Market Resilience Amid Economic Uncertainty: A Deep Dive into Recent Stock Movements

Introduction

The stock market has recently shown signs of resilience, particularly with the S&P 500 snapping a four-week losing streak. This recovery comes amid a backdrop of economic uncertainty, with various sectors experiencing mixed performances. As investors grapple with shifting economic indicators, understanding the underlying factors driving market movements has become increasingly critical.

Recent Performance Overview

On March 23, 2025, the S&P 500 index experienced a notable rebound, reflecting a 2% increase as investors reacted positively to new economic data indicating potential growth. This uptick is significant as it follows a period of volatility that had seen the index decline consistently over the previous month.

The recent fluctuations in the stock market can be attributed to a variety of macroeconomic factors, including consumer confidence, sector performances, and trade policy shifts.

Key Drivers of Market Movement

1. Economic Indicators

Recent reports suggest that consumer confidence is on the rise, which has bolstered investor sentiment. Analysts point to a 2.5% increase in retail sales as a key indicator of economic health. According to the U.S. Commerce Department, this uptick in consumer spending is a positive sign for the overall economy, as it suggests that households are willing to spend despite ongoing uncertainty.

2. Sector Performance

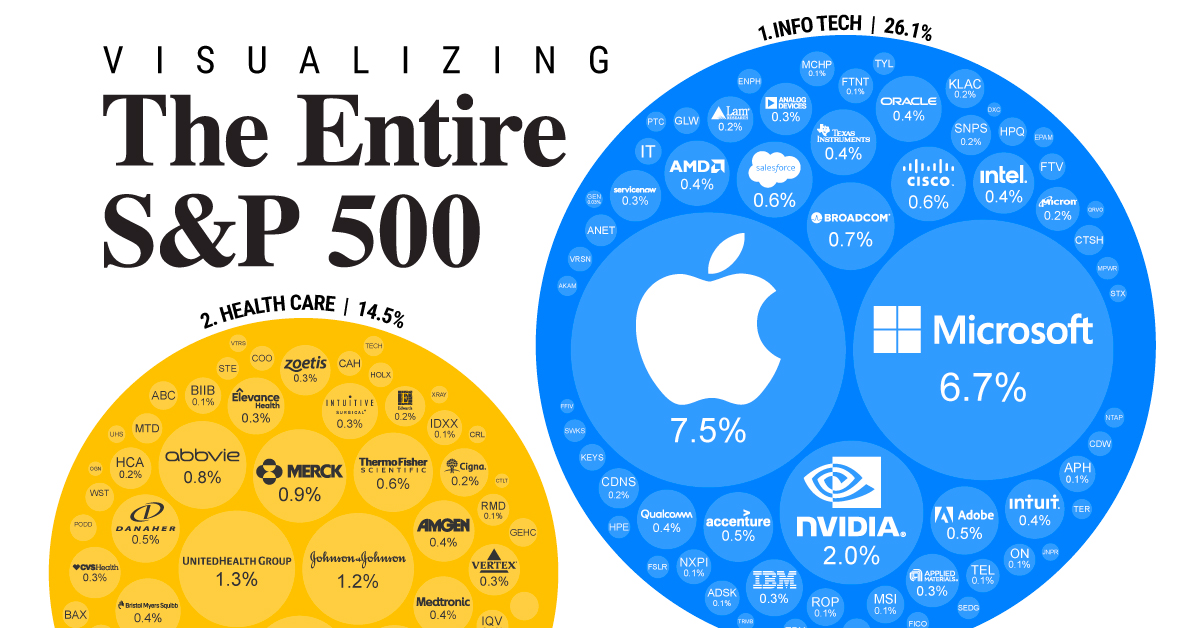

Technology stocks, particularly giants like Apple (AAPL) and Microsoft (MSFT), have shown resilience. Apple saw an increase of approximately 2%, while Microsoft gained 1.5% on March 23. These stocks are crucial as they often lead market trends. The performance of large-cap technology stocks has historically been a bellwether for broader market movements, and their recent gains have provided a much-needed boost to investor confidence.

3. Tariff Flexibility

The announcement of potential tariff flexibility by the U.S. government has also contributed to a more favorable outlook for investors, particularly in sectors sensitive to trade policies. President Trump’s indications of possible adjustments to tariffs have sparked optimism that trade tensions may soften, potentially benefiting companies reliant on imports and exports. This adjustment comes at a critical time, as businesses are navigating supply chain disruptions caused by previous tariff implementations.

Implications for Investors

Investors are advised to remain vigilant and consider sector-specific dynamics as they navigate this volatile market. The recent recovery may present buying opportunities, especially in technology and consumer discretionary stocks, which are expected to benefit from improved consumer spending.

However, caution is warranted. While the S&P 500's recent uptrend is encouraging, ongoing economic uncertainties—such as inflation rates, geopolitical tensions, and potential regulatory changes—could still exert downward pressure on markets in the near future.

Market Sentiment and Future Outlook

Investor sentiment remains cautious but optimistic, particularly as signs indicate a potential stabilization of economic conditions. The composite index's resilience in the face of previous declines suggests that many investors are looking for opportunities to enter the market at lower valuations, particularly in sectors that have historically performed well during periods of economic recovery.

According to market analysts, if consumer spending continues to rise, it may lead to a more robust economic recovery, positively impacting corporate earnings and stock prices in the long run. However, investors should continue to monitor economic indicators closely, as changes in unemployment rates, inflation, and interest rates could influence market dynamics significantly.

Conclusion

The stock market's recent performance highlights a complex interplay between economic indicators and investor sentiment. As the market continues to evolve, staying informed about economic trends and sector performances will be crucial for making informed investment decisions. The recent rebound of the S&P 500 may signal a turning point, but investors must remain aware of macroeconomic challenges that could derail progress.

For those looking to navigate the current landscape, diversifying portfolios and focusing on sectors showing strong fundamentals—such as technology—could be wise strategies moving forward. As always, consulting with financial experts and leveraging credible market data will aid in making sound investment choices.