Navigating Forex Volatility: Insights from Recent Market Trends

As global markets react to geopolitical tensions and economic indicators, forex traders are grappling with unprecedented volatility, which has become a defining characteristic of the 2025 financial landscape. The recent imposition of tariffs by the U.S. has sent shockwaves through currency valuations, particularly impacting key pairs such as EUR/USD and USD/JPY. Investors are now tasked with recalibrating their strategies to navigate this tumultuous terrain effectively.

Market Overview

As of April 7, 2025, the forex pairs reflect significant fluctuations, with the EUR/USD trading at approximately 1.0957, marking a decline of about 0.86%. Meanwhile, the USD/JPY pair shows resilience, trading at 149.25, bolstered by safe-haven demand amidst escalating geopolitical risks. The volatility in these major currency pairs illustrates the ongoing challenges traders face as they adapt to rapidly changing market conditions.

Key Currency Movements

-

EUR/USD: After hitting resistance at 1.10, analysts suggest potential bearish targets around 1.0660/0680. A reversal from this resistance could lead to a retest of these levels, with market sentiment heavily influenced by broader economic indicators.

-

USD/JPY: As a safe-haven currency, the Japanese yen has seen increased traction, with the pair dropping to 149.00. This reflects a pronounced risk-off sentiment in the market, driven by fears related to global trade tensions and economic instability.

Strategic Insights for Traders

In light of the current market volatility, traders are advised to adopt comprehensive strategies that can mitigate risks and capitalize on potential opportunities:

-

Diversification: It's crucial for traders to diversify their portfolios across various currency pairs. This approach helps to spread risk and reduces the potential impact of adverse movements in any single currency.

-

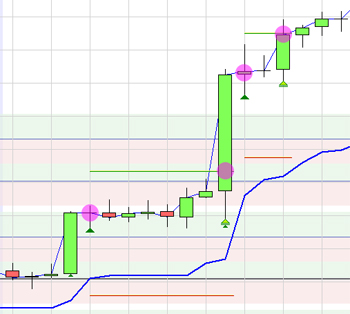

Technical Analysis: Utilizing technical indicators such as moving averages and support/resistance levels can enhance trading decisions. For instance, the analysis of EUR/USD's resistance and potential pullback targets is essential for setting stop-loss orders and executing trades.

-

Stay Informed: Continuous monitoring of economic indicators, including U.S. Non-Farm Payrolls and Consumer Price Index (CPI) data, will be vital for anticipating market movements. These indicators often trigger significant reactions in the forex market and can influence trading strategies.

Economic Indicators to Watch

Investors should keep a close eye on the following economic indicators:

-

U.S. Non-Farm Payrolls: Scheduled for release soon, this report will provide insights into the labor market's health, which is a critical factor in shaping Federal Reserve policy.

-

Consumer Price Index (CPI): A key measure of inflation, CPI data will inform expectations about future monetary policy and directly impact currency valuations.

Conclusion

As forex markets continue to evolve in response to geopolitical events and economic shifts, traders must remain agile and informed. Leveraging technical analysis, maintaining a diversified approach, and staying updated on critical economic indicators will empower investors to navigate the complexities of the current forex landscape effectively.

In this environment, those who adapt swiftly will be positioned to seize opportunities that arise amidst the volatility. Whether it's through capitalizing on technical patterns or rebalancing portfolios in response to new data, the proactive trader will likely emerge as the most successful in a fluctuating market.

For ongoing updates and detailed financial analyses, resources such as ForexLive and FXStreet provide valuable insights.

With the right tools and knowledge, forex traders can not only survive but thrive in this uncertain economic climate.