Assessing the Impact of Trump's Tariff Policies on Global Markets

Introduction

The announcement of President Donald Trump's tariffs has sent ripples of uncertainty through global markets, most notably within the automotive sector. As the prospect of a 25% tariff on imported vehicles looms, investors brace for potential fallout that could reshape market dynamics. Understanding how these tariffs affect various sectors is essential for making informed investment decisions as the landscape becomes increasingly volatile.

Market Reactions

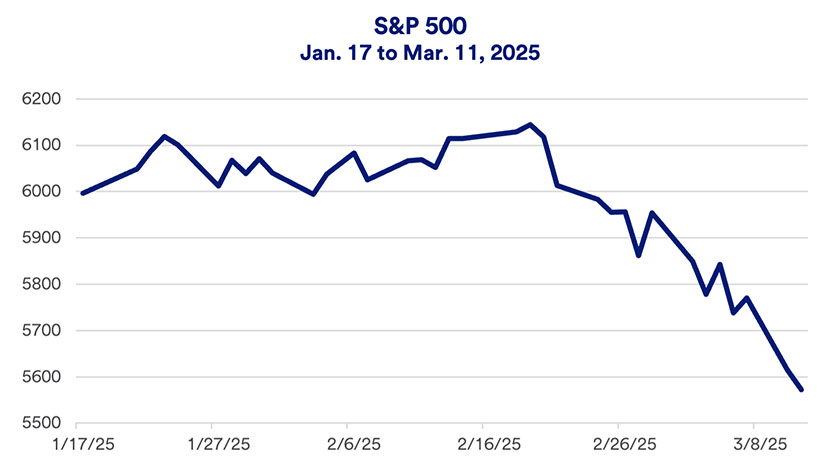

The stock market has experienced heightened volatility in the wake of the tariff announcement. The Dow Jones Industrial Average saw significant fluctuations, dropping over 200 points on March 31, 2025, a day marked by apprehension surrounding Trump's "Liberation Day." This proposed day signifies the formal rollout of the tariffs, leading to increased anxiety among investors.

Analysts predict that the impending tariffs could elevate production costs for automakers, thereby squeezing profit margins. Major players in the industry, including Ford Motor Company (F) and General Motors (GM), face the brunt of these tariffs, which could lead to higher vehicle prices and a subsequent decline in consumer demand. The overall impact on investor sentiment suggests a cautious approach, particularly in sectors heavily reliant on international supply chains.

Sector Analysis

1. Automotive Industry

The automotive sector stands at the frontline of Trump's tariff policies. Major automakers have begun to express concern regarding the potential repercussions. "If production costs increase due to tariffs, we may have to pass those costs onto consumers, which could dampen sales," stated a senior executive at a major automotive manufacturer.

The proposed tariffs aim primarily at vehicles imported from countries such as Germany and Japan, which could destabilize the competitive landscape. For instance, if Ford and GM raise prices to offset the tariffs, they may lose market share to competitors producing vehicles domestically or in countries not affected by these tariffs.

2. Consumer Goods

The ramifications of these tariffs are not limited to the automotive sector. Companies in the consumer goods space are likely to feel the ripple effects as well. Products manufactured abroad may see prices increase, which could adversely impact consumer spending. The National Retail Federation has raised alarms about potential price hikes, suggesting that consumers might scale back their expenditures amid rising costs.

3. Technology Sector

Despite appearing somewhat insulated from immediate tariff impacts, the technology sector faces its own set of challenges. Many tech companies rely on components manufactured overseas, making them vulnerable to supply chain disruptions. A report from Gartner indicated that a 25% tariff could lead to an average 15% increase in costs for consumer electronics, potentially stifling innovation and delaying product launches.

Strategic Recommendations

In light of the turbulence created by Trump's tariff policies, investors should consider the following strategies to navigate the uncertain waters:

-

Diversification: Investors should aim to spread their portfolios across sectors less impacted by tariffs, such as renewable energy and domestically focused industries. This strategy can help mitigate losses in sectors that may be more sensitive to tariff changes.

-

Quality Stocks: Focusing on companies with robust balance sheets and strong competitive advantages will be crucial. Firms that can withstand economic pressures, such as Procter & Gamble (PG) or Johnson & Johnson (JNJ), may offer more stability.

-

Hedging Strategies: Utilizing options to hedge against potential downturns in affected sectors can provide an extra layer of protection. Strategies such as buying put options or investing in inverse exchange-traded funds (ETFs) can be effective for risk management.

Conclusion

As the situation evolves, remaining informed and agile will be vital for investors navigating the turbulent landscapes of global markets. Trump's tariffs will have profound implications across multiple sectors, particularly the automotive and consumer goods industries. By understanding these potential impacts and employing strategic investment practices, investors can better position themselves to weather the storm of market volatility that lies ahead.

In summary, the landscape of global markets is shifting as tariff policies take effect. Investors are advised to remain proactive, diversifying their investments and focusing on quality assets to navigate these uncertain times effectively.