The Surge in Global Copper Prices: Analyzing Market Dynamics and Future Outlook

In March 2025, global copper prices have experienced what analysts are calling a "rocket-like" surge, with prices escalating sharply due to a confluence of factors. Market dynamics are increasingly influenced by rising demand, particularly from the renewable energy sector and electric vehicle production, while supply chain disruptions stemming from geopolitical tensions have added to the upward pressure on prices. This article delves into the current state of the copper market, the factors driving these trends, and expert insights into future projections.

Current Market Dynamics

As of late March 2025, copper prices have shown substantial increases, with markets outside of China exhibiting higher volatility. For instance, the Shanghai Futures Exchange (SHFE) has reported significant fluctuations, reflecting both domestic demand and the pressures of international markets.

According to recent data, copper prices have surged to approximately $9,000 per metric ton, a marked increase from the $7,500 reported at the beginning of the year. This dramatic rise has sparked discussions among investors and analysts about the sustainability of these prices and the long-term outlook for the copper market.

Key Factors Influencing Prices

-

Increased Demand: The transition toward renewable energy sources and the growing electric vehicle market have drastically amplified copper demand. The International Energy Agency (IEA) projects that copper demand could increase by over 200% by 2030 as countries ramp up investments in green technologies.

-

Supply Chain Disruptions: Geopolitical tensions, particularly in South America, have led to significant supply chain challenges. Major copper-producing countries like Chile and Peru have faced labor strikes, political instability, and logistical issues, creating substantial production deficits. According to the Chilean Copper Commission (Cochilco), copper production fell by 8% in the last quarter of 2024 due to these disruptions.

-

Investment Trends: Institutional investors are increasingly viewing copper as a critical commodity for future growth, especially as the world pivots towards sustainable energy solutions. Reports indicate that investment in copper-focused funds has surged by 45% year-over-year, highlighting a shift in investor sentiment towards this essential metal.

Expert Insights

Market experts suggest that while the current surge is fueled by immediate pressures, the long-term outlook for copper remains bullish. According to a report from S&P Global, "The fundamentals for copper are strong, and as the world transitions to greener technologies, we expect sustained demand growth."

Paul Harris, a metals analyst at S&P Global, stated, "Copper is more than just a commodity; it is integral to the green transition. As electric vehicles and renewable energy projects proliferate, the demand for copper is set to soar."

Future Projections

Looking ahead, the copper market is expected to remain robust, with some analysts predicting that prices could reach up to $10,000 per metric ton by the end of 2025. Factors contributing to this outlook include:

- Continued Infrastructure Investment: Governments worldwide are increasing infrastructure spending to stimulate economies, with copper being a key component in construction and electrical systems.

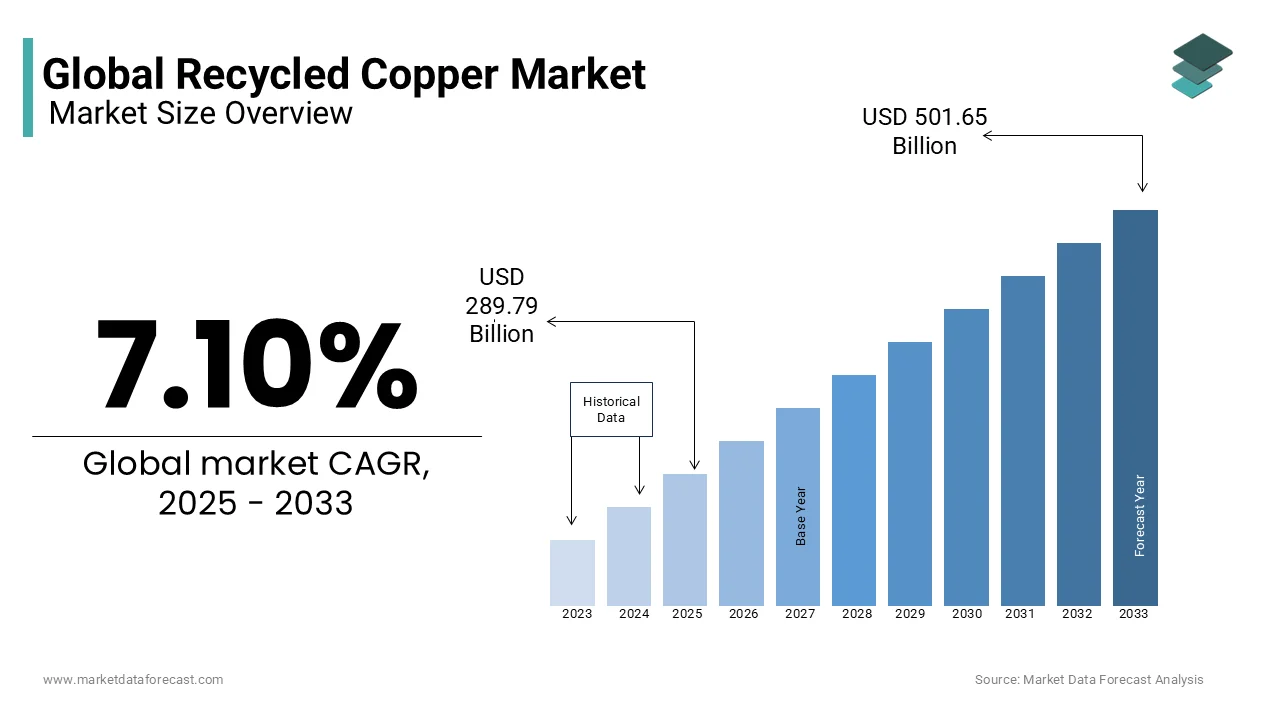

- Technological Advancements: Innovations in recycling and processing technologies may help alleviate some supply constraints, although demand is likely to outpace these gains for the foreseeable future.

Conclusion

Investors should monitor the copper market closely, paying attention to both immediate price trends and the underlying factors influencing future movements. The growing emphasis on renewable energy and electric vehicles positions copper as a pivotal commodity in various industries, making it essential for stakeholders to stay informed as the global economy continues to evolve.

For further insights, industry stakeholders can access resources from S&P Global and other market analysis firms that provide in-depth reports on commodity trends.

Keywords: Copper, Prices, Market Dynamics, Supply Chain, Demand, Renewable Energy, Electric Vehicles

References: