The Rise of Sustainability Bond Ratings: Enhancing Transparency in ESG Debt Markets

As the sustainable finance market continues its rapid ascent, investors are increasingly confronted with the pitfalls of greenwashing and inconsistent disclosures. Institutional Shareholder Services (ISS), a prominent player in ESG analytics, has taken a bold step to address these challenges by launching its Sustainability Bond Ratings. This innovative rating system promises to enhance transparency and bolster investor confidence in the burgeoning realm of environmental, social, and governance (ESG) debt.

Introduction

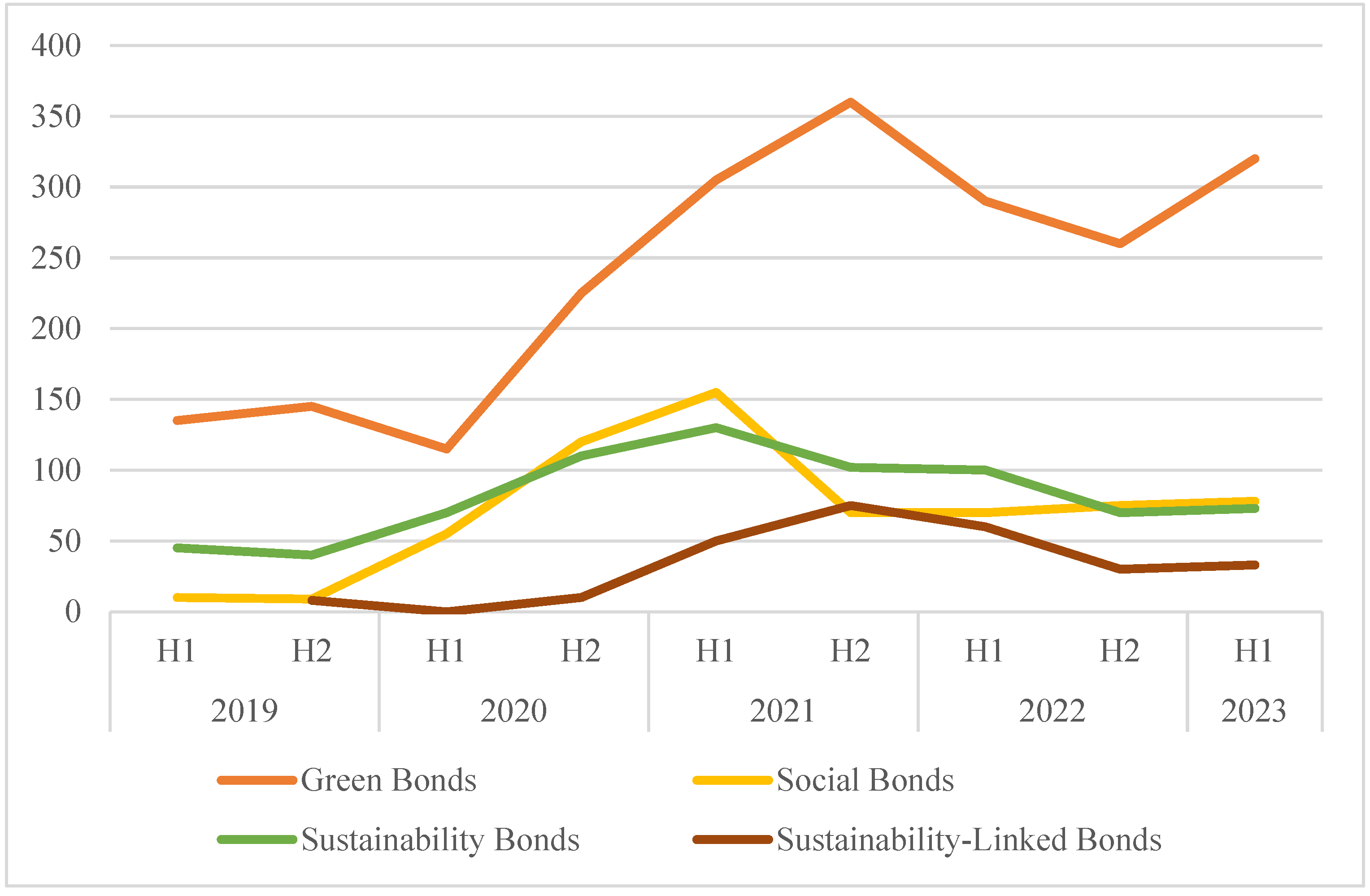

The sustainable finance market has experienced explosive growth over the past decade, with green, social, and sustainability-linked bonds (collectively referred to as GSS+ bonds) becoming mainstream instruments for financing environmental and social initiatives. According to recent data, the global issuance of green bonds alone reached approximately $500 billion in 2024, reflecting a significant uptick from previous years. This surge in popularity, however, has been accompanied by heightened scrutiny regarding the validity and reliability of these financial products, primarily due to instances of greenwashing—where securities are marketed as environmentally friendly without adequate substantiation.

ISS Sustainability Bond Ratings

In light of these concerns, ISS has introduced its Sustainability Bond Ratings, a new methodology designed to provide independent evaluations of ESG-related bonds. This initiative aims to enhance transparency, comparability, and investor trust within the ESG debt market, thereby addressing the credibility gaps that have undermined the sector's growth.

"The launch of our Sustainability Bond Ratings is a crucial step in fostering a more sustainable investment landscape," stated John M. Williams, CEO of ISS. "As institutional investors face mounting pressure to demonstrate their commitment to ESG principles, our ratings will serve as a vital tool for informed decision-making."

Key Features of the Ratings

While ISS is not the first to assess sustainable bonds, its approach introduces several distinctive features aimed at addressing existing market challenges:

-

Enhanced Transparency: The ratings will focus on issuers with robust ESG practices and transparent frameworks. This transparency is expected to improve demand and pricing for their bonds, as investors increasingly seek credible projects aligned with their values.

-

Warning Signals: Low ratings may serve as a warning signal for investors, encouraging governance or strategic reforms among issuers. Such a mechanism could promote accountability and drive improvements in ESG practices across the board.

Impact on Investors

The introduction of ISS’s Sustainability Bond Ratings is timely, coinciding with a period of heightened interest in ESG investing. Institutional investors are under increasing pressure to integrate ESG factors into their investment processes. A report by BlackRock revealed that over 80% of institutional investors believe ESG considerations will become a crucial part of their investment strategies within the next five years.

As a result, ISS’s Sustainability Bond Ratings may become essential in due diligence processes, particularly for sovereign bonds, emerging market issuers, and complex sustainability-linked bonds (SLBs). Investors will likely leverage these ratings to gauge the credibility of potential investments and assess their alignment with sustainability goals. This trend signals a shift towards more rigorous scrutiny of ESG-related investments, encouraging issuers to adopt more transparent practices.

Market Context

The rise of sustainability bond ratings also occurs against the backdrop of changing market dynamics. A growing number of governments and corporations are committing to net-zero emissions targets, fueling demand for green financing solutions. In 2025, the European Union is expected to increase its sustainable finance initiatives, which include stricter regulations and enhanced disclosure requirements for ESG investments.

Moreover, a report from Morningstar indicated that ESG assets under management reached a record $35 trillion in early 2025, showcasing the robust appetite for sustainable investing. This environment underscores the necessity for reliable rating systems that can enhance investor confidence and prevent greenwashing.

Conclusion

As the market for ESG-related bonds continues to evolve, the introduction of ISS’s Sustainability Bond Ratings represents a pivotal moment in enhancing transparency and accountability in the sustainable finance landscape. By providing independent evaluations and fostering trust, these ratings will empower investors to make informed decisions while encouraging issuers to adhere to higher ESG standards.

In an era where sustainable finance is not just a trend but a critical component of global investment strategies, the role of rigorous rating systems cannot be overstated. As institutional investors navigate the complexities of ESG integration, tools such as the ISS Sustainability Bond Ratings will be indispensable in driving the sustainable finance market towards a more credible and transparent future.

As the financial landscape shifts towards sustainability, the demand for reliable ratings and transparency will only grow. By addressing the barriers to trust, the ISS Sustainability Bond Ratings may well set a new benchmark for the ESG debt market, ultimately leading to a more sustainable future for investors and the planet alike.