The Resurgence of Catastrophe Bonds: A Strategic Asset Class for Fixed Income Investors

In the evolving landscape of fixed-income investments, catastrophe bonds (cat bonds) are emerging as a unique and compelling asset class, particularly amid increasing market volatility. These securities, which transfer the risk of natural disasters from insurers to investors, are gaining attention for their attractive yields and diversification potential. As traditional bond markets face challenges in generating competitive returns, catastrophe bonds present a valuable alternative for investors seeking higher yields and lower correlation to conventional market fluctuations.

Market Dynamics

As of early April 2025, catastrophe bonds are yielding approximately 10.5%, a figure that includes both the insurance risk premium and the yield generated by the collateral invested. This yield is notably attractive, especially in a low-interest-rate environment where traditional fixed-income securities, such as U.S. Treasury bonds, have struggled to provide competitive returns. According to data from Plenum Investments, the current yield reflects not only the premium for risk but also the increased collateral yields that have risen in line with interest rates since 2022.

Characteristics of Catastrophe Bonds

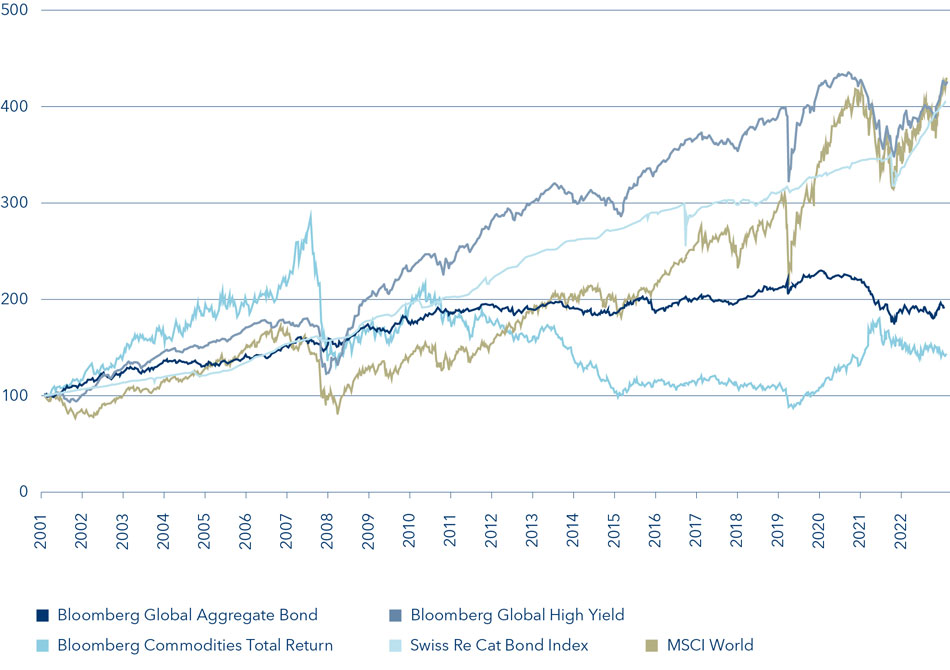

Catastrophe bonds are typically issued by insurance companies and reinsurers to offload the financial risks associated with major disasters like hurricanes, earthquakes, and wildfires. One of the defining features of cat bonds is their low correlation with broader economic cycles. Unlike traditional bonds, which can be heavily affected by economic downturns, cat bonds remain largely insulated from such risk. According to Bryan Armour, director of passive strategies research at Morningstar, "cat bonds as an asset class are somewhat compelling because you get something similar to high-yield bonds but with uncorrelated risks to other bonds."

This unique structural characteristic makes cat bonds an appealing option for investors looking to hedge against market downturns and enhance yield in their portfolios.

Performance and Investor Sentiment

Historically, liquidity in the catastrophe bond market has been a concern, as these securities were primarily traded over-the-counter and often held to maturity by their owners. However, the recent launch of the Brookmont Catastrophic Bond ETF (ILS) has significantly improved liquidity options for investors. The ETF allows for easier access to this asset class and is expected to enhance cash creations and redemptions, which will further bolster the liquidity profile of catastrophe bonds.

According to Ethan Powell, chief investment officer at Brookmont Capital Management, "We anticipate doing largely cash creations and redemptions, but it's possible that we will do in-kind during stressed market situations." This development may mark a turning point for the cat bond market, making it more accessible and appealing to a broader range of investors.

Strategic Considerations

Incorporating catastrophe bonds into fixed-income portfolios can enhance yield and provide diversification benefits. The high yields available in this segment, combined with their low correlation to traditional bonds, position cat bonds as a vital component for investors navigating today's complex market environment.

Given the current economic uncertainty and shifting investor sentiment, the appeal of catastrophe bonds is likely to grow. Investors are encouraged to consider these securities as part of a broader fixed-income strategy. The potential for double-digit yields, coupled with the low likelihood of correlation with other asset classes, makes cat bonds a strategic choice in an uncertain market.

Conclusion

In conclusion, catastrophe bonds represent a unique opportunity for fixed-income investors seeking to enhance their yield and diversify their portfolios amid ongoing market volatility. As the financial landscape continues to evolve, these securities are positioned to play an increasingly important role in fixed-income investment strategies. The combination of attractive yields, improved liquidity through innovative products like the Brookmont ETF, and low correlation to traditional investments makes cat bonds a compelling choice for today’s discerning investors.

Keywords

- Catastrophe bonds

- Fixed income

- Investment strategy

- Yield

- Diversification

- Market volatility

- Brookmont ETF

References

As investors increasingly seek new sources of income and innovative strategies to adapt to changing market dynamics, the resurgence of catastrophe bonds as a strategic asset class may provide the necessary yield enhancement and risk mitigation needed to succeed in today’s financial environment.