Navigating Cryptocurrency Taxation: Essential Insights for Investors

As the cryptocurrency market continues to flourish, investors are finding themselves navigating an increasingly complex landscape of tax obligations. With the IRS enforcing specific regulations on cryptocurrency transactions, understanding the tax implications of these digital assets is crucial. This article explores the various taxable events associated with cryptocurrencies, including capital gains and ordinary income taxes, providing actionable strategies for compliance and optimization.

Taxable Events

Certain transactions involving cryptocurrencies can trigger taxable events, while others do not. It is essential for investors to identify which activities require reporting to the IRS:

-

Selling Crypto for Cash: If you sell your cryptocurrency for more than you paid, you incur capital gains tax. This tax applies even if you do not convert your crypto into dollars. For example, if you purchased Bitcoin (BTC) at $30,000 and later sold it for $50,000, you would report a capital gain of $20,000.

-

Receiving Crypto as Payment: If you receive cryptocurrency as payment for goods or services, it is taxed as ordinary income based on your income tax bracket. For instance, if you received 0.5 BTC for your freelance work and the fair market value of Bitcoin at the time of receipt was $40,000, you would report that amount as income.

-

Gifting Crypto: Giving or receiving cryptocurrency as a gift also comes with tax obligations, but only up to a certain limit. According to IRS guidelines, you can gift up to $16,000 (in 2025) per recipient without incurring gift taxes.

Capital Gains Tax

Capital gains tax varies depending on how long you hold the asset before selling:

-

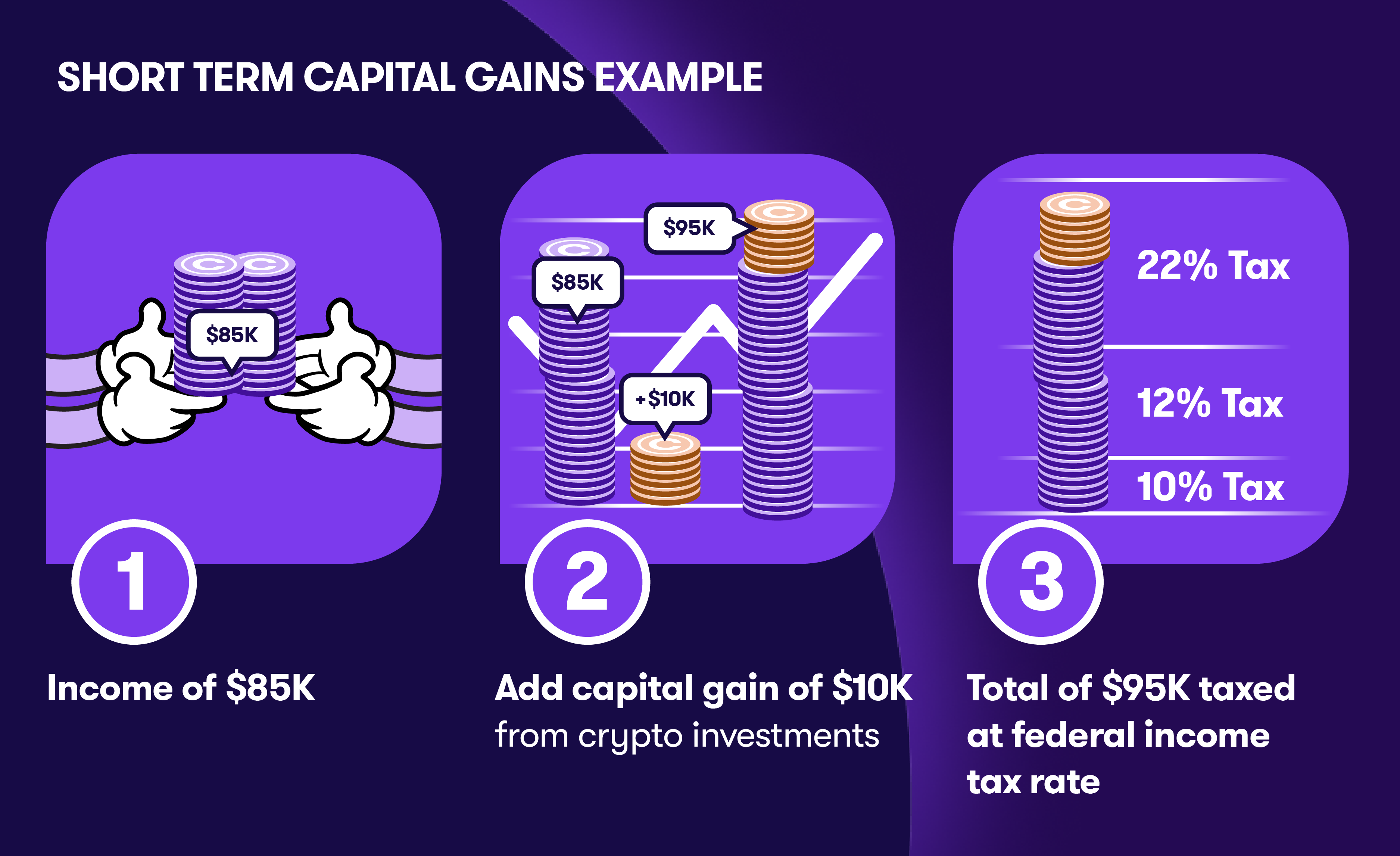

Short-Term Capital Gains: If you sell your cryptocurrency within one year of purchase, you pay short-term capital gains tax, which typically aligns with your ordinary income tax rate. This rate can vary significantly depending on your total taxable income.

-

Long-Term Capital Gains: If you hold your cryptocurrency for more than one year, you benefit from lower long-term capital gains tax rates. For example, the long-term capital gains tax rates in the U.S. are currently set at 0%, 15%, or 20%, depending on your income level.

If you sell your cryptocurrency for a loss, you may deduct that loss on your taxes, which can lower your overall tax bill. This deduction can offset other capital gains or up to $3,000 of ordinary income in any given tax year. Losses exceeding this amount can be carried over to offset future gains.

Reporting Requirements

It is essential to report any crypto income to the IRS, including income earned through mining, which is taxed at the fair market value on the day you received it. Investors must maintain detailed records of all transactions, including:

- Dates of transactions – When you bought or sold crypto.

- Amount of cryptocurrency – The number of coins or tokens involved.

- Fair market value – The dollar value of the cryptocurrency at the time of the transaction.

- Purpose of the transaction – Whether it was a sale, payment for services, or a gift.

The IRS requires this level of detail to ensure compliance with tax regulations, preventing potential penalties for failing to report income.

Conclusion

With the evolving regulatory landscape surrounding cryptocurrencies, staying informed about taxation is vital for investors. By understanding the implications of taxable events, capital gains taxes, and reporting requirements, individuals can navigate the complexities of cryptocurrency investments more effectively.

To optimize your tax strategies, consider the following actionable steps:

-

Maintain Detailed Records: Keeping thorough documentation of all cryptocurrency transactions will simplify your tax reporting and ensure compliance.

-

Consult Tax Professionals: As the tax landscape evolves, consulting with a tax professional knowledgeable about cryptocurrency can help you navigate complex regulations and optimize your tax strategy.

-

Stay Informed: Regularly update yourself on changes in tax legislation regarding cryptocurrencies. This will help you adapt your investment strategy and tax planning accordingly.

By taking these steps, investors can better position themselves for success in the burgeoning world of cryptocurrency while ensuring they meet their tax obligations.