The Impact of Trump's Tariffs on Investor Sentiment and Market Dynamics

As the stock market grapples with uncertainty, President Trump’s impending tariff announcements scheduled for April 2 are creating a ripple effect across financial markets. Recent sell-offs—particularly in the automotive sector—have sparked significant concerns among investors, leading to a notable decline in major indices. The Dow Jones Industrial Average recently plunged over 700 points, underscoring heightened anxiety regarding the potential economic repercussions of these tariffs.

The Tariff Landscape

Market analysts and investors are closely monitoring the situation, as these tariffs could exacerbate existing tensions in global trade, further destabilizing investor sentiment. According to Lisa Shalett, Chief Investment Officer at Morgan Stanley, "The pace and sequencing of policy reform appear to have structurally impaired confidence, impeding growth forecasts." This sentiment highlights the critical relationship between government policy and market performance, suggesting that the ramifications of tariffs extend well beyond mere price adjustments.

Historical trends indicate that tariffs can lead to increased production costs and decreased demand, particularly in industries reliant on imported materials. For instance, the automotive sector could face significant production hurdles as companies may struggle to absorb the added costs associated with these tariffs. Such challenges may result in reduced consumer choice and elevated prices, compounding existing economic pressures.

Investor Confidence in Jeopardy

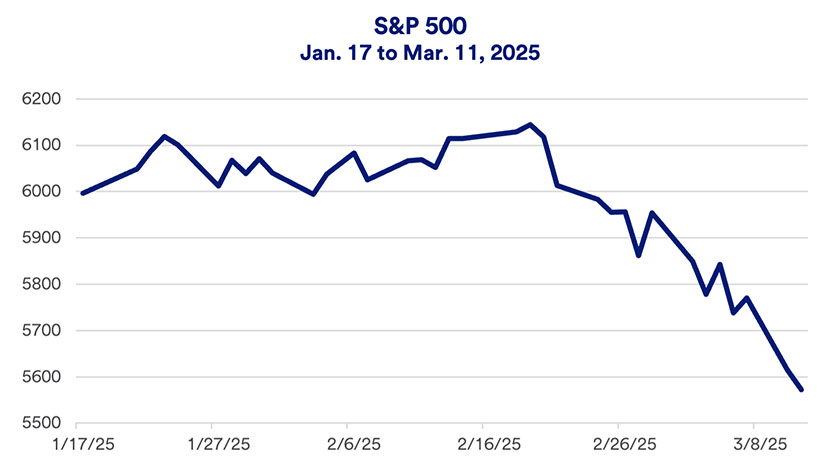

The psychological effects of the stock market's downturn are particularly pronounced on affluent consumers, who often view their investments as a direct reflection of their economic stability. According to a recent report, the sharp decline in the stock market coincides with softening consumer sentiment data, raising alarms about potential declines in consumer spending. As noted by economists, "Affluent consumers in the US are likely to be reducing spending at least partially because of the substantial stock market drop, which has historically impacted perceptions of net worth and negatively affected consumer spending."

The current environment poses significant risks for both consumer behavior and broader economic growth. If investors and consumers perceive the stock market downturn as a long-term trend rather than a temporary fluctuation, the resulting decrease in consumer confidence may lead to reduced spending, which could trigger a broader economic downturn. Therefore, strategic portfolio adjustments may be necessary for investors looking to navigate this turbulent landscape effectively.

Market Volatility and Strategic Adjustments

As the tariffs loom, investors are urged to reassess their strategies, particularly in light of the current market volatility. Analysts recommend diversifying portfolios into sectors less susceptible to tariff impacts, such as utilities and consumer staples, which tend to demonstrate resilience during economic downturns. This approach can help mitigate risks associated with the uncertainty created by new tariffs and their potential fallout on the economy.

Furthermore, it is essential for investors to remain vigilant and informed about market dynamics as they unfold. Monitoring not only tariff developments but also consumer sentiment indicators will be critical in anticipating market movements. The relationship between policy changes and market performance has never been more evident, and investors must adapt accordingly.

Conclusion

The impending tariffs present both challenges and opportunities for investors. Understanding the nuances of how these policies affect market dynamics will be crucial in making informed investment decisions in the coming weeks. As economic indicators evolve and the reaction of consumers becomes clearer, investors will need to remain agile, ready to adjust their strategies in response to the realities of a rapidly changing market environment.

As history has shown, the intersection of government policy, market performance, and consumer sentiment is complex and unpredictable. Investors must strive to stay ahead of these changes to safeguard their portfolios and capitalize on potential opportunities amid the turbulence.

For further insights and analysis on the impact of Trump’s tariffs, visit sources such as Business Insider and Forbes.