Gold ETFs: A Strategic Hedge in Uncertain Markets

In the face of economic uncertainty, gold has long been considered a safe-haven asset, and Gold Exchange-Traded Funds (ETFs) have sustained this reputation by offering investors a convenient way to gain exposure to gold without the intricacies of physical ownership. As market volatility persists globally, these investment vehicles have emerged as a stabilizing force within diversified portfolios, providing a strategic hedge against economic unpredictability.

Gold ETFs: Stability Amidst Volatility

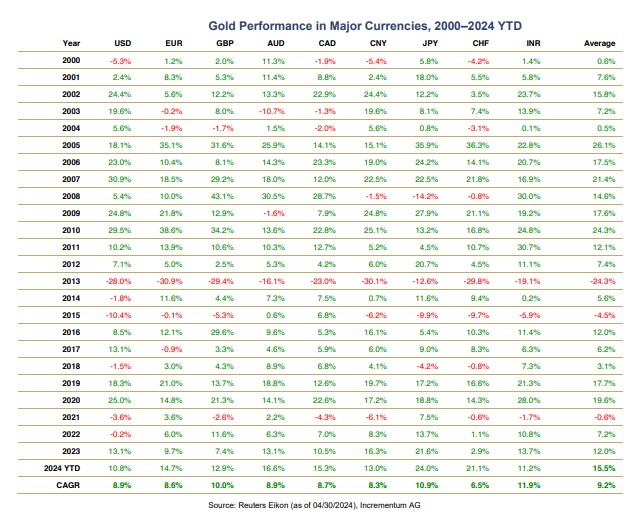

Gold ETFs, such as the widely recognized SPDR Gold Shares (GLD), have demonstrated remarkable resilience amid market turbulence. As geopolitical tensions and economic uncertainties exacerbate, the demand for gold as a protective asset has surged. According to ETF Trends, gold prices have remained resilient, reflecting investors' inclination toward stability during fiscal upheavals.

The relationship between gold and market volatility is underscored by its role as a defensive asset. Gold's inverse correlation with traditional asset classes, particularly equities, makes it an essential component in a balanced portfolio. "In times of financial stress, investors typically flock to gold ETFs as a hedge against market downturns," notes a financial analyst from Schwab.

Factors Contributing to Gold ETF Stability

Several factors contribute to the enduring stability of gold ETFs:

-

Economic Uncertainty: The ongoing global economic instability, marked by geopolitical tensions, has amplified the allure of gold as a safeguard against potential downturns. As Reuters highlights, gold's appeal is particularly pronounced in tumultuous periods when traditional investments falter.

-

Inflation Concerns: Rising inflationary pressures have spurred investors to seek refuge in gold ETFs, aiming to preserve purchasing power and counter the devaluation of fiat currencies. With inflation rates climbing, gold serves as a hedge, providing a buffer against currency erosion.

-

Central Bank Policies: The expansive monetary policies and low-interest-rate environment maintained by central banks worldwide have further bolstered gold's attractiveness as a non-yielding asset. The association of gold with limited supply and intrinsic value strengthens its position as a hedge against inflation and currency devaluation.

Role in Diversified Portfolios

Gold ETFs play a pivotal role in enhancing portfolio diversification, offering investors a hedge against equity market downturns. The inclusion of gold ETFs can reduce portfolio volatility and risk, given their low correlation with traditional financial instruments like stocks and bonds. This strategic allocation is echoed by platforms like Zerodha Fund House, which advocate for incorporating gold ETFs into investment strategies to balance risk.

While gold ETFs present a robust hedge, investors must remain cognizant of potential risks, such as price volatility driven by market sentiment and fluctuations in interest rates. A prudent approach involves integrating gold ETFs alongside other asset classes to ensure a well-rounded and resilient investment strategy.

Conclusion

In summary, gold ETFs continue to serve as a reliable investment vehicle for those seeking stability in uncertain markets. Their resilience amidst economic volatility underscores their importance in diversified investment strategies. As a strategic hedge, gold ETFs offer investors a means to safeguard against market disruptions, inflationary pressures, and central bank policy shifts. By maintaining a steady course through the turbulence, gold ETFs affirm their role as a cornerstone in risk-averse investment portfolios.

For investors considering the integration of gold ETFs into their portfolios, it is essential to balance exposure with other asset classes, thereby optimizing portfolio resilience and performance. As the financial landscape evolves, gold ETFs remain a steadfast option for those navigating the complexities of market uncertainty.