The accelerating shift towards sustainable energy sources has placed commodities at the nucleus of the energy transition journey. As the global demand for clean energy solutions intensifies, commodities such as lithium, cobalt, nickel, copper, and rare earth elements are witnessing unprecedented attention and demand. These materials are quintessential for the development of batteries, electric vehicles, and renewable energy technologies, underscoring their pivotal role in the ongoing energy metamorphosis.

Critical Commodities in the Energy Transition

The global quest for sustainable energy solutions is creating a surge in demand for specific commodities. Lithium, cobalt, and nickel are integral to battery technologies, with lithium-ion batteries forming the backbone of electric vehicles (EVs) and energy storage systems. Copper, known for its excellent conductivity, is essential for extending electricity networks and is a crucial component in wind turbines and solar panels.

According to a report by S&P Global, the production of electric vehicles is expected to multiply by nearly five times by 2030, with batteries alone accounting for more than 70% of the world's lithium demand. Similarly, the demand for cobalt and nickel is anticipated to grow, driven by their extensive application in battery production. However, this escalating demand poses significant challenges.

Challenges in Supply and Environmental Impact

The growing reliance on these commodities raises significant concerns over supply constraints and environmental ramifications. The mining and extraction processes of these minerals are resource-intensive and often environmentally detrimental. Cobalt, primarily sourced from the Democratic Republic of Congo, poses ethical challenges due to child labor and unsafe mining conditions. As the demand for these commodities rises, the industry faces the critical task of ensuring ethical and sustainable extraction processes.

Moreover, geopolitical tensions can further strain supply chains. Recent disruptions in Chile, a major copper producer, have highlighted vulnerabilities within the supply network. As reported by ICIS, these disruptions can have cascading effects on global supply, especially with copper being an indispensable element in renewable energy infrastructure.

Opportunities for Innovation and Investment

Despite the challenges, the energy transition presents vast investment opportunities. The demand for clean technologies is propelling innovation in recycling and alternative sourcing methods. Companies are investing in technologies that enhance the efficiency of raw material extraction and processing, reducing environmental impact and dependency on traditional mining.

Investors have significant opportunities in sectors focused on recycling and developing alternative materials. For instance, ventures into lithium recycling can reduce reliance on virgin materials, a move supported by increasing regulatory pressures to minimize environmental impact. Additionally, alternative battery technologies such as solid-state batteries promise to revolutionize energy storage, offering higher efficiency and safety.

The Strategic Role of Policy and Regulation

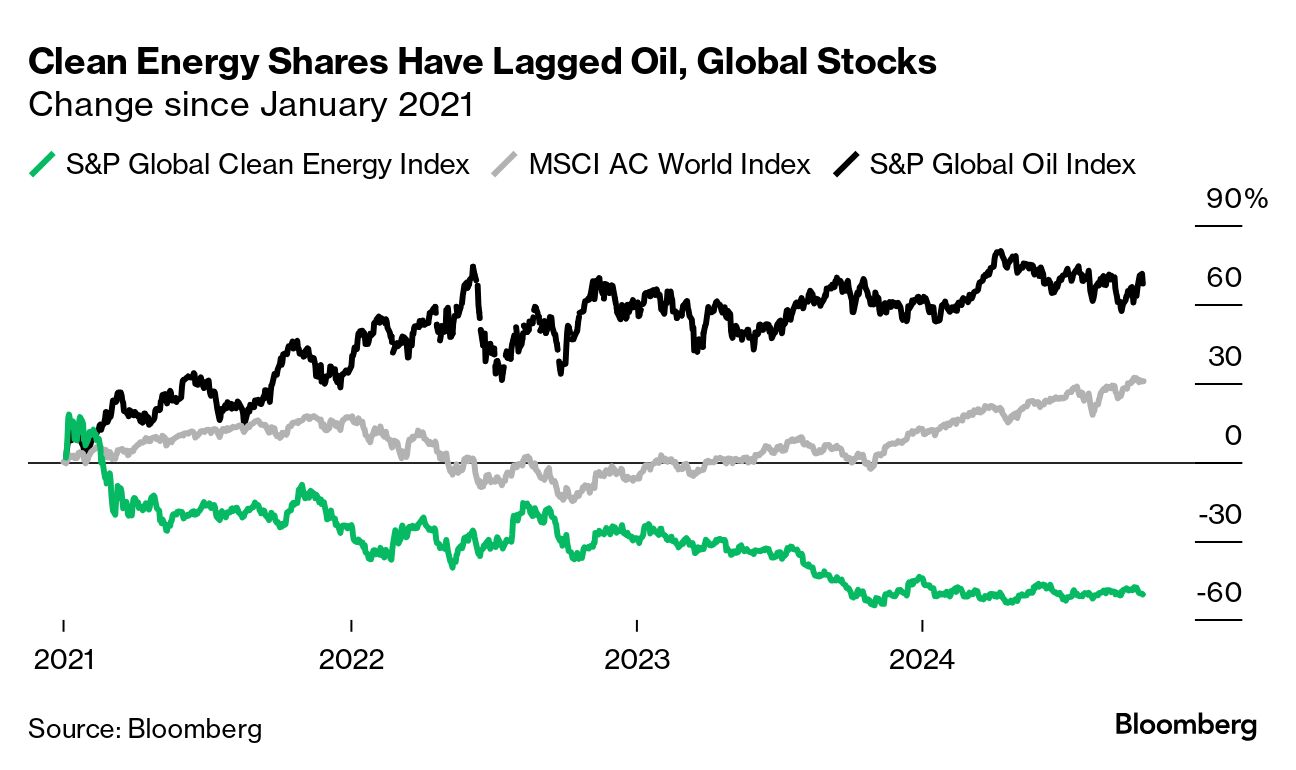

Government policies play a decisive role in directing the future of commodity markets in the energy transition. Incentives and regulations encouraging the sustainable sourcing and recycling of critical minerals are crucial. According to Bloomberg, several countries are implementing stricter environmental standards and offering subsidies for sustainable mining practices, which could reshape global supply chains.

Additionally, international collaborations can enhance supply chain resilience. The European Union's ongoing negotiations with Latin American countries, rich in lithium and copper, aim to develop strategic partnerships that secure a sustainable supply of these critical resources.

The Future Outlook

As the world advances towards a low-carbon economy, commodities will remain central to the energy transition narrative. The dual challenge of meeting increasing demand while ensuring sustainable and ethical practices will define the future trajectory of global commodity markets. With technological innovations and strategic policy interventions, the commodity markets stand to benefit significantly from this transition, offering investors viable opportunities to engage with the emerging green economy.

In conclusion, while the road to a sustainable energy future presents formidable challenges, it equally offers unparalleled opportunities for innovation, investment, and policy development. The successful navigation of these challenges will determine the pace and efficacy of the global energy transition, with commodities playing an indispensable role at its core.