The burgeoning cryptocurrency market presents a convoluted landscape for investors, particularly when it comes to understanding tax implications. As the IRS tightens its regulatory grip, navigating the tax terrain of cryptocurrency transactions has become paramount for investors seeking compliance and optimization of their financial strategies.

Understanding Taxable Events in Cryptocurrency

Cryptocurrency transactions can trigger various taxable events, which investors must identify and manage effectively. According to current IRS guidelines, not all crypto activities are taxable, but several common transactions are. These include selling crypto for cash, trading one cryptocurrency for another, or using crypto to purchase goods or services. Each of these actions could lead to capital gains tax, calculated on the difference between the purchase and sale prices of the cryptocurrency.

Capital Gains Tax: Selling a cryptocurrency asset that has appreciated in value triggers a capital gain. The IRS distinguishes between short-term and long-term gains, based on the holding period. Cryptocurrencies held for one year or less are subject to short-term capital gains tax, aligned with ordinary income tax rates, whereas those held for over a year benefit from favorable long-term capital gains tax rates.

Ordinary Income Tax: Receiving cryptocurrency as payment for services, or through mining operations, falls under ordinary income tax. The value of the cryptocurrency at the time of receipt is crucial, as it forms the taxable income, subject to the individual's federal income tax bracket.

Strategic Tax Planning and Loss Management

Investors can leverage strategic tax planning to optimize their tax liabilities. One significant strategy involves capital losses, which occur when selling a cryptocurrency at a lower price than its purchase cost. These losses can offset capital gains from other transactions, reducing taxable income. The IRS allows up to $3,000 of net capital losses to be deducted against ordinary income annually, with any excess carried forward to future tax years.

"Understanding these tax nuances not only ensures compliance but can significantly affect an investor's after-tax return," says tax expert Jonathan Kroll, emphasizing the importance of informed decision-making in crypto investments.

Non-Taxable Crypto Transactions

Interestingly, not all cryptocurrency actions lead to tax liabilities. For instance, buying crypto with fiat money and holding it, or transferring crypto between personal wallets, remain non-taxable activities. Similarly, receiving crypto as a gift up to a certain limit is not taxed, although the recipient may face taxes if they sell it later.

IRS Scrutiny and Reporting Requirements

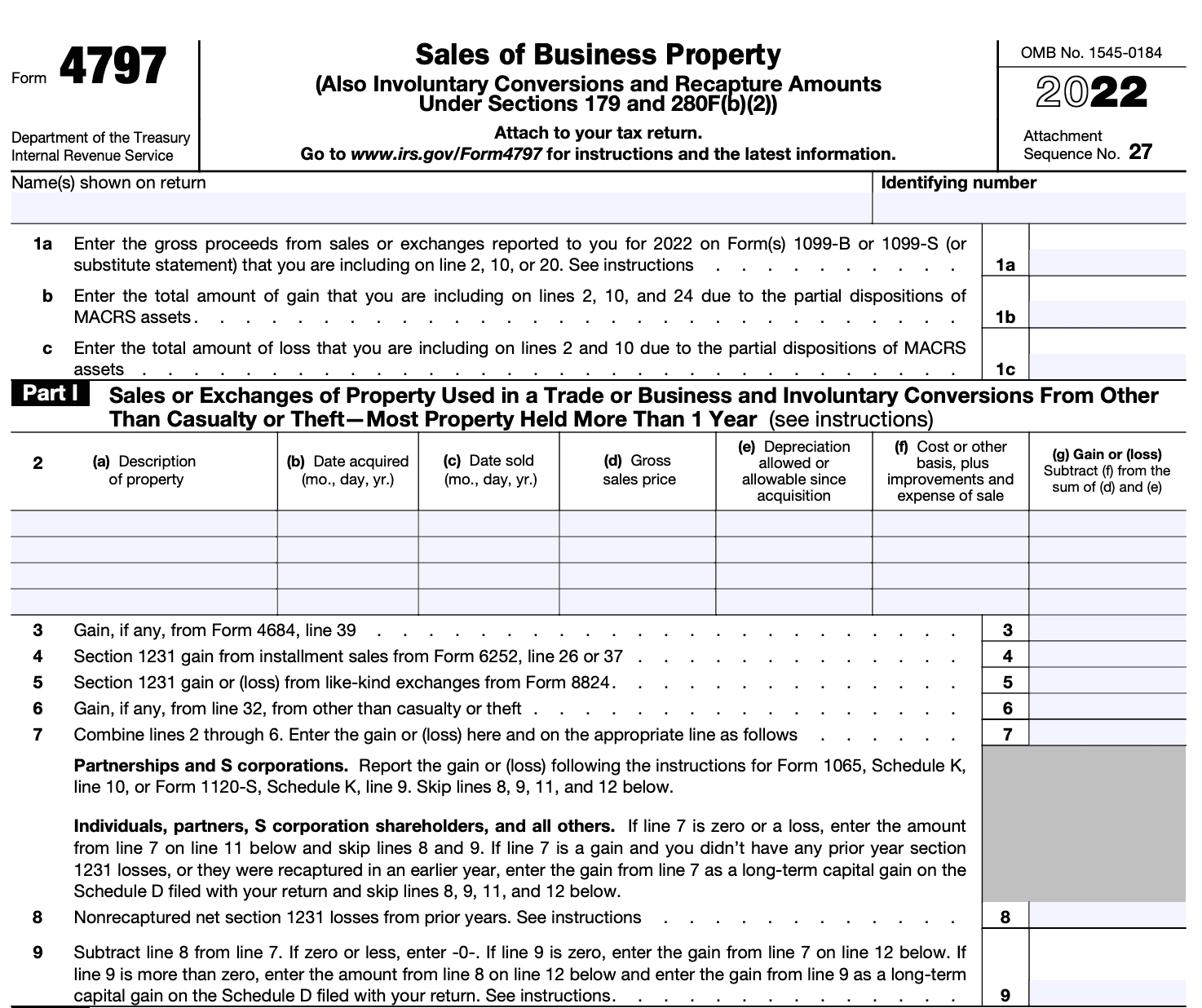

The IRS has ramped up enforcement and scrutiny to ensure taxpayers report their crypto transactions accurately. Investors must maintain detailed records of all their crypto dealings, including dates, values, and purposes of transactions. Failure to report can lead to audits, penalties, or interest charges.

Furthermore, the IRS has added virtual currency questions on tax forms to increase awareness and compliance. The agency's emphasis on crypto reflects its growing importance in the financial ecosystem and the need for robust regulatory oversight.

Expert Insights and Future Considerations

"The evolving regulatory landscape requires investors to stay informed and proactive in their tax planning," advises Cynthia Cole, a leading financial advisor. "Engaging with knowledgeable tax professionals can provide significant advantages in navigating the complexities of crypto taxation."

Looking ahead, as the cryptocurrency market continues to integrate with traditional financial systems, the tax environment will likely evolve. Investors should anticipate and prepare for potential changes in legislation and IRS enforcement policies.

In conclusion, while the cryptocurrency market offers lucrative opportunities, it also demands diligent attention to tax implications. By understanding and strategically managing taxable events, investors can optimize their portfolios, ensuring compliance and enhancing their profit potential.