The Rise of Catastrophe Bonds: A Strategic Shift in Fixed Income Investment

As climate-related disasters intensify globally, catastrophe bonds, or "cat bonds," are increasingly becoming a critical component of fixed income investment strategies. Designed to transfer the financial risk of natural disasters from issuers to investors, these bonds are gaining traction among institutional investors who are seeking innovative ways to manage their exposure to climate-related risks.

Market Growth and Integration of Climate Risk

In a landmark shift, catastrophe bonds now account for 32% of the California Earthquake Authority's reinsurance strategy. This statistic underscores a robust integration of climate risk into investment portfolios, reflecting an evolving recognition of the urgent need to address climate resilience in finance. The increased issuance of cat bonds signifies a growing acceptance and acknowledgment of the financial impacts that climate change can have on investments and the economy at large.

Yield Performance: Attractive Returns in a Low-Yield Environment

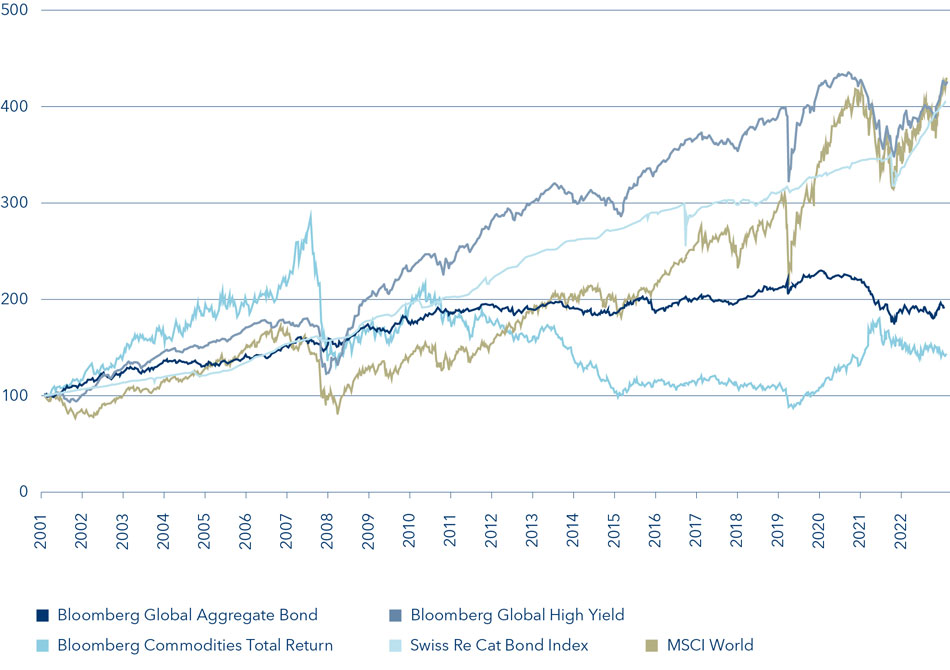

One of the appealing aspects of catastrophe bonds is their yield performance. Averaging around 6%, cat bonds offer competitive returns compared to traditional fixed income securities, particularly in a low-yield environment where investors are scrambling for profitable opportunities. This yield, coupled with the growing awareness of climate risks, positions catastrophe bonds as an attractive asset class for forward-thinking investors.

Investor Sentiment and ESG Integration

The increasing acceptance of catastrophe bonds is part of a broader trend towards incorporating environmental, social, and governance (ESG) factors into investment decisions. Investors are becoming more conscious of their portfolios' alignment with sustainable practices, and the appeal of cat bonds aligns well with this ethos. By investing in cat bonds, investors not only seek financial returns but also contribute to a climate-resilient future.

The Role of Catastrophe Bonds in Investment Strategy

The strategic shift towards catastrophe bonds reflects an essential recalibration within the fixed income landscape, driven by the need to manage climate risk effectively. Investors are recognizing that traditional approaches to risk assessment must evolve to account for the growing frequency and severity of natural disasters. By integrating cat bonds into their portfolios, investors can diversify their holdings while also addressing environmental concerns.

Conclusion: Navigating the Complexities of Climate Risk

As the landscape of fixed income investments continues to evolve, catastrophe bonds are poised to play a pivotal role in helping investors navigate the complexities of climate risk while pursuing competitive yields. Their growing popularity highlights the critical importance of adapting investment strategies to address emerging global challenges, particularly those related to climate change.

Investors and financial institutions must remain vigilant in their strategies, ensuring that they are equipped to handle the realities of a changing climate. The rise of catastrophe bonds is just one example of how innovative financial instruments can aid in building a more sustainable and resilient investment landscape.

For further insights and updates on catastrophe bonds, visit Artemis.