Navigating the UK Natural Gas Market: Trends and Forecasts

The UK natural gas market is currently navigating a landscape marked by fluctuating prices and external pressures, reflecting the complex interplay between demand, supply, and geopolitical factors. As of early April 2025, the benchmark price for UK natural gas has risen to approximately £2.50 per therm, indicating a 5% increase over the past week. This uptick can largely be attributed to seasonal demand spikes and ongoing geopolitical tensions affecting energy supplies across Europe.

Supply and Demand Dynamics

Natural gas demand in the UK tends to peak during the colder months, where it is primarily utilized for residential heating and electricity generation. Recent reports indicate that gas consumption has surged by 15% compared to the previous month, driven by an unusually cold spell affecting much of Europe. In tandem, supply constraints have emerged due to maintenance activities at key production facilities, exacerbating the existing demand pressures and consequently leading to higher prices.

This dynamic is a classic case of supply and demand reacting to short-term changes, a situation that market analysts have been watching closely. The interplay of these factors is critical in understanding the current and future state of the market.

Geopolitical Influences

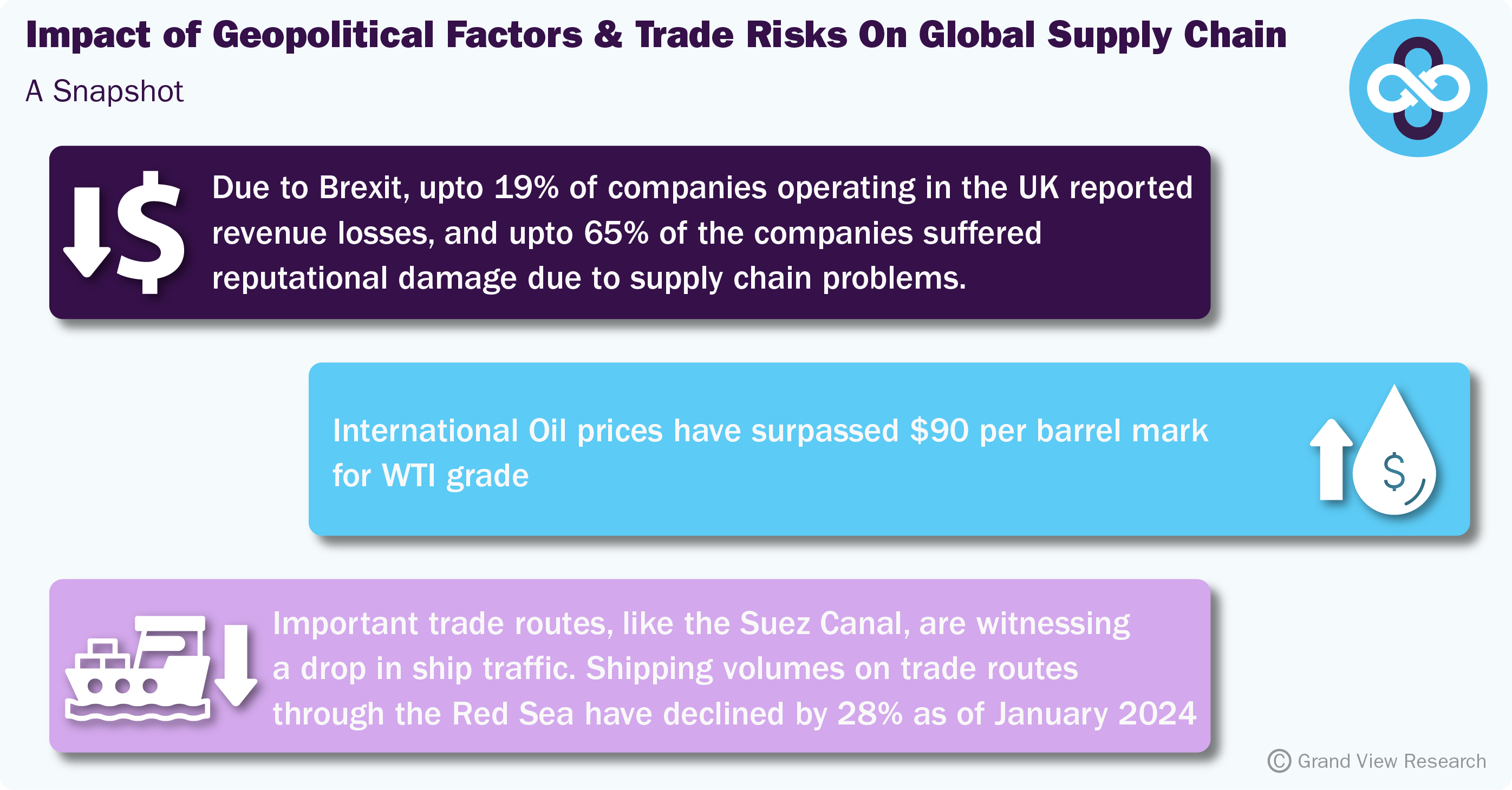

Geopolitical factors continue to loom large over the UK natural gas market, particularly with ongoing conflicts involving major gas suppliers. The situation in Eastern Europe has raised serious concerns regarding the reliability of gas supplies, compelling traders and investors to adopt a cautious approach.

As tensions escalate, there is a tangible risk that prices could experience significant volatility. Analysts stress that any further degradation in geopolitical stability could lead to disruptions in supply chains, thus compounding the existing challenges in the market.

Future Forecasts

Looking ahead, industry experts suggest that natural gas prices may stabilize as supply issues are resolved and demand normalizes in the post-winter period. However, the potential for renewed geopolitical tensions remains a significant risk factor that could affect market stability. Forecasts indicate that prices could range between £2.30 to £2.70 per therm over the next quarter, contingent upon weather patterns and international relations.

This outlook implies a moderately optimistic scenario for consumers, but with an undercurrent of caution driven by geopolitical uncertainties. Investors must stay alert to these dynamics as they develop.

Trading Strategies

For investors looking to navigate this complex market, several strategies can be employed to mitigate risks associated with price volatility. One effective approach is to monitor market trends closely and consider utilizing contracts for difference (CFDs) to hedge against potential fluctuations in prices.

Additionally, diversifying investment portfolios to include energy-related assets may provide a buffer against the inherent volatility of the natural gas market. This approach can not only offer protection but also capitalize on emerging opportunities as market conditions evolve.

Conclusion

The UK natural gas market is currently navigating a complex landscape influenced by seasonal demand spikes, supply constraints, and geopolitical factors. As prices continue to fluctuate, investors must remain vigilant and adaptable, looking to capitalize on emerging opportunities while managing their risks effectively. The interplay of these various factors will undoubtedly shape the future of the market, and those who stay informed will be best positioned to respond to its challenges and opportunities.

For further real-time updates and market data, stakeholders are encouraged to consult resources such as Trading Economics and Bloomberg Energy, which provide valuable insights into commodity prices and market dynamics.