economic competitiveness. In regions where export-driven growth is crucial, such as Southeast Asia and Latin America, this effect can influence broader economic stability.

Strategic Insights for Investors

For investors, understanding the relationship between U.S. Treasury yields and emerging markets is critical for making informed decisions. As the Thai Bond Market Association highlights, awareness of new bond issuances and market alerts can offer insights into potential investment opportunities or risks arising from yield movements.

Investors might consider diversifying their portfolios by including a mix of emerging market bonds and currencies to hedge against potential volatility in U.S. yields. Additionally, monitoring the Federal Reserve's policy statements and economic indicators such as GDP growth and inflation can provide further context for future yield movements.

Conclusion

The impact of U.S. Treasury yields on emerging markets is profound, influencing both debt markets and currency valuations. The recent downtrend in U.S. yields has highlighted opportunities for capital inflows into emerging markets but also underscores the risks associated with potential future yield spikes. As global economic conditions evolve, investors must remain vigilant, leveraging comprehensive market analysis to navigate these complex dynamics effectively.

In an interconnected financial landscape, the interplay between U.S. Treasury yields and emerging markets will continue to be a focal point for investors seeking to optimize their strategies amid global uncertainties.