The SPDR® Bridgewater® All Weather® ETF: A New Era in Portfolio Diversification

The SPDR® Bridgewater® All Weather® ETF (ALLW) has emerged as a significant player in the exchange-traded fund (ETF) landscape, offering investors an innovative approach to asset allocation. Developed by the legendary hedge fund firm Bridgewater Associates, the ALLW ETF aims to provide a balanced investment strategy that mitigates risks across various economic conditions. This article delves into the ETF’s structure, investment strategies, and potential benefits for investors navigating today’s uncertain market environment.

Understanding the All Weather Strategy

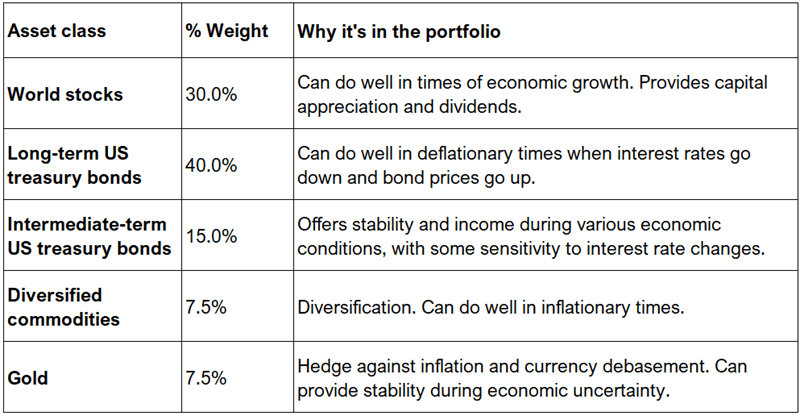

Bridgewater's All Weather strategy is built on a foundational belief that economies oscillate between growth and inflation. The ALLW ETF seeks to address these fluctuations by employing a diversified investment approach that spans multiple asset classes, including equities, bonds, and commodities. This diversification is particularly crucial in a volatile market, where traditional asset classes may not perform consistently.

According to Bridgewater, the All Weather strategy is designed to achieve "good returns in a variety of economic scenarios." By diversifying its holdings, the ETF aims to smooth out returns over time, thereby appealing to long-term investors seeking stability amid market turbulence. This strategic allocation allows investors to tap into the performance of different sectors while reducing exposure to any single economic risk.

Key Features of the ALLW ETF

-

Diversification: The ALLW ETF boasts a well-diversified portfolio designed to balance exposure across various asset classes. This diversification is intended to stabilize returns and provide a cushion against market volatility.

-

Resilience: The ETF is structured to perform well under a variety of economic conditions, aiming to deliver stable returns whether the economy is in a growth phase or experiencing inflationary pressures. This resilience is particularly attractive to investors wary of economic downturns.

-

Accessibility: The ALLW ETF democratizes access to Bridgewater’s sophisticated investment strategies, which have historically been limited to institutional investors. By making these strategies available in an ETF format, individual investors can now benefit from expert asset management techniques that once seemed out of reach.

Market Position and Performance

As of April 2025, the ALLW ETF has gained traction among investors seeking to hedge against economic uncertainty. Its innovative risk management approach aligns with a growing demand for financial products capable of withstanding economic shocks. In a time when traditional investments are often subject to significant fluctuations, the ALLW ETF presents itself as a viable option for investors looking for stability.

Trading like a stock, the ALLW ETF offers liquidity and ease of access, allowing investors to buy and sell on major exchanges. This structure not only adds to its appeal but also facilitates active trading strategies for those looking to capitalize on short-term market movements.

In recent months, the ETF has attracted considerable attention, reflecting a broader trend among investors who prioritize risk management and diversification in their portfolios. The All Weather ETF’s performance metrics are under continuous evaluation, but initial results suggest that it is on track to meet its objectives.

Conclusion

The SPDR® Bridgewater® All Weather® ETF represents a noteworthy evolution in the ETF market, providing a robust tool for investors navigating the complexities of modern financial environments. As global economic conditions continue to shift, innovative products like ALLW may become essential components of diversified investment portfolios.

With its emphasis on risk management and diversification, the ALLW ETF not only serves as a potential hedge against economic volatility but also democratizes access to one of the most respected investment strategies in the financial world. Investors looking for a reliable solution to enhance their portfolio's resilience should consider the SPDR® Bridgewater® All Weather® ETF as a strategic addition.

Keywords

ETF, Bridgewater, All Weather, diversification, investment strategy, risk management

References