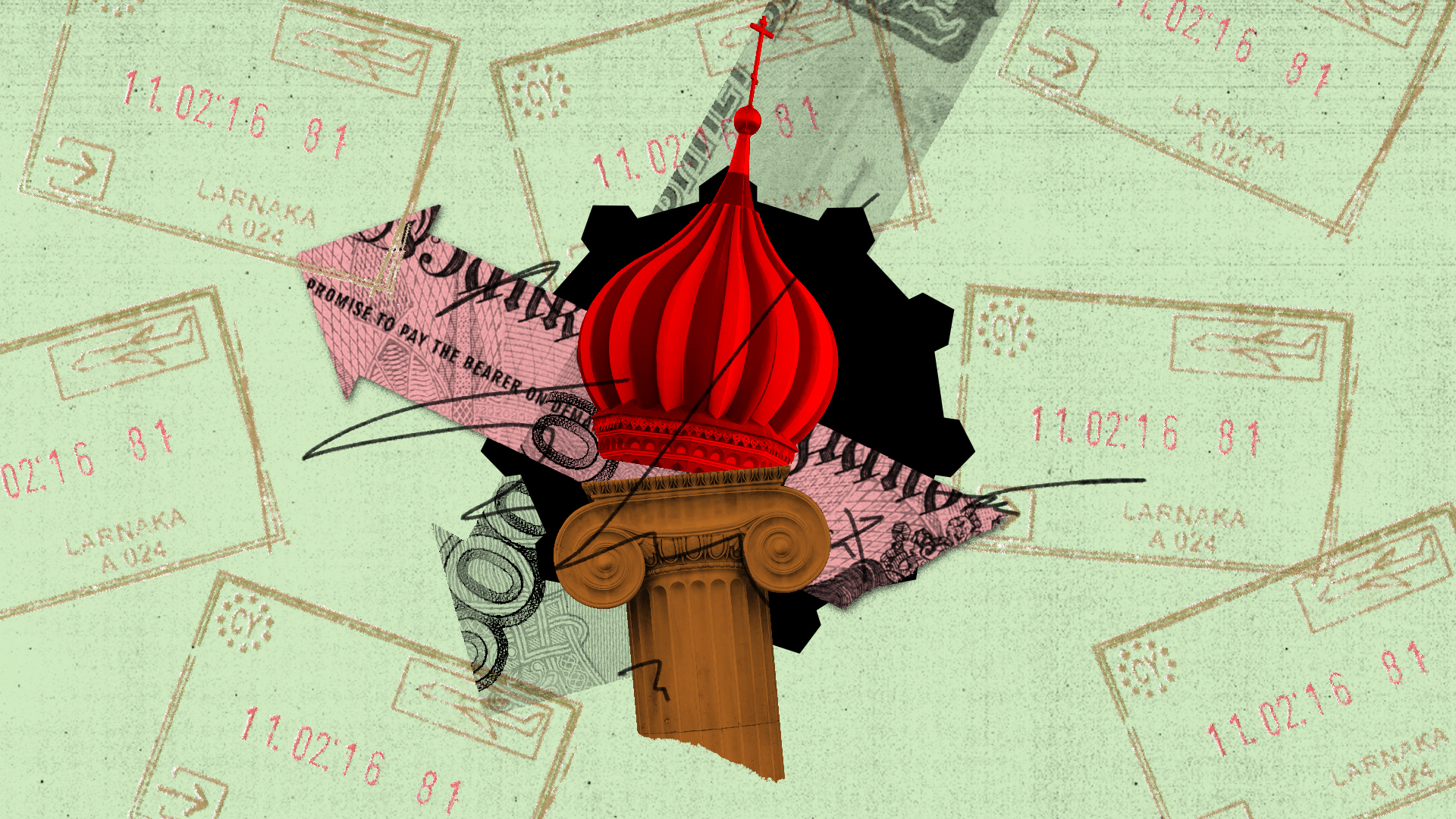

The Rise of Bitcoin: Analyzing the Impact of Russia's Crypto Adoption in Oil Trade

In the wake of significant geopolitical shifts, Bitcoin has seen a remarkable resurgence, recently trading at approximately $87,470. This surge is primarily attributed to Russia's strategic pivot towards cryptocurrencies in facilitating oil transactions, particularly with economic partners like China and India. As the country grapples with the implications of Western sanctions, the adoption of digital currencies has emerged as a crucial mechanism to sustain its $192 billion oil trade. Reports indicate that Russian oil firms are now moving around $10 million monthly through crypto intermediaries, effectively circumventing traditional banking channels that have become increasingly fraught due to sanctions.

The Mechanics of Crypto in Oil Trade

The shift towards cryptocurrency has enabled Russian oil companies to convert yuan and rupees into rubles without the need for conventional banking systems, which are now under heavy scrutiny and restricted by sanctions. This strategic maneuver not only enhances Russia's financial autonomy but also highlights a broader acceptance of cryptocurrencies as legitimate instruments in global trade.

Thomas Dwyer, an analyst at Market Securities, commented, "The utilization of cryptocurrencies for oil trade is a game changer. It allows Russia to maintain liquidity and freedom of action in the face of restrictive measures imposed by Western nations."

Market Implications

The implications for Bitcoin and the broader cryptocurrency market are profound. The BTCUSD H1 chart indicates a bullish trend, showing the cryptocurrency finding support at critical levels. Analysts suggest that while Bitcoin's price is currently constrained by the $87,470 resistance level, a breakout above this threshold could catalyze further upward momentum.

“If Bitcoin can break through that resistance level, we could see a flurry of buying activity that might push the price significantly higher,” remarked Jessica Wong, a cryptocurrency market strategist.

Future Projections

Looking ahead, analysts are optimistic about Bitcoin's trajectory. Projections place the cryptocurrency's price in a base case scenario between $100,000 and $150,000. More bullish forecasts even suggest a potential rise to $350,000, while an extreme black swan scenario could see prices soar to $500,000. These projections hinge on anticipated growth in institutional adoption and the integration of blockchain technology across various sectors.

The recent embrace of cryptocurrencies by corporations, alongside governmental efforts to incorporate digital assets into strategic reserves, further underscores this bullish sentiment. For example, the growing interest from U.S. states and pension plans in cryptocurrency aligns with the increasing institutional validation of Bitcoin as an asset class.

Conclusion

As Russia's adoption of cryptocurrencies in oil trade unfolds, investors should closely monitor these developments. The potential ramifications for Bitcoin and the broader cryptocurrency market could reshape the landscape of global finance. With the interplay of geopolitical dynamics and the increasing integration of digital currencies into traditional finance, the future of Bitcoin looks promising but remains riddled with uncertainties.

For investors, staying informed and vigilant as these trends evolve will be critical in navigating the rapidly changing cryptocurrency environment.

References: