Bitcoin's Surge Amid Geopolitical Shifts: Analyzing the Impact of Russia's Crypto Adoption

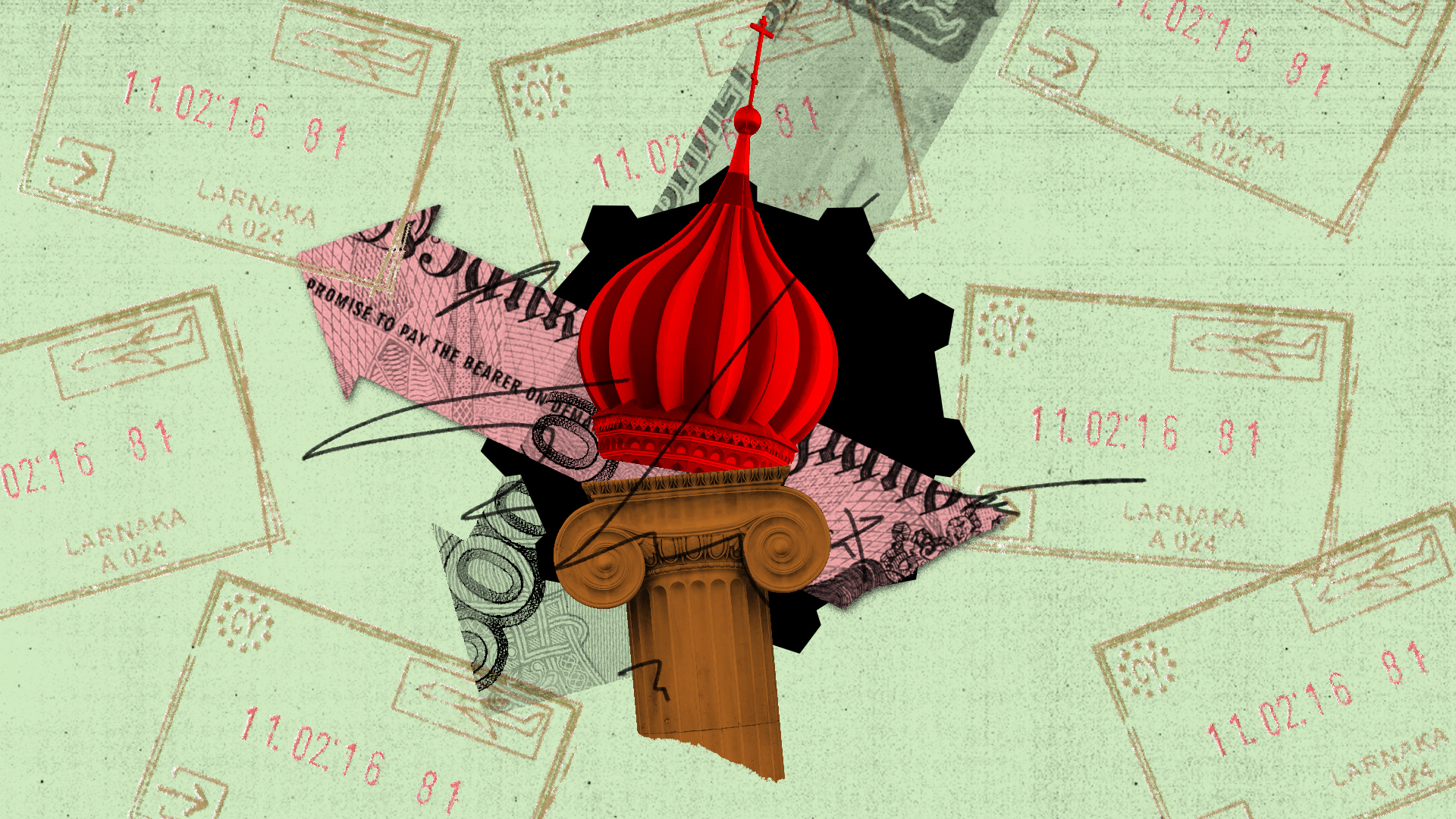

As Bitcoin fluctuates around $87,470, its recent price surge is largely attributed to Russia's strategic embrace of cryptocurrencies for oil transactions with China and India. This maneuver allows Russia to sidestep Western sanctions that have impacted its $192 billion oil trade, with reports indicating that Russian oil firms are processing about $10 million monthly through digital currencies. This development marks a significant pivot in global trading practices and reflects the increasing acceptance of cryptocurrency as a legitimate financial instrument.

The Dynamics of Bitcoin's Price Surge

The price of Bitcoin has seen a remarkable ascent, prompting analysts to forecast future valuations between $100,000 and $150,000. Some bullish estimates even suggest potential peaks as high as $350,000 or $500,000. These optimistic projections are not merely speculative; they are grounded in the evolving landscape of international trade where cryptocurrencies could play an increasingly pivotal role.

The implications are far-reaching, as this geopolitical maneuvering highlights cryptocurrencies' potential to reshape traditional financial systems, particularly in regions facing economic pressures. With the global market capitalization of cryptocurrencies currently hovering around $2.86 trillion, Bitcoin's dominance has been reported to exceed 60%.

Key Market Dynamics

- Current Bitcoin Price: $87,470

- Projected Price Targets: $100,000 - $500,000

- Monthly Crypto Transactions by Russia: $10 million

- Total Value of Russian Oil Trade: $192 billion

This intersection of geopolitics and digital finance underscores a transformative moment where traditional banking and currency systems are challenged by decentralized alternatives.

Russia's Strategic Use of Cryptocurrencies

The shift towards cryptocurrencies in Russian oil trade is emblematic of a broader trend where countries seek financial autonomy in the face of sanctions. Russia's oil sector, which has been a backbone of its economy, is now leveraging digital currencies to convert sales proceeds from Indian rupees and Chinese yuan into Russian rubles.

According to financial analysts, this trend, while nascent, signals a small yet growing segment of Russia's oil trade that could expand significantly. The ability to transact in cryptocurrencies not only mitigates the risks posed by sanctions but also positions Russia as a key player in the burgeoning global digital economy.

Market Reactions and Investor Sentiment

The responses from the investment community to these developments have been mixed, reflecting broader concerns about regulatory frameworks and market stability. The recent aggressive moves towards the acceptance of cryptocurrencies by various governments could bolster the asset's appeal among institutional investors.

Avinash Shekhar, Co-founder and CEO of Pi42, noted, “The crypto markets are showing signs of dynamic shifts as liquidity builds and key technical patterns are established.” This sentiment resonated with many investors who are now more inclined to view cryptocurrencies as viable long-term investments rather than speculative assets.

The Implications for Global Trade

The ramifications of Russia's crypto adoption extend beyond immediate financial gains. As the world increasingly adopts digital currencies, this could redefine how traditional trade agreements and financial transactions are managed. Countries that have historically relied on the U.S. dollar for international trade may begin to explore cryptocurrencies as an alternative, especially in transactions with nations that face stringent sanctions.

Reports indicate that further integration of cryptocurrencies into global commerce could alter the balance of power in international finance. Countries that embrace these technologies early may gain a competitive edge in the evolving economic landscape.

Regulatory Landscape and Future Considerations

While the current trajectory appears promising for Bitcoin and other cryptocurrencies, it is crucial to highlight the ongoing discussions surrounding regulation. The establishment of clearer frameworks could either bolster or hinder the growth of cryptocurrencies as traditional financial systems respond to these shifts.

As governments grapple with the challenges posed by digital currencies, the regulatory environment remains fluid. Investors and traders are advised to stay abreast of developments that could impact market dynamics.

Conclusion

The rise of Bitcoin amid geopolitical shifts serves as a testament to the transformative potential of cryptocurrencies. As Russia's adoption of digital currencies for oil trade illustrates, we are witnessing a paradigm shift in how financial transactions are conducted globally.

With price projections indicating potential new highs and a growing acceptance of digital currencies in international trade, the market is poised for significant changes. Investors must remain vigilant and adaptable to capitalize on these trends, while also navigating the complexities of an evolving regulatory landscape. The future of Bitcoin and cryptocurrencies looks promising, yet it remains intertwined with broader economic and geopolitical developments.

For additional insights on cryptocurrency market trends, you can visit LiveMint or South China Morning Post.