The cryptocurrency hardware market is forecasted to reach an impressive $2.9 billion by the year 2030, driven by a robust compound annual growth rate (CAGR) of 14.2%. This burgeoning sector is being propelled by the escalating adoption of digital assets and the concomitant demand for more efficient and secure mining and transaction verification equipment. As both institutional and retail investors increasingly embrace digital currencies, the need for sophisticated hardware solutions has never been more pronounced.

Technological Advancements Fueling Growth

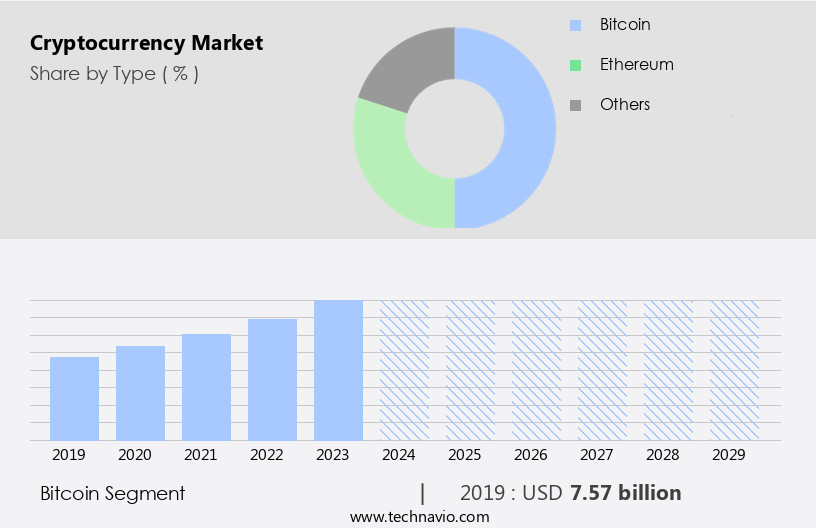

One of the primary catalysts for the cryptocurrency hardware market's expansion is the rapid pace of technological innovation. Companies are continually enhancing their hardware offerings to improve efficiency, reduce power consumption, and increase the security of crypto transactions. This trend is particularly significant as cryptocurrencies like Bitcoin and Ethereum demand high computational power for mining, requiring advanced hardware setups such as application-specific integrated circuits (ASICs) and powerful graphic processing units (GPUs).

In regions like the United States, the market is poised to grow significantly, with estimates valuing it at approximately $557.8 million by 2024. Meanwhile, China is expected to experience a slightly higher CAGR of 14.6%, projecting a market size of $779 million by the same year. These figures underscore the strategic importance of these markets in the global cryptocurrency hardware landscape.

Market Dynamics and Key Players

The industry is characterized by a competitive landscape with key players such as Bitmain Technologies, Canaan Creative, and Ebang International Holdings leading the charge. These companies are heavily investing in research and development to maintain their competitive edge and meet the increasing demand from both new and existing cryptocurrency miners. According to GlobeNewswire, these entities are pivotal in pushing the boundaries of what is technically feasible in the realm of cryptocurrency hardware.

Regional Insights

While North America and China are critical to the market's growth, other regions are also showing significant potential. Europe, for instance, is experiencing a steady increase in cryptocurrency mining activities, driven by favorable regulations and the increasing acceptance of digital currencies. In parallel, the Asia-Pacific region, with its burgeoning tech infrastructure and growing investment in blockchain technology, is emerging as a critical market for cryptocurrency hardware.

Challenges and Opportunities

Despite the rosy growth prospects, the cryptocurrency hardware market is not without its challenges. Regulatory uncertainties and the volatility of cryptocurrency prices pose significant risks. However, these challenges also present opportunities for innovation in regulatory technology (RegTech) and risk management solutions. As governments worldwide grapple with the regulatory frameworks for digital currencies, companies that can navigate these complexities successfully stand to gain a competitive advantage.

Furthermore, environmental concerns related to the energy consumption of cryptocurrency mining could spur advancements in energy-efficient hardware solutions. Companies that prioritize sustainability are likely to attract investments from environmentally conscious investors and consumers.

Expert Opinions

Industry experts suggest that the future of the cryptocurrency hardware market will be heavily influenced by technological advancements and regulatory developments. According to a report by Research and Markets, the ongoing evolution in blockchain technology and its applications will further fuel demand for advanced hardware solutions. Moreover, experts believe that as cryptocurrency becomes more integrated into mainstream financial systems, the hardware market will continue to see robust growth.

Conclusion

The cryptocurrency hardware market represents a $2.9 billion opportunity by 2030, driven by technological advancements and the increasing adoption of digital assets. With key markets like the U.S. and China at the forefront, the sector is poised for significant growth. Companies that can innovate while navigating regulatory landscapes and addressing environmental concerns will likely emerge as market leaders. As the industry continues to evolve, investors should keep a close watch on emerging trends and technological breakthroughs that could reshape the future of cryptocurrency hardware.