Catastrophe Bonds: A Strategic Asset Class Amid Market Volatility

In a financial landscape marked by rising yields and increasing economic uncertainty, catastrophe bonds (cat bonds) have emerged as a compelling investment opportunity. With an overall yield stabilizing at 10.43% as of March 2025, cat bonds present a unique option for investors seeking diversification and higher returns, particularly when conventional fixed-income securities yield less appealing returns.

Market Dynamics

The catastrophe bond market has demonstrated notable resilience despite fluctuations in broader financial markets. With an average insurance risk spread of 6.13% and a 4.30% collateral yield, this asset class offers attractive yields compared to more traditional investment vehicles. According to Plenum Investments, the stability of the yield reflects a balance between strong market demand and the effects of seasonal pricing dynamics.

As institutional investors increasingly recognize the benefits of this asset class, cat bonds have attracted significant interest. The market's ability to provide risk mitigation while maintaining historically attractive yield levels has made it a favorite among those looking to navigate the complexities of today’s investment environment.

Strategic Considerations for Investors

Investors interested in the catastrophe bond market should consider several strategic approaches:

-

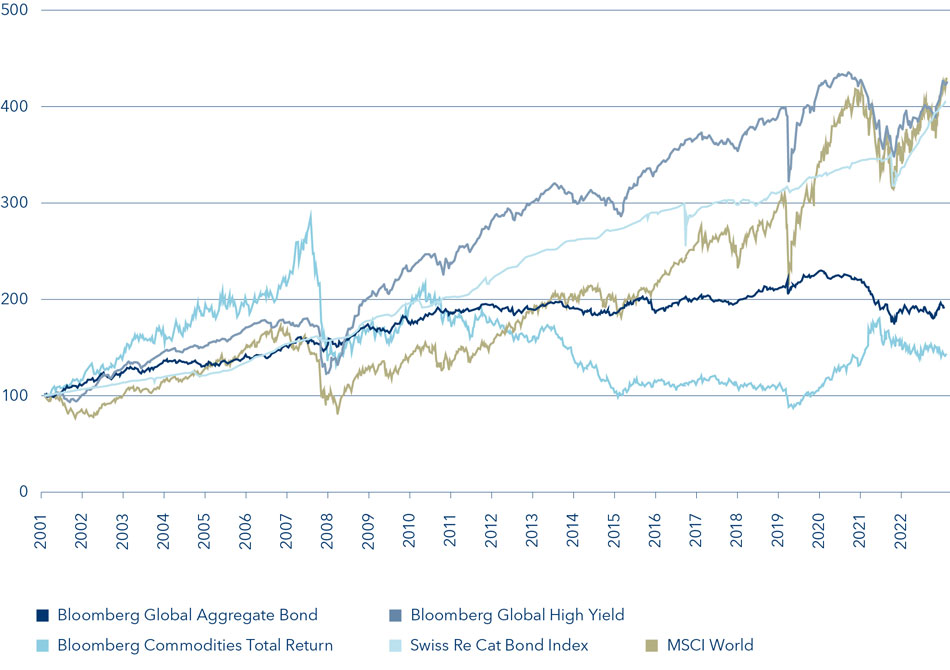

Diversification: Cat bonds are less correlated with equity markets, making them an effective hedge against traditional market volatility. With global markets facing uncertainty, particularly in response to geopolitical events and economic factors, including recent tariff announcements by the U.S. government, cat bonds offer a form of protection against broader market downturns.

-

Focus on Sustainability: Many issuers are now incorporating sustainability measures into their bond structures. This alignment with environmental considerations appeals to socially responsible investors, reflecting a broader trend toward sustainable investing. Ocean Ledger, for example, is working to integrate technology and risk modeling tools into its offerings, providing targeted catastrophe bonds that address specific risks while supporting resilience efforts.

-

Long-Term Risk Transfer: The increasing frequency of climate-related events has emphasized the need for innovative risk-transfer mechanisms. Cat bonds not only facilitate financial protection against natural disasters but also support initiatives aimed at enhancing the resilience of vulnerable regions, which is particularly relevant given the growing threat of coastal erosion and other environmental risks.

Conclusion

As the fixed income landscape evolves, catastrophe bonds stand out as a viable option for investors seeking yield in an increasingly low-return environment. Their unique characteristics, combined with a growing demand for supportive financing mechanisms in light of climate change, position them as a strategic asset class worthy of consideration in diversified investment portfolios.

Investors looking to capitalize on this trend should stay informed about market dynamics and consider incorporating cat bonds into their long-term strategies. As highlighted by Plenum Investments, while the market yield may not exhibit a clear upward direction, the fundamental benefits of catastrophe bonds continue to make them an attractive proposition in today's uncertain financial climate.

For further insights, investors may refer to the latest developments in the catastrophe bond market through resources like Ocean Ledger and the stability reports from Plenum Investments.