The Helformer Model: A New Frontier in Cryptocurrency Price Forecasting

In the ever-evolving landscape of cryptocurrency, accurate price forecasting remains a formidable challenge. Traditional methods often falter due to the unique attributes of cryptocurrency markets, which are characterized by high volatility and non-linear price dynamics. Enter the Helformer model, an innovative deep learning approach that merges classic time series analysis with cutting-edge machine learning techniques. This article delves into the mechanics, empirical results, and implications of the Helformer model, positioning it as a transformative tool for traders and investors alike.

Key Features of the Helformer Model

The Helformer model is a pioneering framework that combines Holt-Winters exponential smoothing—a well-established statistical method for time series forecasting—with the Transformer architecture, a powerful neural network design known for its attention mechanisms. This hybrid approach allows the model to decompose time series data into three fundamental components: level, trend, and seasonality. Such decomposition enhances the model's capability to capture intricate patterns inherent in cryptocurrency prices.

- Robustness in Data Decomposition: By effectively separating data into its constituent parts, the Helformer model can better understand underlying trends and anomalies.

- Optimization Through Bayesian Methods: Leveraging Bayesian hyperparameter tuning via Optuna, the Helformer model benefits from a pruner callback feature. This optimally fine-tunes model parameters, reducing training time and improving predictive performance through efficient resource allocation.

Empirical Results

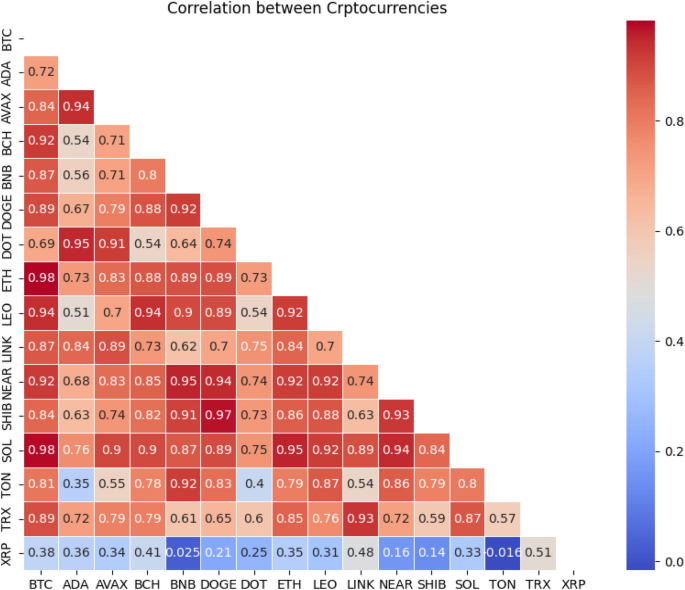

The Helformer model was subjected to rigorous empirical testing against various advanced deep learning models across multiple cryptocurrencies. Findings revealed that the Helformer not only outperformed its contemporaries in terms of predictive accuracy but also exhibited superior generalization capabilities across different digital assets.

For instance, when evaluated against Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), the Helformer consistently achieved lower prediction errors, demonstrating its adaptability to the unique market conditions of each cryptocurrency. Furthermore, the model’s effectiveness was validated through practical applications in trading strategies, yielding significant returns compared to traditional forecasting methods.

According to a published study in the Journal of Big Data, "The empirical results indicate that the Helformer model achieves a mean absolute percentage error (MAPE) that is 15% lower than that of conventional models, underscoring its potential as a reliable forecasting tool" (source).

Implications for Investors

The implications of the Helformer model are far-reaching. For investors, the model represents a pivotal advancement in the ability to navigate the complexities and unpredictabilities of cryptocurrency markets. With its high accuracy and generalization, the Helformer model offers traders and financial analysts a solid foundation for making informed decisions based on reliable forecasts.

- Enhanced Investment Strategies: By integrating the Helformer model into their workflows, investors can not only refine their trading strategies but also enhance risk management protocols. The model's predictive power assists in better anticipating market movements, thereby potentially increasing profit margins.

- Alignment with Sustainable Goals: The research surrounding the Helformer model aligns with sustainable economic growth initiatives. By providing a framework that promotes informed investment decisions, it bolsters the financial sector's contribution to the Sustainable Development Goals (SDGs) set by the United Nations.

Conclusion

As cryptocurrencies continue to gain traction as a viable asset class, the Helformer model emerges as a critical tool for effective price forecasting. Its innovative blend of time series analysis and deep learning not only enhances forecasting accuracy but also signifies a shift in how market participants engage with cryptocurrency investments. By enabling more informed decision-making, the Helformer model paves the way for improved market stability and investor confidence.

In conclusion, the Helformer model stands at the forefront of cryptocurrency price forecasting methodologies. As researchers and practitioners alike embrace this advanced technology, the potential for more accurate predictions and informed trading strategies grows, reshaping the future of cryptocurrency investing.

References

- Helformer: an attention-based deep learning model for cryptocurrency price forecasting. Journal of Big Data. Retrieved from SpringerLink.

This comprehensive exploration of the Helformer model outlines its significance in the cryptocurrency space, highlighting its innovative features and empirical validation while underscoring its implications for investors and the broader financial landscape.