The Dynamics of Currency Pairs: A Deep Dive into Major Forex Markets

In the vast landscape of Forex trading, understanding the dynamics of currency pairs is crucial for any trader aiming to succeed. The Forex market, with a staggering daily trading volume exceeding $7 trillion, operates 24 hours a day, making it the largest financial market globally. Each currency pair tells its own story, shaped by economic indicators, geopolitical influences, and market sentiment.

Major Currency Pairs Overview

Major currency pairs include the EUR/USD, USD/JPY, and GBP/USD. These pairs are characterized by high liquidity and volatility, making them attractive to traders. For instance, the EUR/USD is the most traded currency pair, accounting for approximately 20% of daily Forex transactions. This liquidity ensures that trades can be executed swiftly, minimizing slippage and enhancing trading efficiency.

Economic Indicators and Their Impact

Economic indicators such as GDP growth rates, employment figures, and inflation data significantly influence currency valuations. A stronger-than-expected U.S. Non-Farm Payrolls report typically strengthens the USD, leading to a bearish outlook for the EUR/USD pair. Conversely, if the Bank of England signals a potential interest rate hike, the GBP/USD may see bullish momentum.

For example, consider the immediate reaction of the Forex market to the latest U.S. Consumer Price Index (CPI) data. If inflation rates rise unexpectedly, the Federal Reserve may tighten monetary policy, prompting a rally in the U.S. dollar across multiple pairs. This direct relationship between economic performance and currency strength is pivotal for traders seeking to capitalize on short-term moves.

Correlation Between Currency Pairs

Understanding the correlation between different currency pairs can also enhance trading strategies. For instance, the AUD/USD and NZD/USD pairs often move in tandem due to their economic ties, driven primarily by commodity prices and trade relations with China.

As highlighted by recent market analyses, traders can leverage this correlation to hedge positions or identify potential trading opportunities. For example, if both pairs are showing strength, a trader might consider going long on both, whereas divergence could signal a potential reversal.

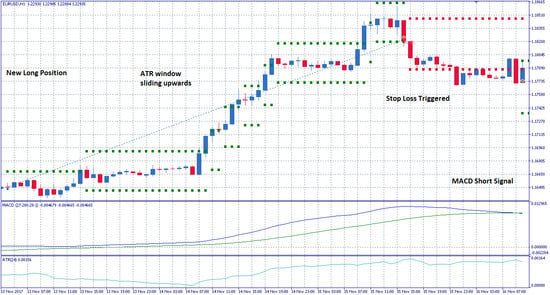

Technical Analysis in Forex Trading

Technical analysis plays a pivotal role in Forex trading. Traders often utilize tools such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels to forecast price movements. For example, if the USD/JPY approaches a significant resistance level at 150.00, traders might look for reversal patterns to capitalize on a potential downtrend.

To illustrate, a recent analysis of the USD/JPY pair has shown that the market is currently testing a pivotal resistance level at 150.97. Observers note that if this level holds, traders could anticipate a corrective move lower, providing a potential shorting opportunity.

Additionally, patterns such as head and shoulders or double tops can signal to traders when to enter or exit positions, further refining their strategies.

Conclusion

In conclusion, mastering the dynamics of currency pairs requires a blend of fundamental and technical analysis. By staying informed about economic indicators and understanding market correlations, traders can make more informed decisions in the fast-paced Forex market.

As always, disciplined risk management is essential to navigate the inherent volatility of currency trading effectively. With the right tools and strategies, traders can thrive in this dynamic environment, leveraging their insights to enhance performance and increase profitability.

The Forex market presents a multitude of opportunities for traders willing to engage with its complexities. By continuously educating themselves and refining their strategies, traders can achieve a critical edge in navigating this ever-evolving marketplace.