Navigating Forex Volatility: The Impact of Tariff Announcements on Currency Markets

The foreign exchange (forex) market is experiencing notable turbulence following the recent announcement of a 25% tariff on imported vehicles by the Trump administration. This decision, made on April 1, 2025, has reverberated throughout currency markets, particularly affecting the Canadian Dollar (CAD) and the Mexican Peso (MXN), both of which have reported declines of approximately 2% against the U.S. Dollar (USD). As investors absorb the ramifications of these tariffs, a risk-off sentiment has emerged, leading traders to recalibrate their strategies in a rapidly shifting landscape.

Market Reactions and Currency Movements

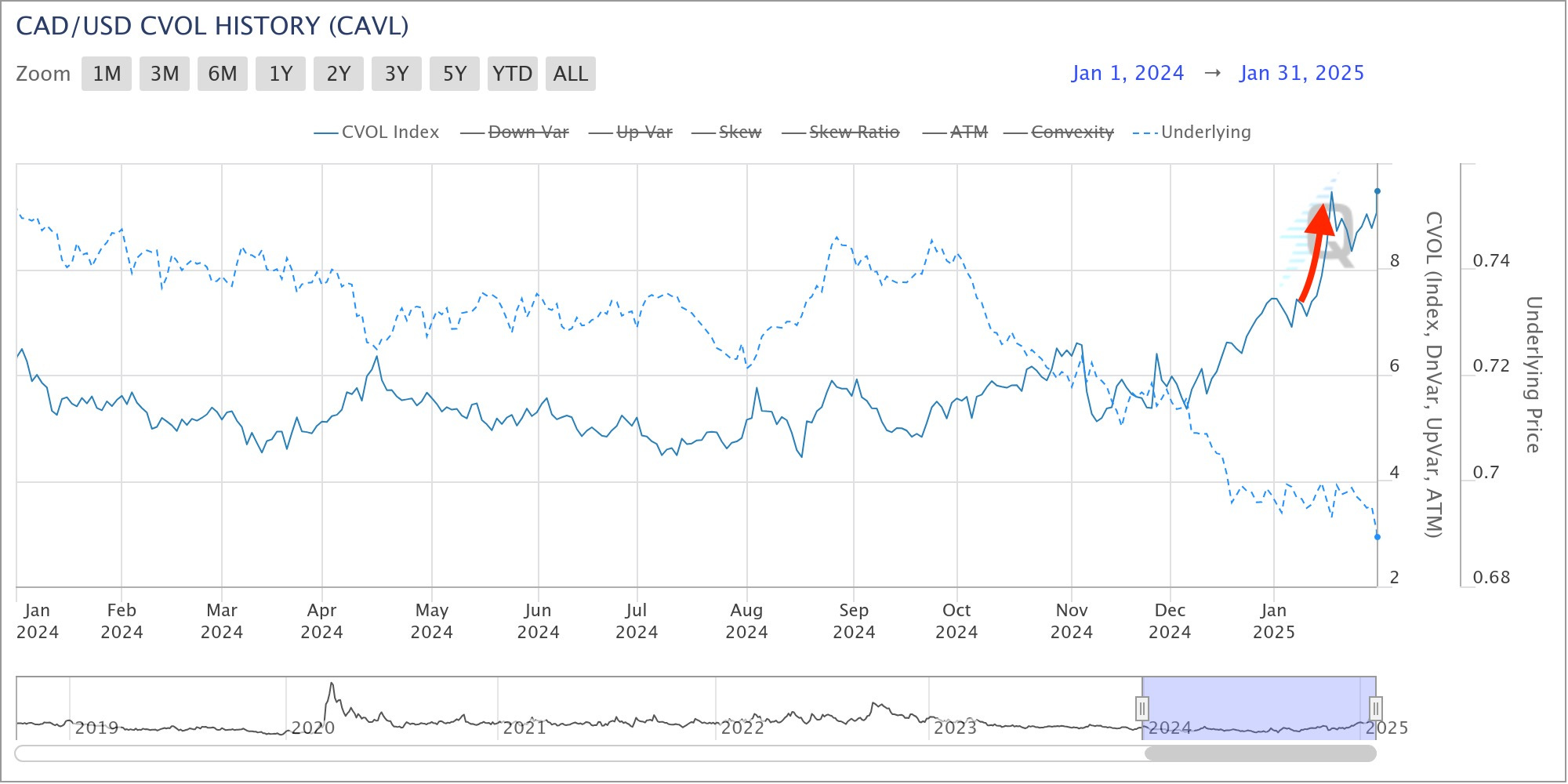

In the aftermath of the tariff announcement, the USD has demonstrated a marked increase in strength. Analysts attribute this shift to a flight to safety from investors who are increasingly wary of the potential economic fallout. The CAD and MXN, which are intrinsically linked to U.S. trade dynamics, have been particularly vulnerable. As the tariffs threaten to escalate trade tensions, market participants are left to reconsider their positions.

The Australian Dollar (AUD) has exhibited sideways trading behavior as traders have largely refrained from making significant bets until further clarity on the tariff situation emerges. This cautious approach reflects a broader sentiment of uncertainty, with many forex participants awaiting additional economic indicators and geopolitical updates before committing to substantial trades.

Strategic Recommendations for Traders

In this environment of heightened volatility, traders are advised to adopt diversified strategies to mitigate risks. Implementing technical analysis will be crucial for identifying key support and resistance levels, allowing traders to navigate the turbulent waters of currency fluctuations. For instance, a close eye on the USD/CAD and USD/MXN pairings can provide actionable insights into potential breakout points or reversals.

Experts recommend that traders remain vigilant in monitoring economic indicators, such as U.S. unemployment rates and consumer confidence indices, as these can significantly influence currency movements. Additionally, geopolitical developments—especially those related to trade negotiations—are critical to keep on the radar, as they can provoke rapid changes in market sentiment.

Furthermore, maintaining flexibility in trading strategies is paramount. The forex market is notorious for its rapid shifts; thus, being equipped to adapt to new information or unexpected news is essential.

Conclusion

As the economic landscape continues to evolve in the face of new tariff policies, it is imperative for forex traders to remain informed and adaptable. Understanding how tariffs impact currency values will be key to navigating this volatile environment effectively. Continuous monitoring of relevant economic indicators and geopolitical events will enhance decision-making and trading performance.

For more insights and real-time updates, traders are encouraged to consult reputable financial news sources such as ForexLive and FX Street for timely information and analysis.

In summary, the forex market’s reaction to the recent tariff announcements underscores the interconnected nature of global economies and the profound impact that policy changes can have on currency values. As traders navigate this landscape, employing a strategic approach while remaining alert to market dynamics will be essential for long-term success.