Catastrophe Bonds: A Strategic Asset Class Amid Market Volatility

As the financial world grapples with rising interest rates and economic uncertainty, catastrophe bonds (cat bonds) have emerged as an attractive investment avenue. In March 2025, the overall yield of the catastrophe bond market stabilized at 10.43%, a figure that has caught the attention of investors looking for refuge from the volatility of traditional fixed income assets. This yield underscores not only the resilience of this niche market but also the compelling risk-reward profile that catastrophe bonds offer in an unpredictable economic climate.

Market Dynamics

The catastrophe bond market has demonstrated robust activity, with $7.1 billion in issuances recorded in the first quarter of 2025. This influx reflects a strong appetite among investors, driven partly by seasonal demand and a favorable risk-return dynamic. According to data from Plenum Investments, the underlying yield structure comprises a 6.13% insurance risk spread and a 4.30% collateral yield, making it an appealing alternative to traditional bond instruments.

The cat bond market's yield stability, particularly amidst the pressures of seasonal demand, highlights its resilience. Plenum Investments noted that the yield has maintained a consistent trajectory, with the dynamics of demand and supply effectively counterbalancing each other. This is significant as investors often seek assets that can offer predictable returns in turbulent times.

Strategic Considerations for Investors

Investors contemplating the addition of catastrophe bonds to their portfolios should weigh the following strategic considerations:

-

Yield Comparison: With a total return forecast of approximately 8.5% for 2025, cat bonds provide a competitive yield, especially appealing in environments characterized by rising interest rates. This forecast positions them favorably against traditional fixed income securities that have struggled to maintain performance.

-

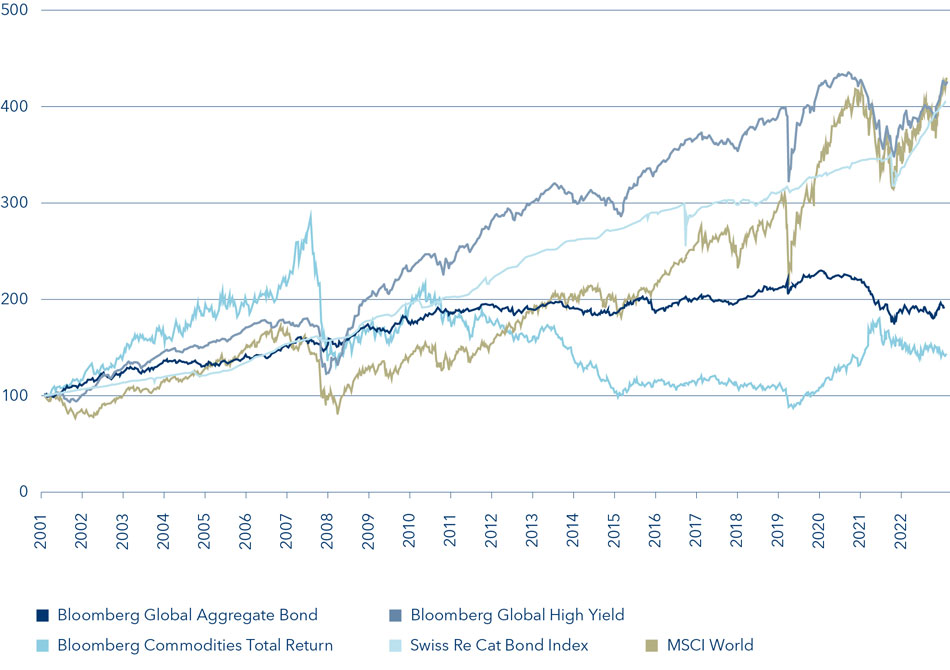

Risk Management: These bonds are less correlated with conventional economic cycles, making them a viable hedge against broader market risks. The unique nature of cat bonds—paying out upon the occurrence of specific natural disasters—means their performance can be insulated from the day-to-day fluctuations of equities and other fixed income assets.

-

Long-term Viability: Given the increasing frequency of climate-related events, demand for insurance-linked securities is anticipated to grow. This burgeoning need makes catastrophe bonds a potentially lucrative long-term investment, aligning well with the growing emphasis on sustainable and responsible investing.

The Role of Catastrophe Bonds in a Diversified Portfolio

Incorporating catastrophe bonds into an investment portfolio can enhance diversification. They provide a unique asset class that can yield higher returns while mitigating risks associated with traditional investments. This characteristic is particularly vital as traditional fixed income assets face headwinds from rising rates and inflationary pressures.

Moreover, the increasing awareness and impact of climate change heighten the strategic relevance of catastrophe bonds. As global temperatures rise and natural disasters become more frequent, the risks associated with not investing in such securities may outweigh the perceived risks involved in the investment itself.

Conclusion

In conclusion, amid the complexities of the current fixed income landscape, catastrophe bonds present a strategic opportunity for investors. Their attractive yields, coupled with the potential for capital appreciation and risk mitigation, make them a compelling option for those looking to enhance their fixed income allocations in 2025 and beyond. Investors should remain vigilant about prevailing market trends and the broader implications of climate change on the performance of these unique securities.

As investors seek to navigate the challenges posed by rising interest rates and economic uncertainty, catastrophe bonds represent not just a refuge but a forward-thinking investment strategy that aligns with both financial and societal imperatives.

References

- Plenum Investments. "Cat bond market yield stable at 10.43%." Artemis

- Lane Financial LLC. Forecasts for catastrophe bonds in 2025.